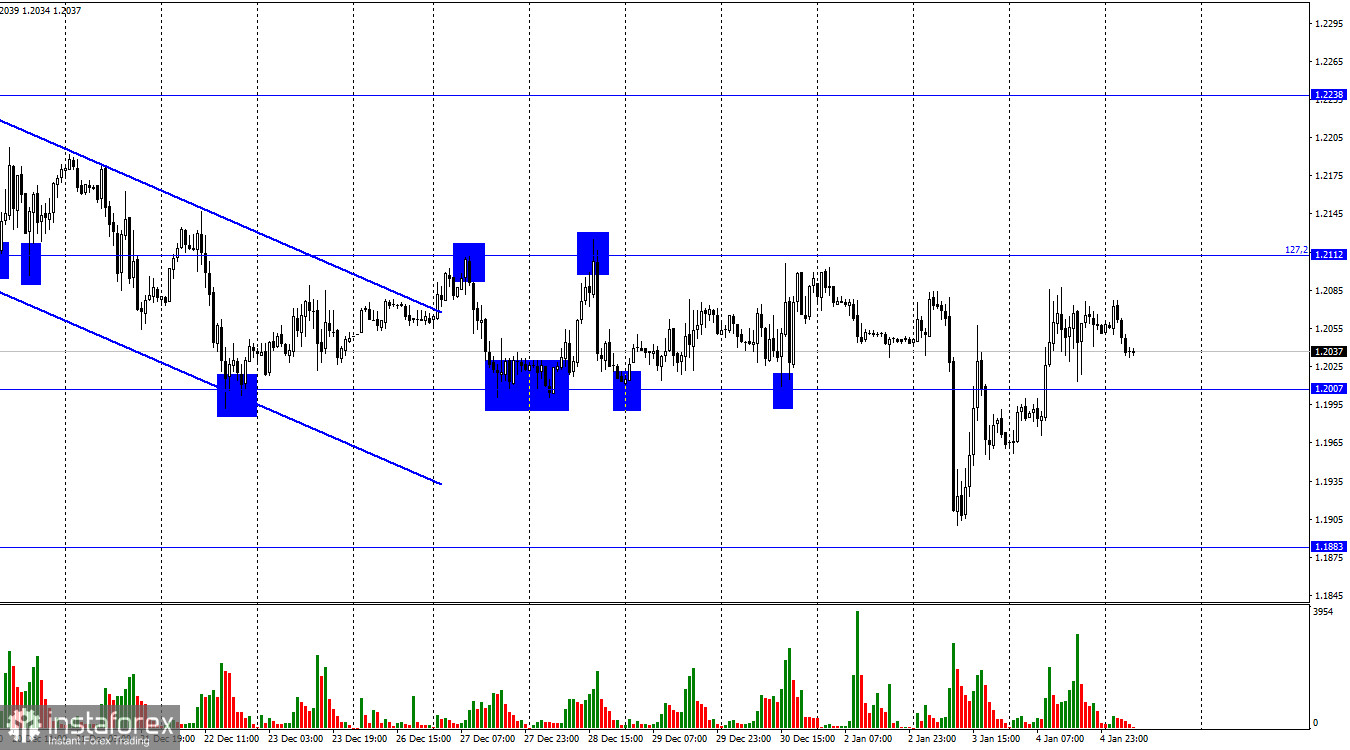

Hi, dear traders! On the 1-hour chart, GBP/USD carried on with its growth on Wednesday and closed below 1.2007. This enabled traders to reckon a further growth towards 1.2112, the next correction level which is the 127.2% Fibonacci level. However, the currency pair reversed in favor of the US dollar overnight. Now the instrument is moving down toward 1.2007. In case the price rebounds from this level, traders could bet on GBP's growth. Alternatively, if GBP/USD settles below this level, the next move will be a fall towards 1.1883.

The economic calendar was nearly empty for the UK yesterday. During the New York trade, market participants were focused on the ISM manufacturing PMI and the FOMC minutes. The minutes did not surprise traders with new information. The document just cemented traders' expectations that the Fed was committed to its hawkish rhetoric. The minutes revealed that most FOMC policymakers do not advocate for a softer stance and rate cuts in 2023. At the same time, Jerome Powell and some of his colleagues dropped hints about even more aggressive tightening because the central bank has not tamed soaring inflation yet. To sum up, the Fed could be poised to increase interest rates by another 1% at the most this year. For the time being, it is unclear how sharp the Bank of England is going to raise the key interest rates this time. Such prospects determine the balance of trading forces between the pound sterling and the US dollar in Q1 and Q2 2023.

I would like to pinpoint the macroeconomic report on the UK which is due today. It is the only report worthy of traders' attention. The UK services PMI could have climbed to 50.0 in December which could support the sterling bulls. Traders commonly give a muted response to British economic data, unlike statistics from the US. Nevertheless, the recovery of the UK services PMI to 50.0 could assure traders to go long on GBP/USD.

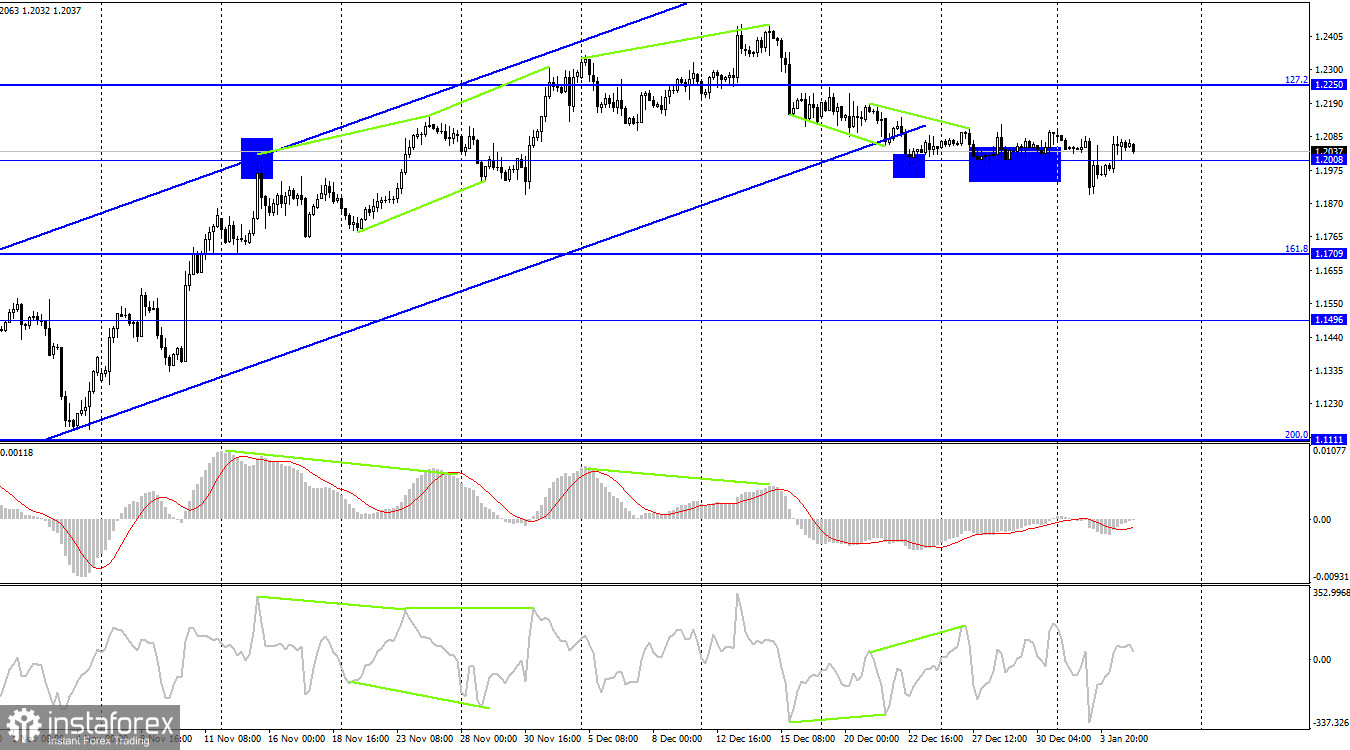

On the 4-hour chart, the currency pair closed below the ascending trend channel. I consider this a crucial point because from now on, market sentiment is turning bearish. GBP/USD might continue its fall towards 1.1709, the 161.8% Fibonacci level. Nevertheless, the currency pair closed yesterday above 1.2008. Now the instrument needs to close below this level to ensure a further drop. None of the indicators signal divergences in progress.

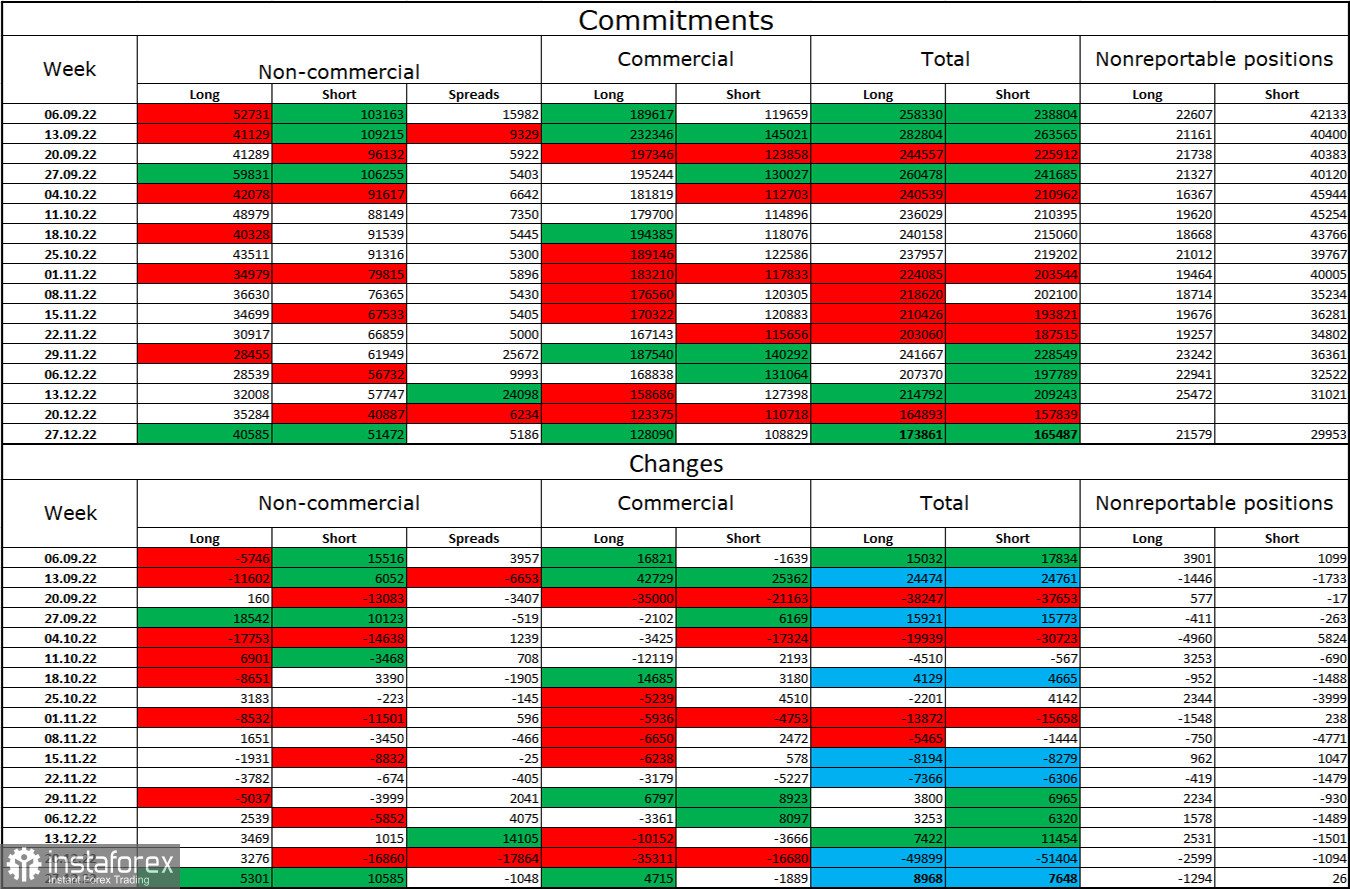

Commitments of Traders (COT):

The sentiment of the "Non-commercial" category over the past week has become more "bearish" than a week earlier. The number of long contracts held by speculators increased by 5,301, while the number of short contracts jumped by 10,585. Still, the overall sentiment among big market players remains the same: bearish. Besides, the number of short contracts still exceeds the number of long contracts. However, over the last few months the situation has changed dramatically and now the difference between the number of long and short contracts kept by speculators is not significant. A couple of months ago, the difference was threefold. All in all, lately the sterling's outlook has improved notably. Be aware that the pound sterling might extend its fall because the price has come out of a three-month ascending channel on the 4-hour chart.

Economic calendar for US and UK

UK: services PMI (09-30 UTC)

US: ADP employment report (13-15 UTC)

US: initial unemployment claims (13-30 UTC)

US: services PMI (14-45 UTC)

On Thursday, the only index (the services PMI) will be available in the UK. Three reports will be released in the US. However, I expect the strongest response to the index for business activity in the British service sector. The information background makes an average impact on trading sentiment today.

Outlook for GBP/USD and trading tips

I would recommend selling GBP/USD in case the instrument closes below 1.2007 with the target at 1.0883. Conversely, I would advise buying GBP/USD provided that it settles above 1.2007 on the 1-hour chart with the target at 1.2111. You could keep your positions open if you wish.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română