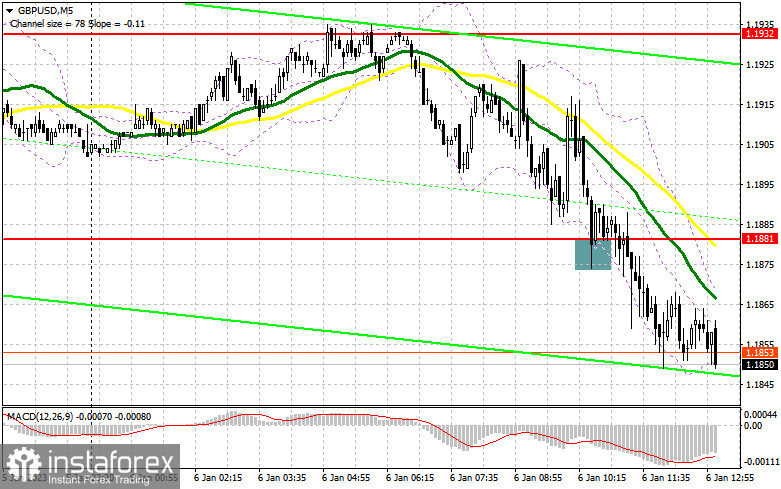

In my morning forecast I highlighted the level of 1.1881 and recommended making entry decisions with this level in mind. Let us have a look at the 5-minute chart and figure out what happened. The pound sterling performed a false breakout below 1.1881, but did not rebound strongly afterwards. This affected the plans of bullish traders, as noted in the morning forecast. The technical situation and the trading plan for the second half of the day remain unchanged.

When to open long positions in GBP/USD:

The US labor market data will be released today during the US session. If the non-farm payrolls for December show that the number of new jobs has declined, it will give support to the the pound sterling. However, if the data exceeds forecasts, GBP will continue to drop. In that case the best course of action is to wait until a false breakout of the new support level of 1.1829. This will create a buy signal and may push the pair towards regaining 1.1881. If GBP/USD breaks through this level as well, it will trigger stop loss orders of bears and create another buy signal. Afterwards the pair may hit 1.1932, which it lost during the Asian session. From there, it may rise towards 1.1932, where I recommend taking profit. If bulls lose 1.1829 due to strong US labor market data, it will trigger stop loss orders of bulls below it. Traders are recommended to open long positions after a false breakout of the low at 1.1781. You can buy GBP/USD immediately if it bounces off 1.1747, keeping in mind an intraday correction of 30-35 pips.

When to open short positions in GBP/USD:

While bears aim at monthly lows, much will depend on US labor market data, which has a direct impact on inflation and further Fed policy. Yesterday's ADP data triggered a big GBP sell-off. It is quite possible that the same will happen today after the non-farm payrolls report. The main task of bears now is to hold the pair below 1.1881, this morning's support level. As long as the pair remains below this range, bearish traders have a good chance of pushing GBP/USD back to the monthly low. The best opportunity for opening new short positions is a false breakout of 1.1881. This will be a good sell signal, assuming that the bear market will continue, and the pair will drop to the low at 1.1829. Only a breakout and an upward retest of this level from will be a sell signal, pushing the pair down to 1.1781 and 1.1747, where I recommend taking profit. If GBP/USD rises and bears are inactive at 1.1881 in the second half of the day, the pair will surge upwards as GBP bulls become stronger. In that case, only a false breakout of 1.1932, where the moving averages lie, will create an entry point for opening short positions for a new downside move. If there is no activity in that area either, I recommend you to sell GBP/USD immediately at its high and at 1.1982, keeping in mind a 30-35 pips intraday downward correction.

Commitment of Traders (COT) report:

According to the Commitment of Traders (COT) report for December 20, long positions increased while short positions decreased. After the key meetings of central banks, including the Bank of England, it became clear that the regulators intend to continue interest rate hikes and monetary tightening. This is supposed to raise demand for national currencies, including the pound sterling. This is exactly what the report suggests. However, given that the UK's Q3 GDP data was revised downwards, and the recession is now a reality rather than a possible event next year, it is unlikely that traders will continue buying the pound in January as eagerly as they do now. The latest COT report showed that the noncommercial short positions declined by 16,860 to 40,887, while long positions rose by 3,276 to 35,284, which reduced the net short positioning to -5,603 from -25,739 the week before. The weekly closing price fell to 1.2177 from 1.2377.

Indicators' signals:

Moving averages

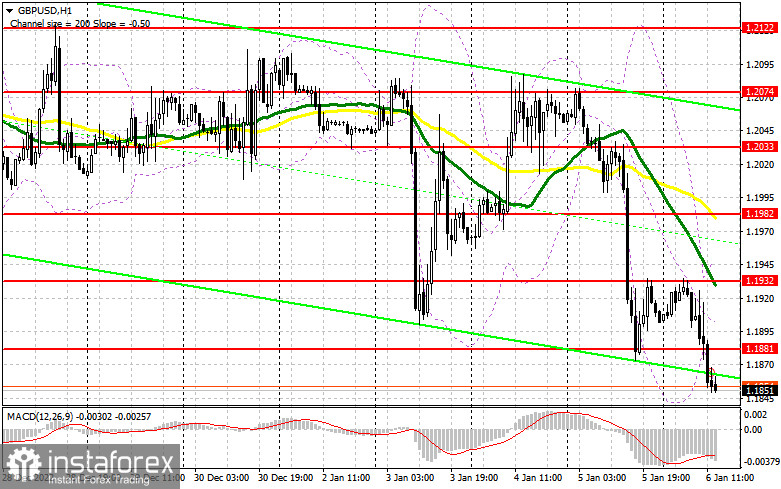

Trading is carried out below the 30-day and 50-day moving averages, which indicates that the pair is likely to fall further.

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If GBP/USD rises, the upper boundary of the indicator at 1.1932 will serve as resistance.

Description of indicators

• Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

• Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

• MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

• Bollinger Bands (Bollinger Bands). Period 20

• Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română