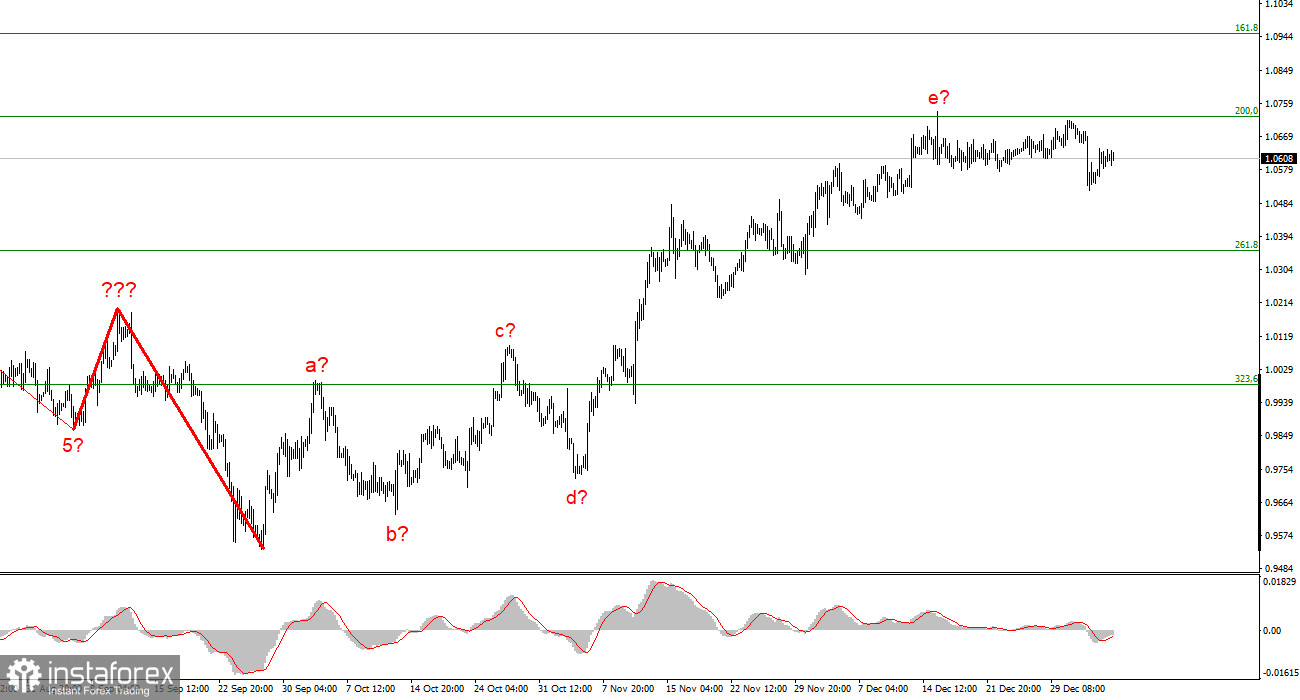

The wave marking on the euro/dollar instrument's 4-hour chart still appears to be fairly accurate, and the entire upward phase of the trend is still highly complex. It now has a clear corrected and lengthened form. Waves a-b-c-d-e have been combined into a complicated corrective structure, with wave e having a form that is far more complex than the other waves. Since the peak of wave e is substantially higher than the peak of wave C, if the existing wave arrangement is accurate, construction on this structure may be nearly finished or may already be finished. I'm getting ready for a decrease in the instrument because, in this scenario, we are predicted to build at least three waves down. The instrument fell the day before yesterday as a result of a sharp decline in demand for the euro. These two marks, along with a failed attempt to surpass the Fibonacci 200.0% level at 1.0726, could indicate the end of the development of the upward trend section. Now, nevertheless, US dollar demand must increase further. The context of the news this week enables us to anticipate such a result.

The market is making use of what it has because there is still little news.

On Wednesday, the euro/dollar instrument lost 60 basis points, but the downturn has only started. To be more specific, it began about an hour ago, and to determine what precipitated the sudden increase in the US dollar, we must look at the calendar of events. Consequently, two significant reports were released an hour ago. The ADP report on the shift in the labor force in the American economy is the first. The second is the November trade balance. Both of these reports ended up being favorable for the US dollar. In contrast to market predictions of roughly 72 billion dollars, the trade imbalance came to 61.5 billion dollars, and in December, there were 235 thousand more Americans on the job than in November. Since the trade balance typically does not pique the markets' interest, I continue to believe that the ADP report was what actually increased demand for US currency.

But I can't help but notice one intriguing thing about this. It is a reality that the ADP report hardly ever shows any market interest. It should be noted that the Nonfarm Payrolls report, which will be made public on Friday, is the "older brother" of this one. In most cases, despite reflecting the same thing—the situation of the labor market—their figures do not even match. The Nonfarm Payrolls report can succeed but the ADP report can easily be negative. Based on the foregoing, I think that the market was prepared to buy the dollar today, as suggested by the present wave markup, and that it just used American statistics as a justification. I don't care whether the market has discounted or accepted these stories as justification, though. The instrument is declining once more, which is what matters most, so I'm still waiting for the development of a downward trend section.

Conclusions in general

Based on the analysis, I conclude that the rising trend section's construction has multiplied to five waves and is either finished or nearly so. As a result, I suggest making sales with objectives close to the predicted 0.9994 level, or 323.6% Fibonacci. We have a signal for a drop and a departure of quotes from the recent highs, while there is a chance that the rising phase of the trend will become even more lengthy and complicated. The likelihood of this scenario is still pretty high.

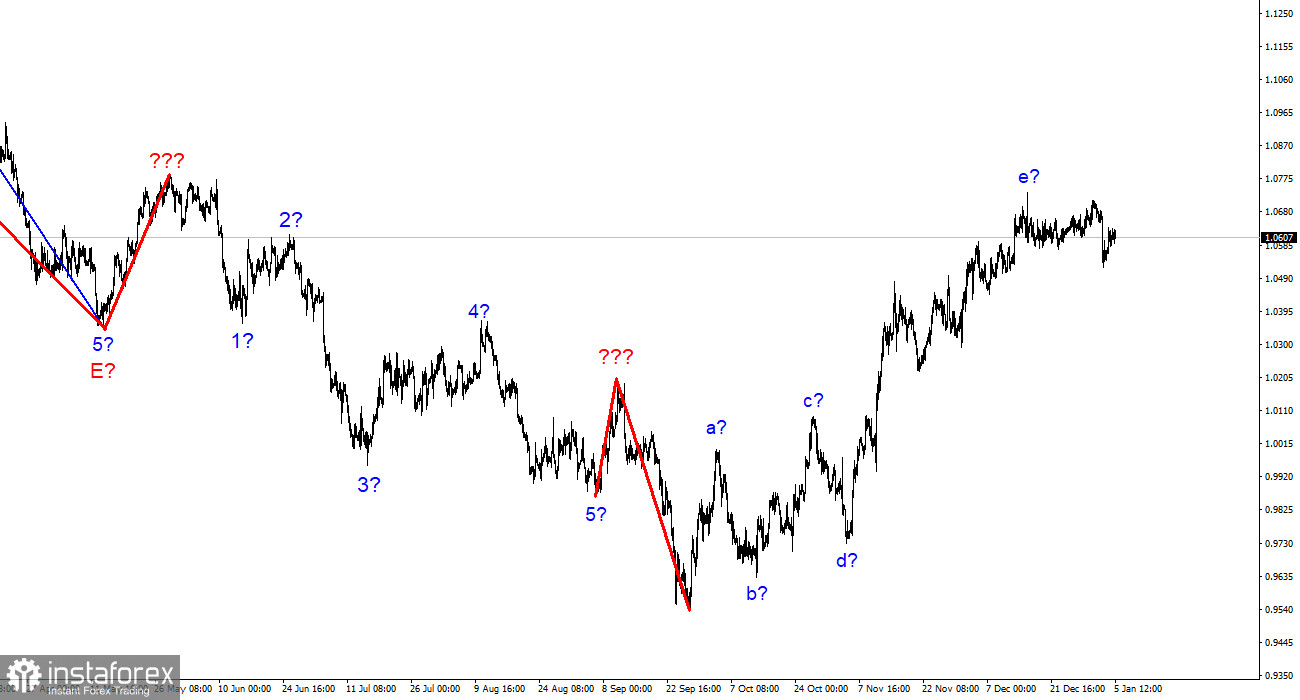

The wave marking of the descending trend segment notably becomes more intricate and lengthens at the higher wave scale. The a-b-c-d-e structure is most likely represented by the five upward waves we observed. After the construction of this portion is complete, work on a downward trend segment can start.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română