Yesterday, the British pound continued the bullish momentum seen on Tuesday afternoon, but failed to rise above resistance at 1.2080

When to open long positions on GBP/USD:

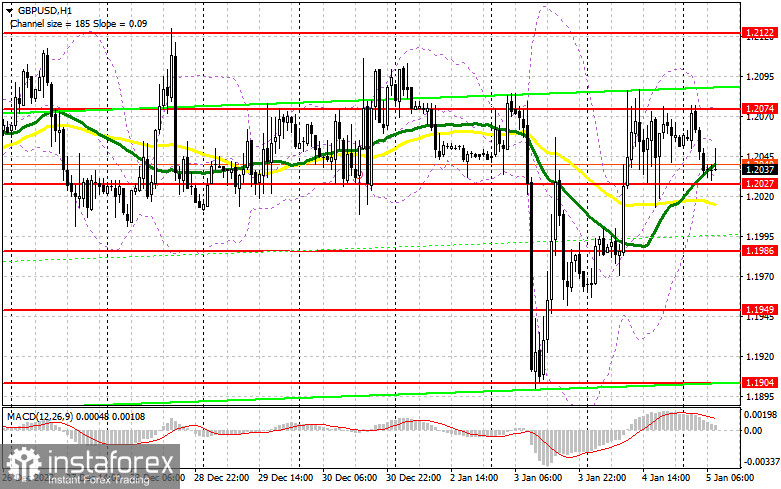

Today, a lot will depend on the UK Services PMI and the Composite PMI. Both indicators are projected to turn out better than economists' forecasts and the service sector activity, which is important for the British economy, will return to the 50-point mark and this will indicate slight growth. Bulls will engage in a tight resistance at 1.2074 . However, in the current situation, I don't expect the pound to advance in the morning. It would be nice to see a false breakout around the new support at 1.2027, which was formed yesterday. At this level, the moving averages are benefiting the bulls. This will produce a buy signal so that the price can rise above 1.2074. A breakout and a consolidation in this range amid strong data, allows us to expect a sharper rally and an update of 1.2122, from which the pound was actively traded late last year. A breakout above 1.2122 with a similar test will open up the growth prospects at 1.2183, where I recommend locking in profit. If the pair fails to reach 1.2027, the pressure on the pair will increase considerably and this will affect the bulls' stop orders, and the update of the December low at 1.1986. For this reason I wouldn't rush to buy: it would be wise to open longs on a decline and a false breakout around the low at 1.1986. It is also possible to buy the asset on the rebound from 1.1949, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on GBP/USD:

The bears made it clear that the pound has nothing to do above 1.2074. Now the main thing to do is to protect this resistance. While trade is carried out below this range, bears have the chance to update this year's lows. Of course, in the current situation a lot will depend on the data. Disappointing PMIs and a false breakout around the resistance at 1.2074 will be a good signal to sell, this will give hope for a bearish movement and a new fall to 1.2027, and then the low of 1.1986 . A breakout and upward test of 1.1986 will provide a sell signal with the prospect of a movement to 1.1949 and the possibility of returning to 1.1904, where I recommend locking in profit. If GBP rises and bears are not active at 1.2074 nothing bad will happen, but the pressure on the pound will weaken. In that case, only a false breakout around 1.2122 will provide an entry point into short positions, with the goal of moving down. If bears are not active there either, you could sell GBP/USD right from the high and 1.2183, keeping in mind a downward intraday correction of 30-35 pips.

COT report:

The COT report for December 20 logged a rise in long positions and a fall in short ones. After the key meetings of central banks, including the Bank of England, it became clear: central banks are going to continue to raise interest rates and tighten monetary policy, which by all rules, should lead to demand for national currencies, including the British pound. However, given that the UK's Q3 GDP data was revised downwards, and the onset of recession is not an expectation but a reality for next year, it is unlikely that traders will continue to buy the pound with the same fervor in January. According to the latest COT report, short non-commercial positions were down 16,860, to 40,887, while long non-commercials were up 3,276, to 35,284. Consequently, the non-commercial net position came down to -5,603 from -25,739 a week ago. The weekly closing price of GBP/USD was down to 1.2177 versus 1.2377.

Indicators' signals:

Trading is carried out around the 30 and 50 daily moving averages. It indicates that the pair is moving sideways.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If GBP/USD rises, the indicator's upper limit at 1.2074 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română