2023 began the way 2022 ended. Markets remain fixated on inflation and how central banks will react to it. The Fed still insists on raising the federal funds rate, and investors are counting on a dovish reversal. Nothing changes, which allows EURUSD bulls to look to the future with optimism. If in the fourth quarter they completely controlled the situation on Forex, then why should it be different at the beginning of the coming year?

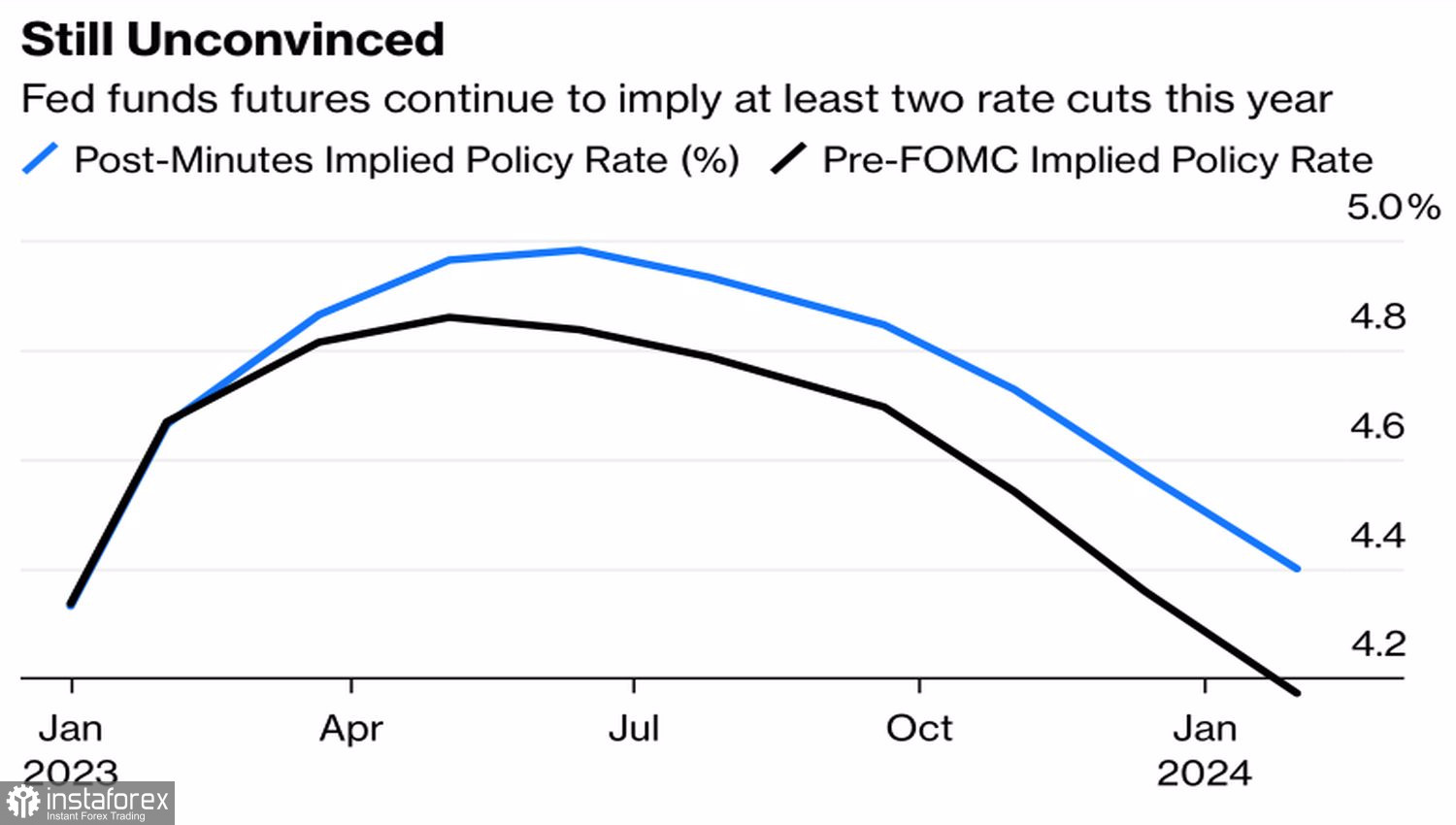

The minutes of the December meeting of the Fed were unequivocal. If the markets continue to fiddle with wishful thinking, it will improve financial conditions, make it harder to fight inflation and force the central bank to act more aggressively. The end result will be bad for us. The economy will plunge into recession, but investors continue to ignore even such threats. Derivatives are betting on lower borrowing costs in the second half of 2023, supporting bulls on EURUSD.

Dynamics of expectations for the federal funds rate

Another reason for optimism for euro fans is the fall in gas prices in the euro area to their lowest levels since late 2021. The warm weather, which will continue in Germany and France until mid-January, is reducing demand for the blue fuel to the lowest levels in 10 years. Stocks have rebounded to 84%, eliminating the risks of rationing this winter and allowing for a margin of safety for next. The energy crisis is fading into oblivion, the recession in the eurozone promises to be shallow and short-lived, which makes the future of EURUSD bright. The pair can rise above the consensus forecast of Bloomberg experts at 1.08 at the end of the year.

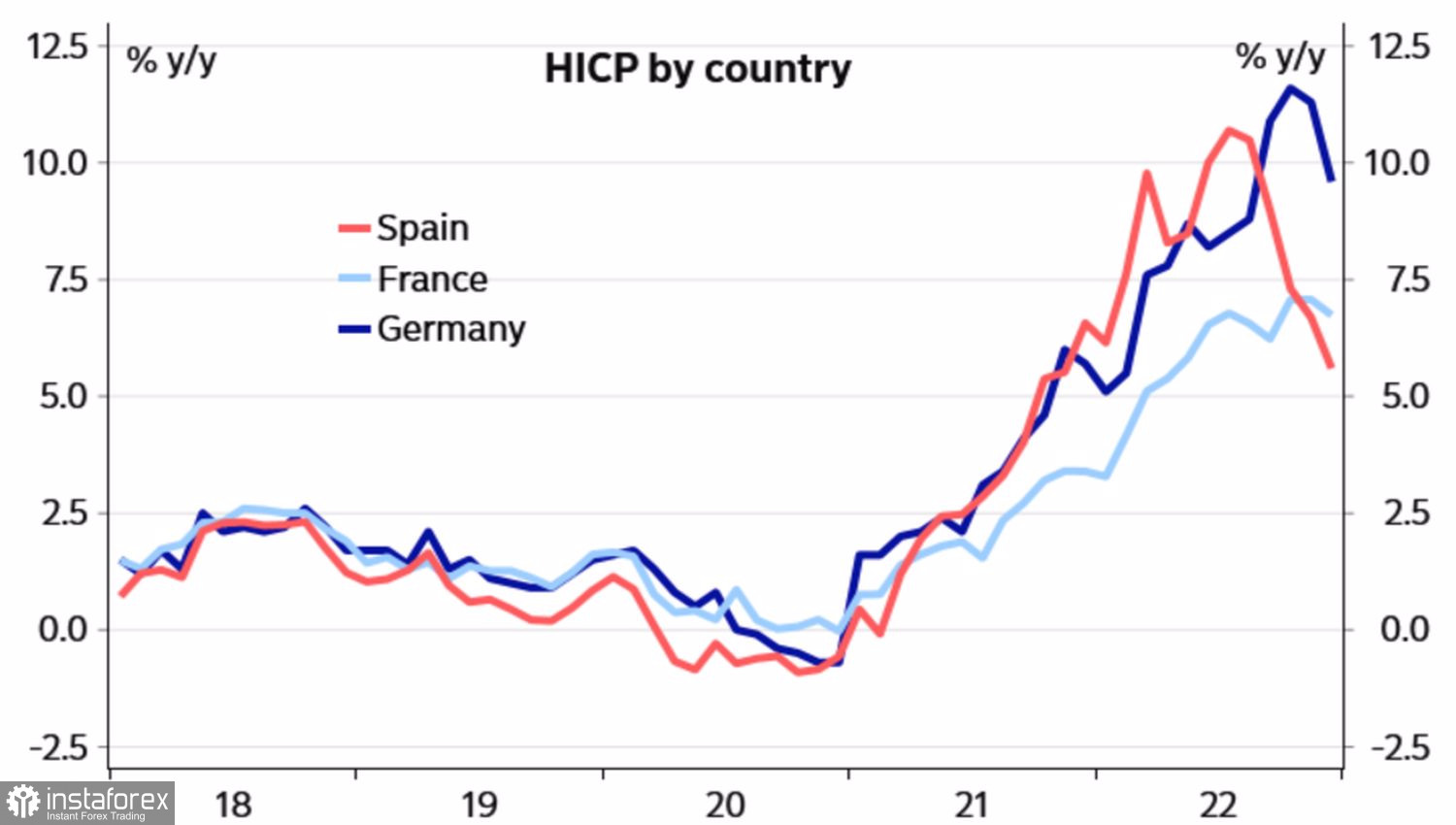

A potentially constraining factor is the slowdown in inflation in the key economies of the currency bloc. However, the base indicator remains at elevated levels, so the ECB will most likely not deviate from the plan to raise the deposit rate by 50 bps at the first meeting of the Governing Council in the coming year.

Dynamics of European inflation

If EURUSD can pass the test of the U.S. labor market report for December, the rally risks continuing. But can it? In an environment where Fed policy depends on data rather than FOMC officials' rhetoric, strong statistics will return interest in the U.S. dollar faster than the central bank's threats to the financial markets. In that regard, a 200k gain in employment, a 3.7% jobless rate and a 5% increase in average pay are impressive numbers to say that the labor market is still strong as a bull. That means the Fed can, in good conscience, raise the rate above 5%.

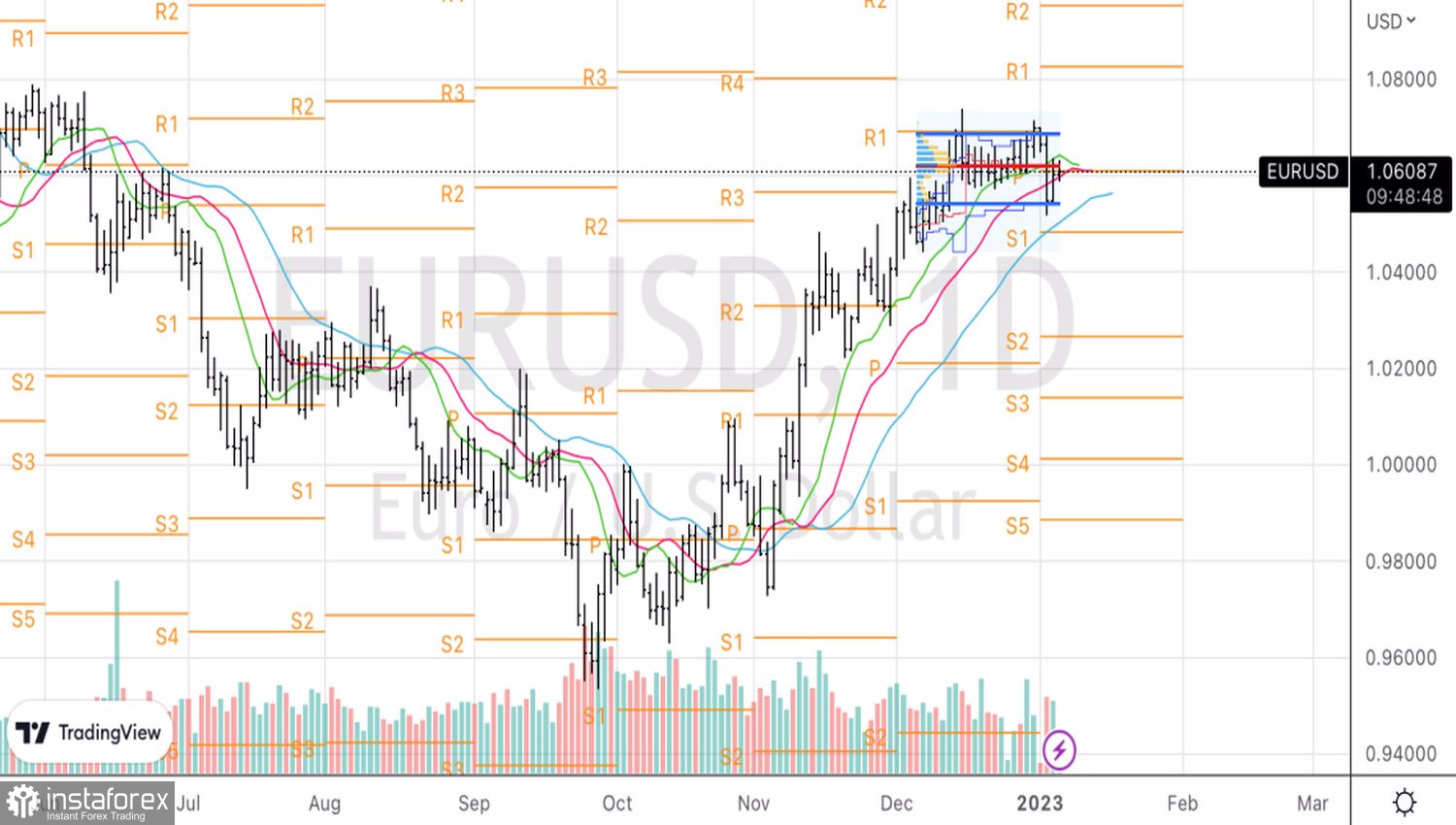

Technically, the formation of an inside bar on the EURUSD daily chart indicates uncertainty, which is quite logical ahead of an important report. A break of the upper border near 1.0635 may become the basis for the formation of longs. But the inability of the "bulls" to keep quotes above the fair value by 1.062 is a reason for sales with a subsequent increase in positions at the level of 1.054.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română