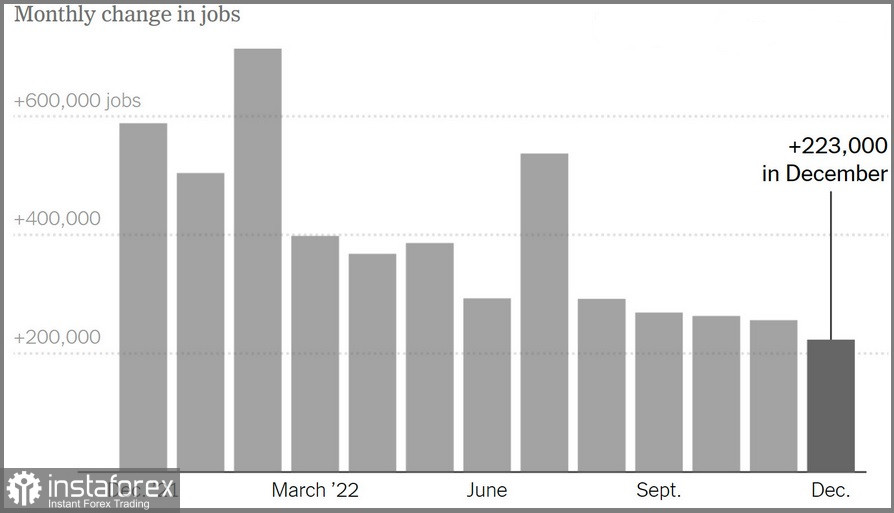

Friday's strong price movement in the markets was after the publication of the employment report for December. The report shows that the labor market ended 2022 on a positive note, with 223,000 new jobs added in December. This was well above estimates that suggested an additional 200,000 jobs were added last month.

In addition, Friday's report from the Institute for Supply Management showed that non-manufacturing PMI fell from 56.5 in November to 49.6 last month. It was the first contraction within a month in more than 2.5 years. Together, these two reports will influence the Federal Reserve's monetary policy as their data reduces the chance of a recession.

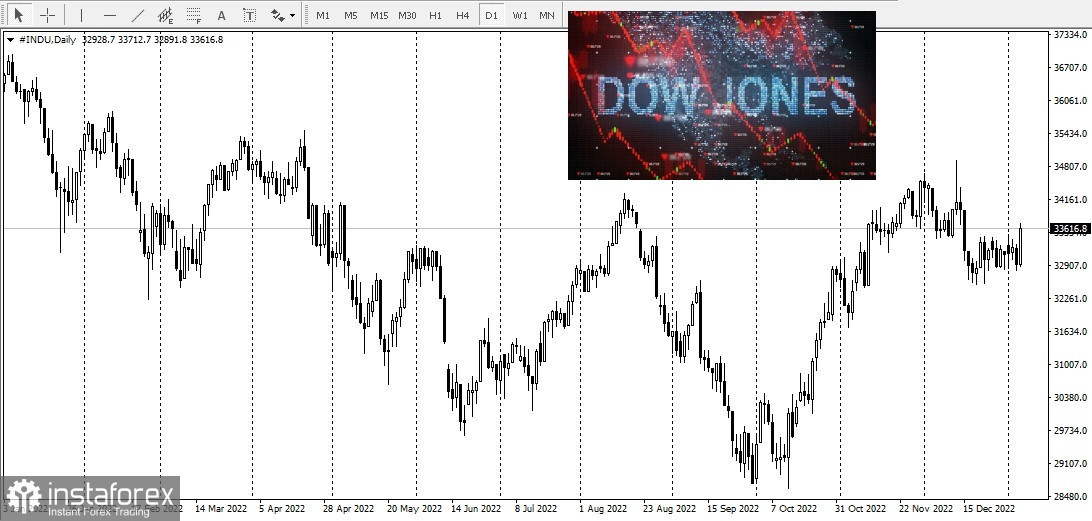

The report caused a strong rally across the board in U.S. stock markets. The Dow added 2.13%:

NASDAQ composite index with 2.56%:

and S&P 500 with 2.28%:

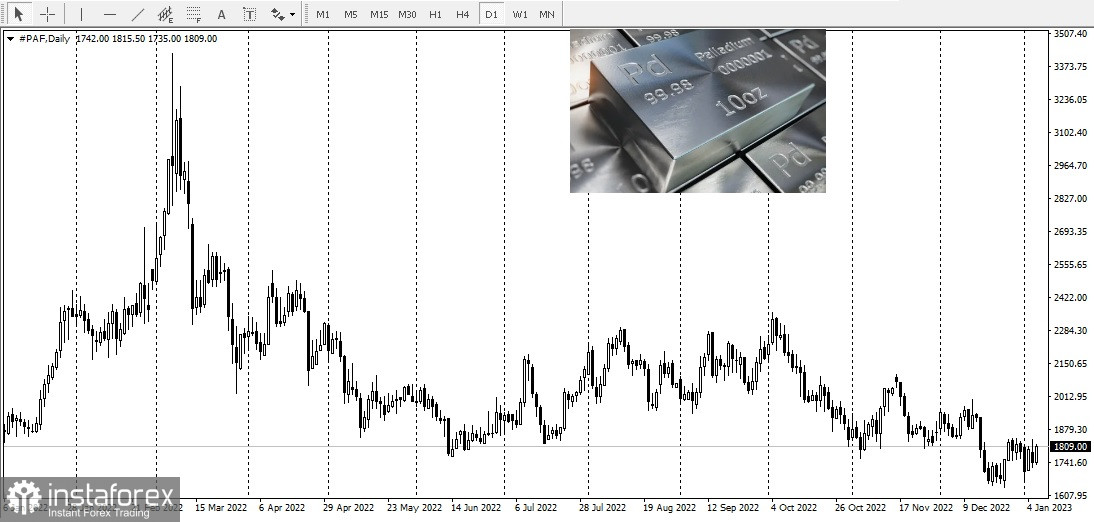

The entire precious metals complex closed sharply higher, with palladium up 4.06%:

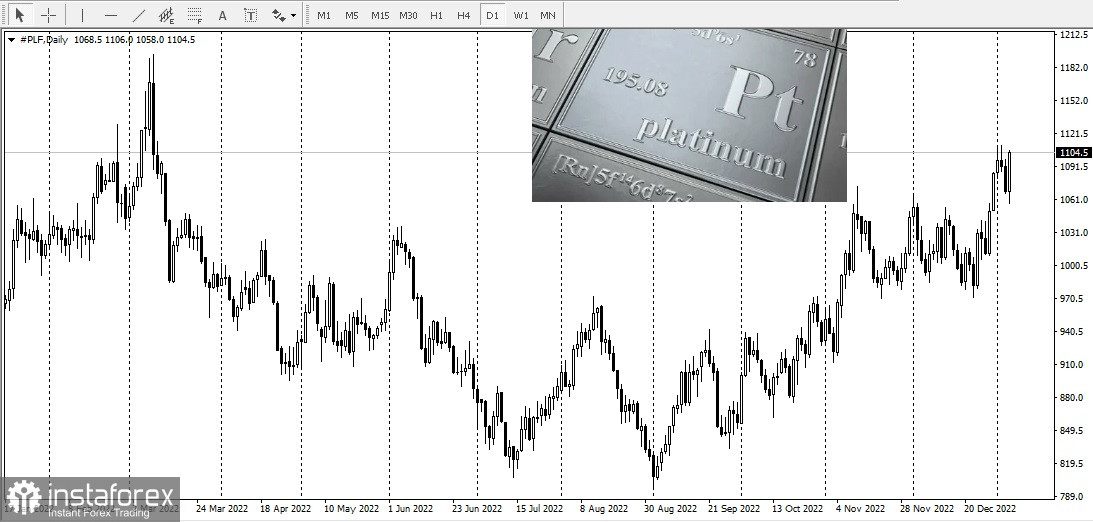

Platinum added 3.29%:

Gold up 1.66%:

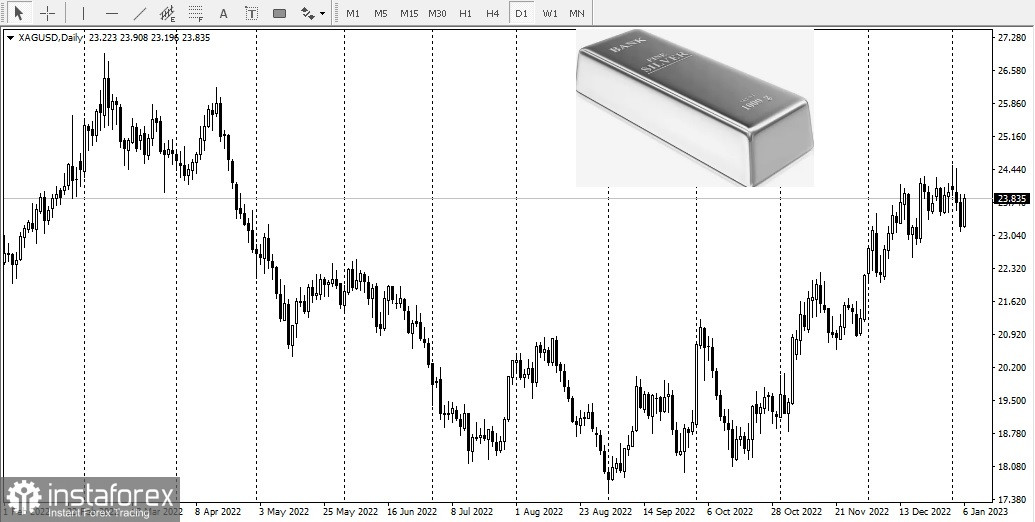

Silver up 2.35%:

The vast majority (over 60%) of gold price growth was directly related to the weak dollar. The US dollar index lost 1.11% in price:

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română