Details of the economic calendar on January 9

The data on unemployment in the EU did not affect the market in any way, as figures remained at the same level.

The eurozone unemployment rate remains at 6.5%, coinciding with the estimates.

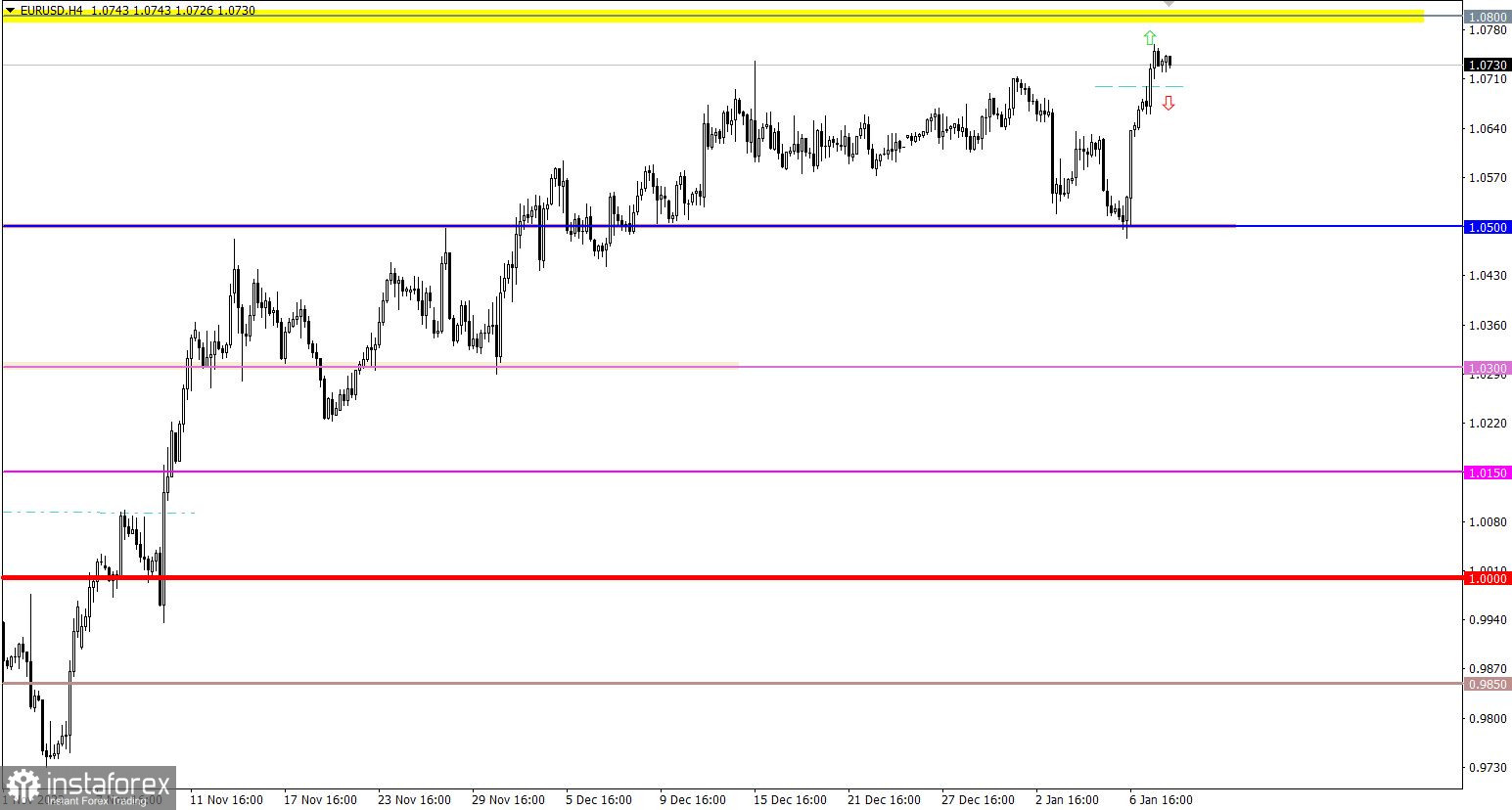

Analysis of trading charts from January 9

The EURUSD currency pair reached 1.0760 during the inertial movement from the 1.0500 support level. As a result, the local high of the upward trend from October last year was updated.

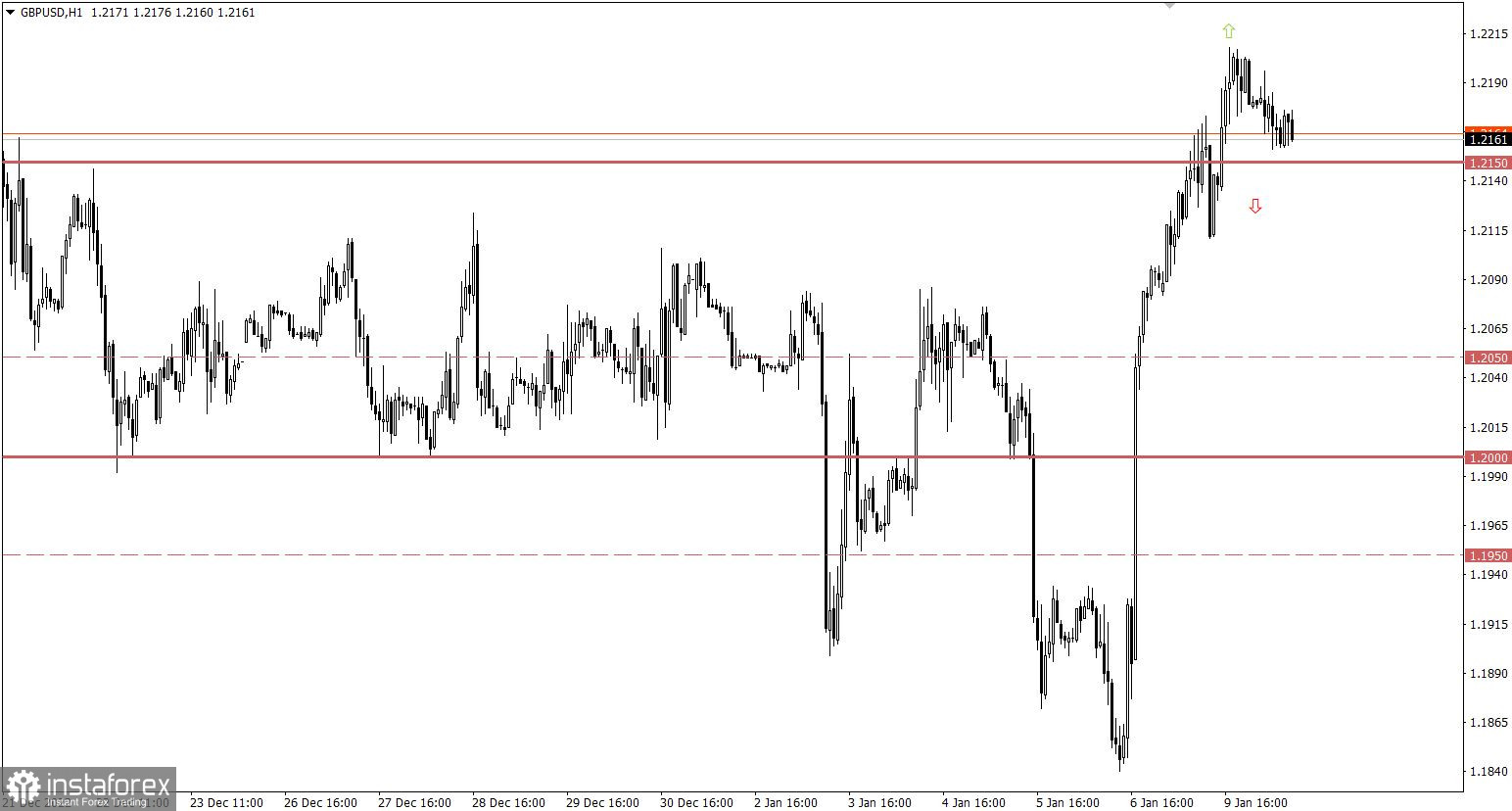

During the rapid inertial course, the GBP/USD rose to the value of 1.2200, despite the fact that a few trading days ago, the quote was around the 1.1850 mark. The overbought condition is obvious, but speculators ignore this technical signal.

Economic calendar for January 10

No important statistical data are scheduled to be published today.

For this reason, investors and traders will monitor the incoming information flow. At 14:00 UTC, the speech of Federal Reserve Chairman Jerome Powell is scheduled.

EUR/USD trading plan for January 10

In this situation, the inertial move still takes place in the market, where speculators ignore technical signals about the overbought euro. Updating the local high of the previous day may bring the price closer to the level of 1.0800. As for the corrective movement, this scenario will be considered by traders in case the price declines below 1.0700.

GBP/USD trading plan for January 10

In this situation, there is a slight pullback, during which the quote returned to the level of 1.2150, while the upward mood is still maintained among traders. For this reason, the return of the price above the value of 1.2200 may restart the inertial move.

At the same time, keeping the price below 1.2130 in a four-hour period may be the first technical signal for the formation of a full-size correction in the direction of the 1.2000 psychological level.

What's on the charts

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed in history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română