Following the decline that occurred on January 2, which was due to the collapse of TESLA and APPLE shares, stock indices rose as investors focused on the latest economic statistics from the US and the minutes of the December Fed meeting. Data in the Euro area also caused a strong surge not only in local indices, but also in EUR/USD.

Conversely, the US indicator was in decline, which should have led to a decline in the US stock market. However, this did not happen, probably due to growing expectations that the Fed will soon stop raising rates. Investors are clearly hopeful that the local equity market will not fall further as they believe that the worst has already happened. It can be said that the US stock market is off to a low start before the bull market resumes. The positioning of short and long positions has reached the strongest divergence in favor of sellers, which can be overcome at any time if the market thinks that it is time to start buying. The upcoming inflation data in the US will be a signal to buy, but only if there is a noticeable decline in the figures.

Forecasts for today:

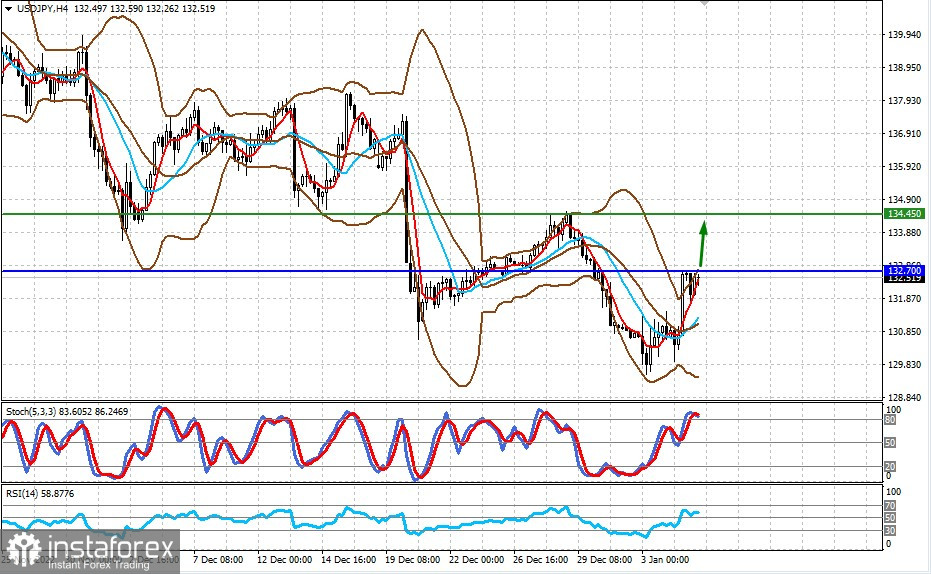

USD/JPY

The pair is trading around 132.70. A break above this level, which could happen if there is positive sentiment in the market, will push it to 134.45.

WTI

Oil found support at 73.00. If this level holds and positive sentiment prevails, a rise to 75.00 can be expected.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română