The market continues to ignore the Fed's hawkish rhetoric that the job is not done yet, that it is premature to judge a slowdown in inflation based on a couple of reports, that rate hikes will continue. And at the same time, investors take for granted the ECB's promise to raise borrowing costs by 50 bps at its first Governing Council meeting in 2023. Such different approaches allow EURUSD to return to a rally, contrary to Bloomberg experts' forecasts about the pair's potential slump by the end of the first quarter, followed by a recovery during the rest of the year.

The first slowdown in European consumer prices to single digits since August did not bother euro fans. Core inflation remains at a record high and will not return to the 2% target until 2025, according to ECB forecasts. The process of tightening monetary policy will continue. Moreover, the European Central Bank argues that the strong labor market factor is not yet fully factored into prices. Inflation risks fixing at elevated levels, and the regulator is obliged to act.

Dynamics of wages and inflation in the eurozone

According to Capital Economics, the ECB will remain hawkish for quite some time, even if the eurozone economy begins to feel the effects of aggressive tightening of monetary policy. Goldman Sachs is optimistic. The bank believes that the fall in gas prices in Europe by 75% of its peak levels will reduce the cost of blue fuel by households and companies, while the resources saved from it will go to the economy and stimulate it. At the same time, China's opening will allow the currency bloc to boost exports. Its future is unlikely to be bleak as the forecasts in late 2022 suggest. As a result, the EURUSD will be able to continue its upward march.

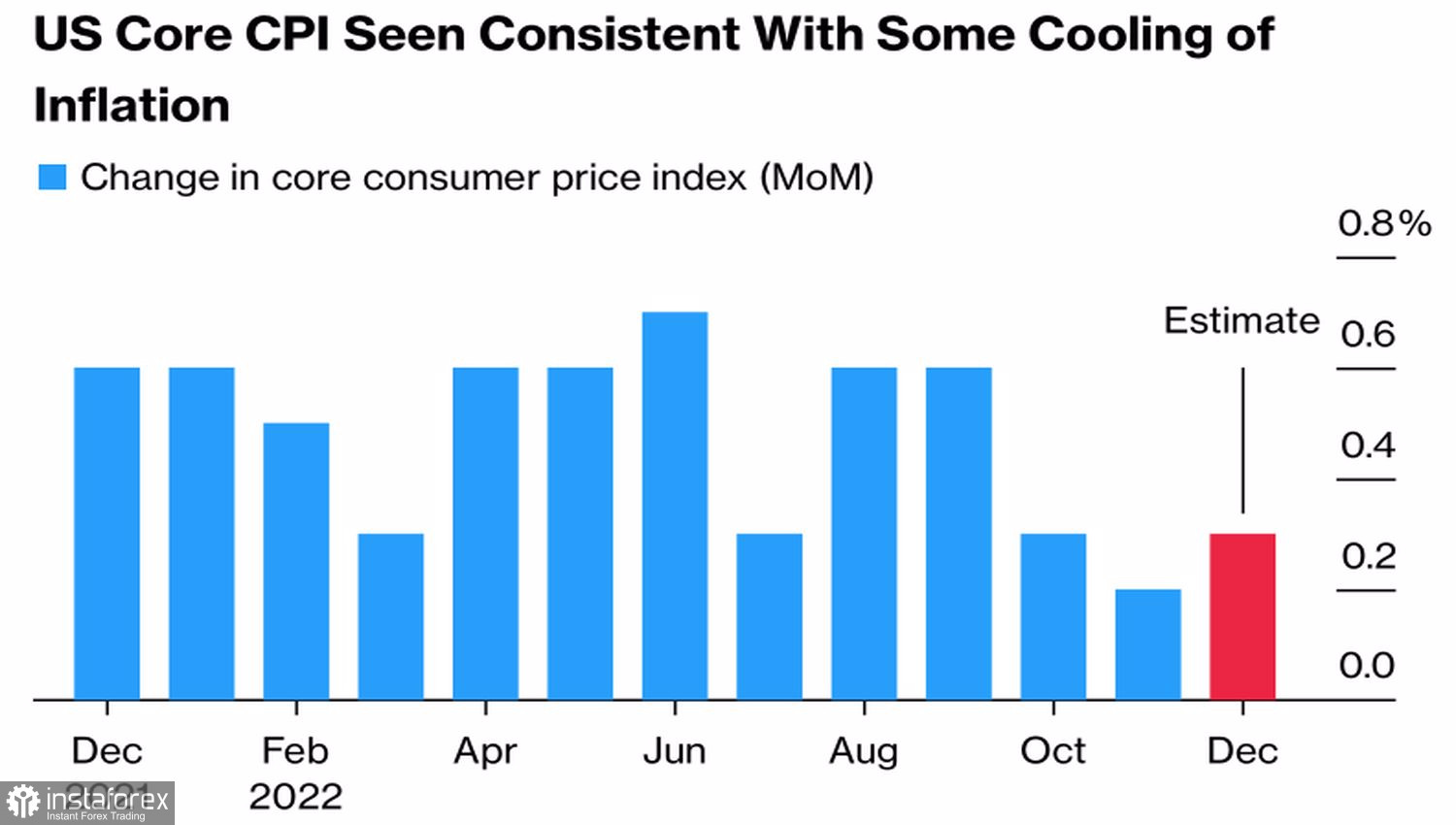

It is unlikely to be possible if inflation in the United States, contrary to forecasts, unexpectedly accelerates. Bloomberg experts expect a slowdown in consumer prices from 7.1% to 6.6%, and if this happens, the U.S. dollar will fall into another wave of sales. In the meantime, the main currency pair is growing on rumors.

Dynamics of U.S. inflation

The market confidence in the ECB may be a result of the fact that Christine Lagarde and her colleagues did not make such fatal mistakes as the Fed did. The U.S. central bank insisted in late 2021 that inflation in the United States would slow down by itself, and investors paid the price for that. It's one thing when you forecast a 75–100 bps rate hike, another when it actually goes up 475 bps.

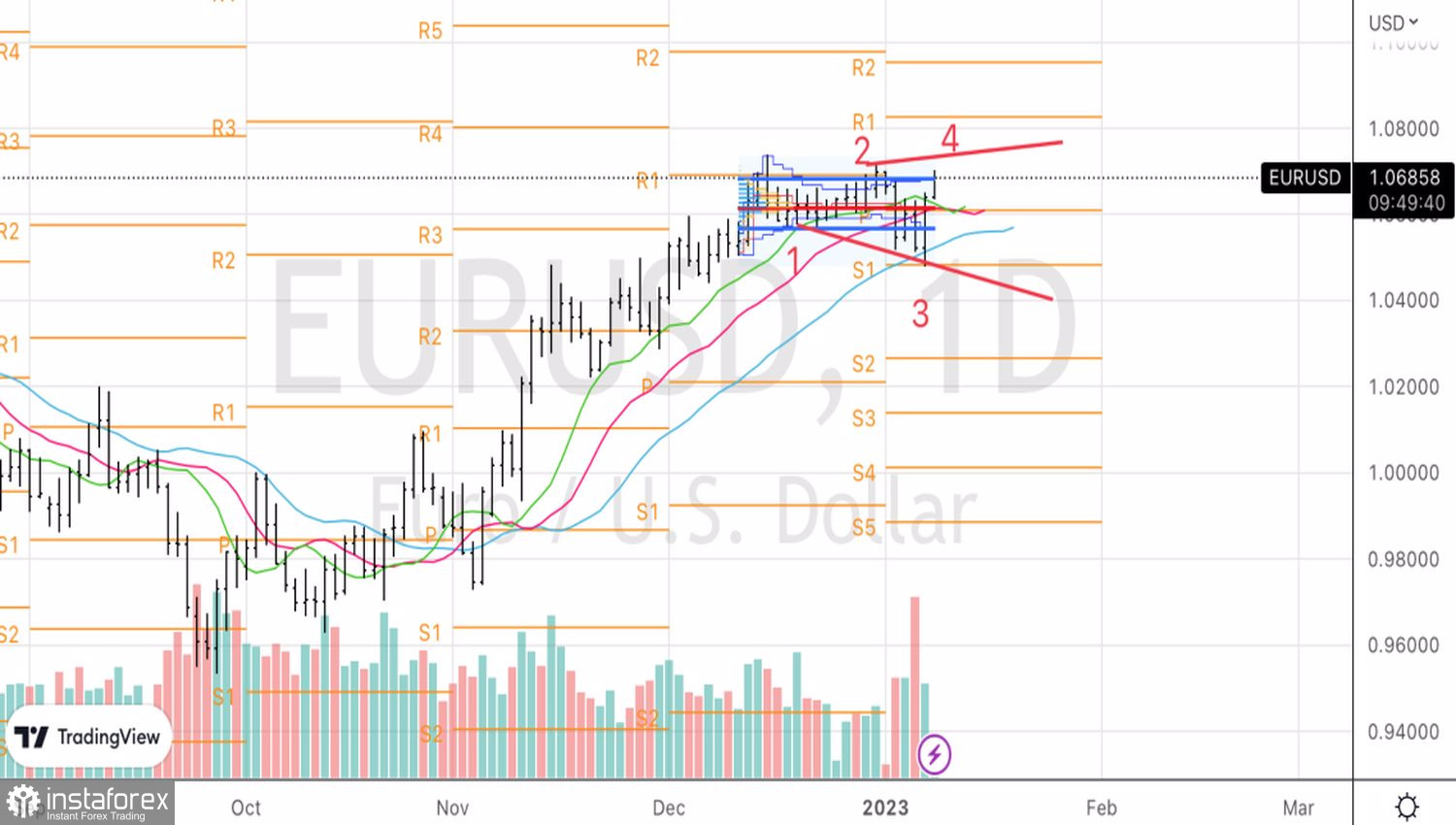

Technically, a lot depends on the ability of EURUSD to rise above the 1.0725 level. In this case, the upward trend will be restored. On the contrary, if the bulls fail to realize their plans, the risks of implementing the Broadening Wedge reversal pattern will increase. So far, we prefer sales on rebounds from resistances at 1.069 and 1.0725.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română