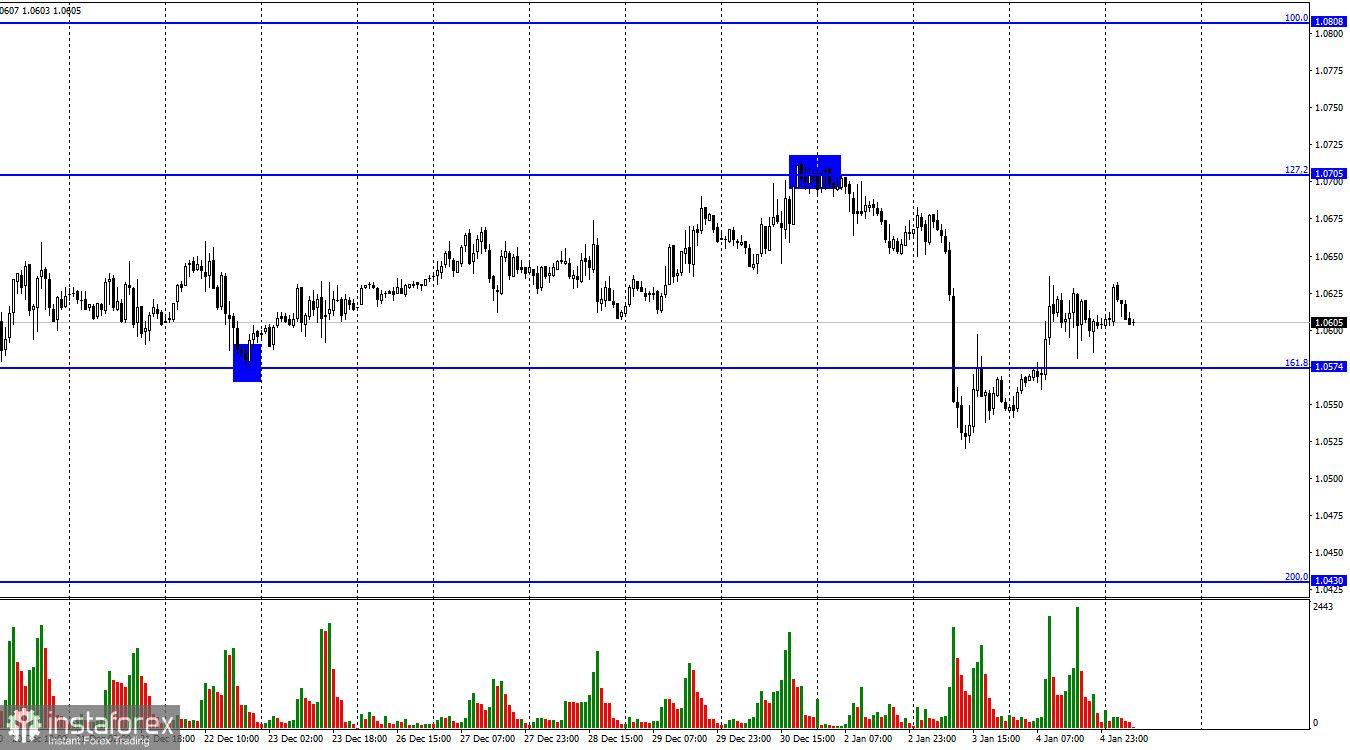

On Wednesday, the EUR/USD pair kept advancing and managed to surpass the corrective level of 1.0574. As a result, the rise in euro currency quotes can be extended in the direction of the following Fibo level, which is 1.0705 or 127.2%. I believe that a new decline in the euro/dollar pair is more plausible, though. The likelihood of the US dollar appreciating is increased if the pair's exchange rate is held below the 1.0574 level.

Yesterday's information background was not very good. I can only highlight the surprising rise in the EU services sector's business activity index from 48.5 to 49.8, as well as the ISM manufacturing sector's business activity index's ongoing fall from 49.0 to 48.4. As a result, the expansion of the euro yesterday was justified because both data were favorable to bull traders.

Martin Kazaks, a member of the ECB Governing Council, also told Bloomberg in an interview that the regulator will considerably boost interest rates in February and March. Since it was essential to decrease the rate of growth in December to speed it up in February, I believe we are talking about two additional rate increases of 0.50%. A "substantial rise" may therefore not truly be that significant. Nevertheless, the euro currency may benefit greatly from such a background. In addition, Kazaks noted that the increments can get smaller over time as the ECB looks for the ideal rate at which to bring inflation down to 2%. Since there won't be any central bank meetings in January, traders took note of Kazaks' remarks and made modest purchases of the euro, although they are currently concentrating on other data. On Wednesday, the euro gained strength, but today it could start to lose ground again.

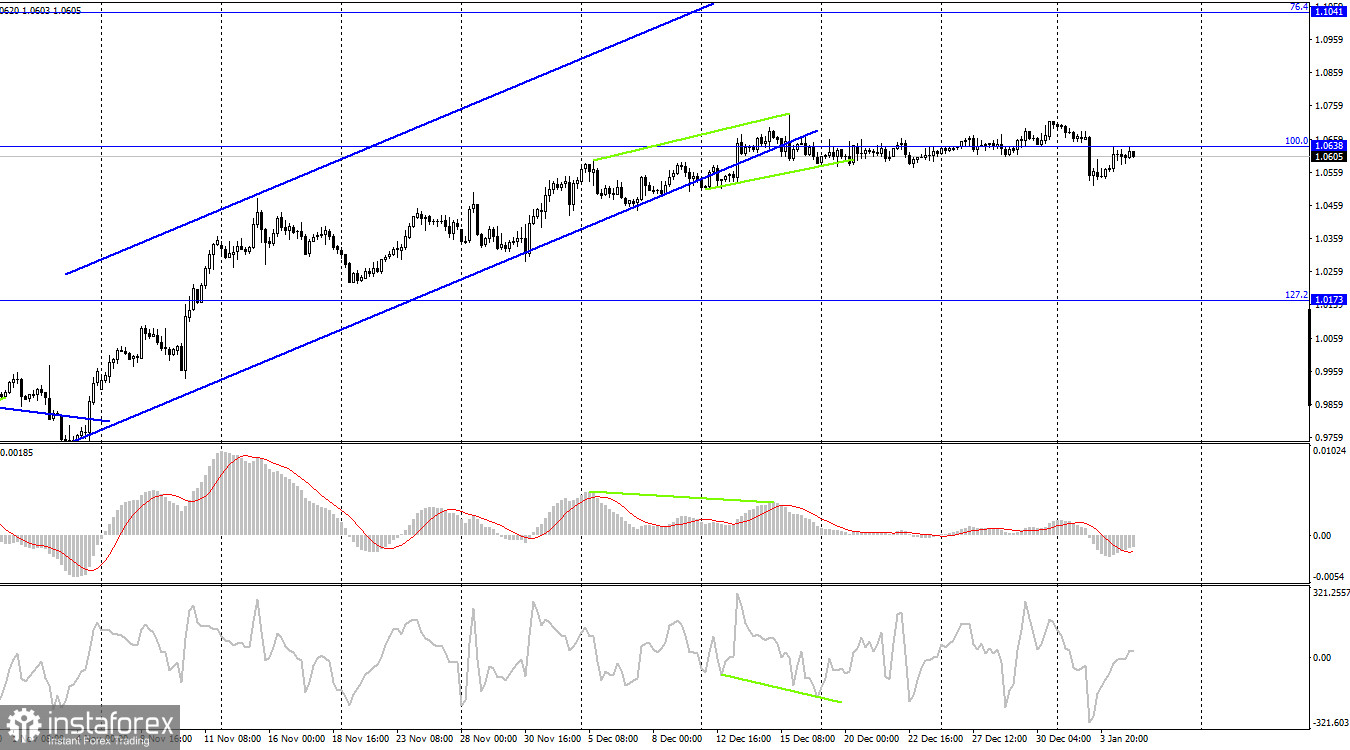

The pair reversed in favor of the US dollar on the 4-hour chart and anchored under the Fibo level of 100.0% (1.0638). The pair closed under a side corridor on the hourly chart, thus the downward process may continue in the direction of the following corrective level of 127.2% (1.0173). By itself, the consolidation beneath this level does not have the character of a signal.

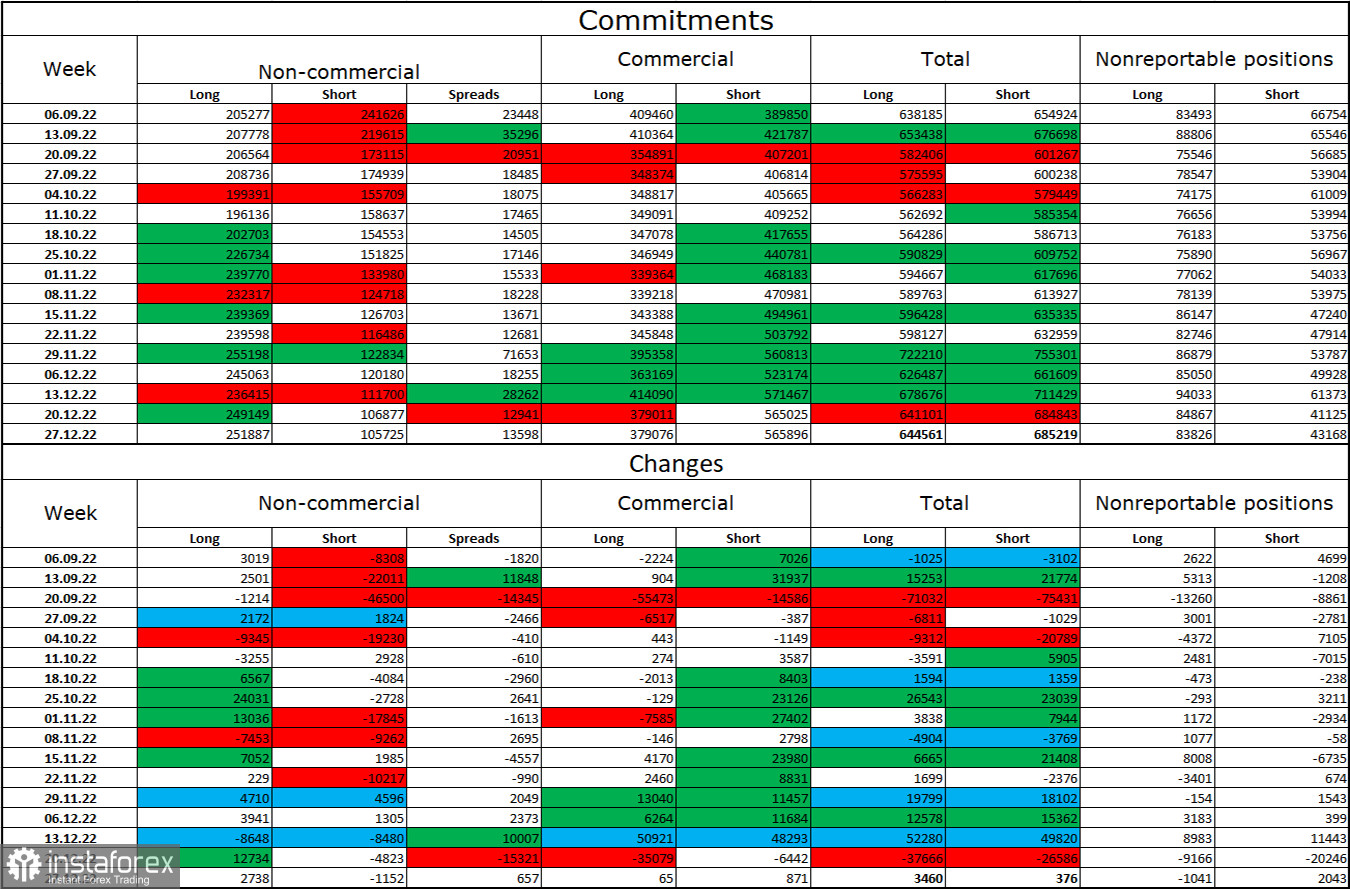

Report on Commitments of Traders (COT):

Speculators opened 2,738 long contracts and closed 1,152 short contracts over the previous reporting week. The positive sentiment among large traders is still present and getting stronger. Speculators now have 252 thousand of long contracts, while just 106 thousand short contracts are concentrated in their hands. According to COT statistics, the euro is currently rising, but I also notice that the number of long positions is already 2.5 times higher than the number of short positions. The likelihood of the euro currency increasing has been steadily increasing over the past few weeks, but I now wonder if it has increased too quickly. After a protracted "dark time," the situation is now improving for the euro, so its prospects are still good. On the hourly and 4-hour charts, however, breaking through the ascending corridors may indicate a strengthening of "bearish" positions in the short term.

News calendar for the USA and the European Union:

US – Change in the number of people employed in the non-agricultural sector from ADP (13:15 UTC).

US - The number of initial jobless benefit applications (13:30 UTC).

US - Business activity index (PMI) in the services sector (14:45 UTC).

Three entries appear simultaneously on the US calendar of economic events for January 5 but not the main ones. The information background may have a weak to moderate impact on traders' attitudes today.

Forecast for EUR/USD and trading suggestions:

With a target price of 1.0574, I advised selling the pair as it recovered from 1.0705. The objective has been completed. When anchored below the level of 1.0574, new sales with a goal of 1.0430 are expected. On the hourly chart, I suggested purchasing the euro when it closed above 1.0574 with a goal of 1.0705, but be cautious because the decline can resume today.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română