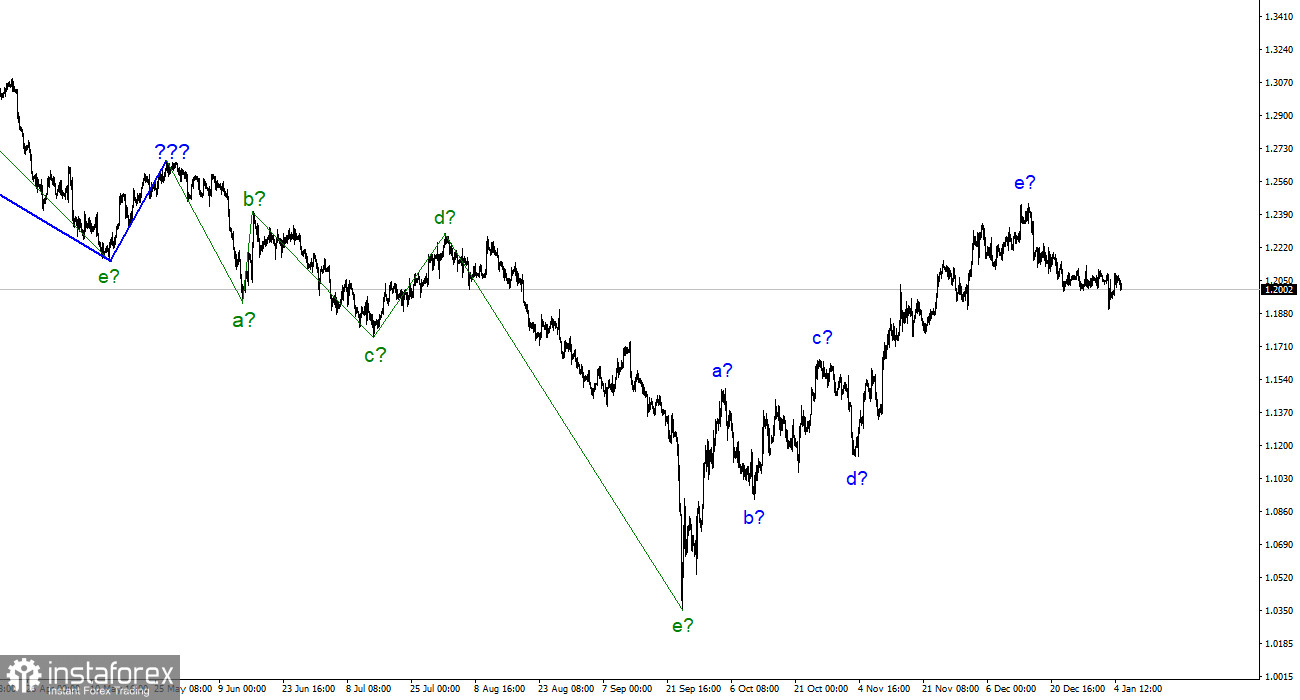

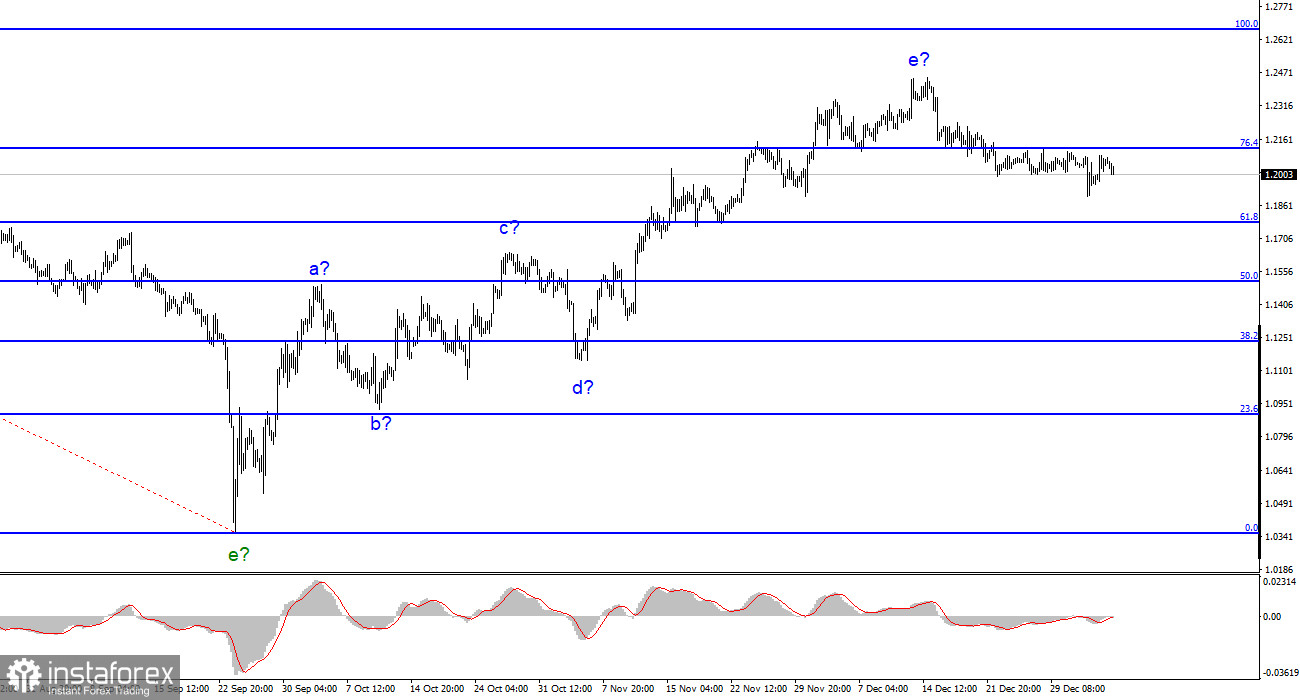

Although the wave marking for the pound/dollar instrument now appears extremely complex, clarifications are not necessary. The five-wave upward trend segment has the form a-b-c-d-e, and may already be finished. British quotes continue to actively move away from the previously set highs, increasing the likelihood of finishing the rising trend section in that market. As a result, I can say that the downward part of the trend has started to shape and will include at least three waves. In actuality, it can handle a five-wave pulse as well. The trend's previous segment was corrective, thus the following one may be anything. However, since only one downward wave has been formed thus far, the British pound should continue to fall. Of fact, the rising portion of the trend can extend indefinitely and increase in complexity at any point. However, because it is not a typical scenario, it can be challenging to predict. I continue to attempt to expand upon the conventional wave structures, which can be utilized for both work and prediction.

The British news did not particularly excite the market.

On Wednesday, the pound/dollar exchange rate decreased by 150 basis points, but the decline was not yet complete. Since the instrument's drop started at night, the news context initially had little to do with trading. How can I forget to inform you one more that the wave pattern suggests the British continue to fall? But as the USA and then Europe awoke, the market had fresh justifications for getting rid of the instrument. First, reports on commercial activities in the UK were made public. Activity rose in the services sector to 49.9, only 0.1 points below the projection and the 50.0 thresholds, over which positive dynamics are already evident. Following forecasts, the composite business activity index was 49. But because both indicators continued to be below 50.0, I consider them to be poor. The British were no longer in high demand at this time.

The American reports followed, which I have already touched upon in my analysis of the euro/dollar contract. The American figures are undeniably impressive, but I'm not sure if the market did not merely utilize them as a justification to raise demand for US currency. What does it matter to us if we anticipated a decline in the instrument and it happened? The market must now survive tomorrow when the United States will disclose figures on unemployment, economic activity, and wages in addition to Nonfarm Payrolls, the most crucial indicator of the state of the labor market. Even "average" data can be interpreted as robust to enhance demand for the US currency because, in my opinion, the market will be paying close attention to dollar purchases tomorrow. Well, if the data is truly strong, then the US currency's increase is practically inevitable, which is in line with the forecasts generated using the wave markup.

Conclusions in general

The building of a downward trend section is still assumed by the wave pattern of the Pound/Dollar instrument. Right now, I still suggest sales with objectives near the level of 1.1508, which corresponds to a 50.0% Fibonacci. The upward portion of the trend is probably over, however, it might yet take a lengthier shape than it does right now.

The euro/dollar instrument and the picture seem extremely similar at the larger wave scale, which is fortunate because both instruments should move similarly. Currently, the upward correction portion of the trend is almost finished (or has already been completed). If this is the case, a downward portion will likely be built for at least three waves, with the possibility of a dip in the region of figure 15.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română