After declining on Tuesday, the EUR/USD currency pair managed to make a minor recovery on Wednesday and reach the moving average line. Now, from a purely technical standpoint, everything hinges on how the price behaves close to the moving average. The pair will either return to the flat or the rising trend if it overcomes it, but a rebound from it will mark the start of a new round of negative movement (which, in our opinion, will be the most logical development of events). Anyway, a rebound from the moving average is necessary for the sequence of events to proceed rationally. Today's macroeconomic and basic background information will mostly be lacking, but tomorrow will be a highly exciting day with data on European inflation, American nonfarm employment, and the ISM services sector index. Naturally, it is hard to predict at this point how people will respond to these occurrences. It is quite impossible to predict even what the report values will be. Recall that although continuing to contract during the past year, the labor market in the United States is not a cause for concern. However, as we've already mentioned, this decline was preceded by growth against a backdrop of the economy's post-pandemic rebound. As a result, nonfarm rates are merely returning to normal levels rather than declining right now. And each month, 200–300,000 new jobs are created. Therefore, we do not anticipate a negative market reaction if the number of Non-Farms for December is not significantly lower than 200 thousand.

In any case, tomorrow will still pass. Additionally, traders are awaiting the ADP figures and the service sector business activity index today (not ISM). It's unlikely that any of these findings will have any impact on traders' attitudes. The second evaluation will include information on company activity for December, which is hardly likely to shock investors. As for the ADP report, traders rarely pay it any attention because they favor the traditional Nonfarm Payrolls. As a result, the pair can walk extremely calmly today during the day.

The IMF's predictions are dismal.

In theory, the initial backdrop can still be described as zero. There are still no significant speeches or events. This week, macroeconomic reports have only recently started to materialize, and even then, most of them are, to put it kindly, unimportant. So, rather than macroeconomics or the foundation, we are more likely to think that the technological sphere is to blame for the market's awakening. However, IMF chief Kristalina Georgieva stated in an interview yesterday that the simultaneous lowering of the GDP growth rates in China, the United States, and the European Union might result in a fall in the global economy in 2023. Georgieva predicts that a third of the global economy will experience a recession, with China possibly suffering the most as a result of COVID's quick spread. She added that if the armed confrontation between Ukraine and Russia had not broken out on February 24, 2022, which eventually led to an energy war between the Russian government and the European Union, the world economy would have most likely been able to handle the issues of the "post-covid age."

The IMF chief, however, is confident that the United States can escape a recession despite the downturn in the economy. A healthy labor market and low unemployment make it possible to attain this outcome. Georgieva, however, thinks that for this to happen, unemployment must remain at or below 3.7%. As you can see, information about the American labor market is currently virtually as significant for the foreign exchange market. Everything regarding American inflation and the Fed's interest rates is already more or less obvious. But preventing a recession at a time when it will almost certainly start in the UK and the European Union will be significant support for the US dollar. Recall that the euro rose too quickly and too high from a macroeconomic and fundamental standpoint. At this point, a significant technical correction is required. And there are just no justifications for additional purchases of the euro. We are therefore anticipating a further decline of the pair, which might start tomorrow if the American reports' values are favorable.

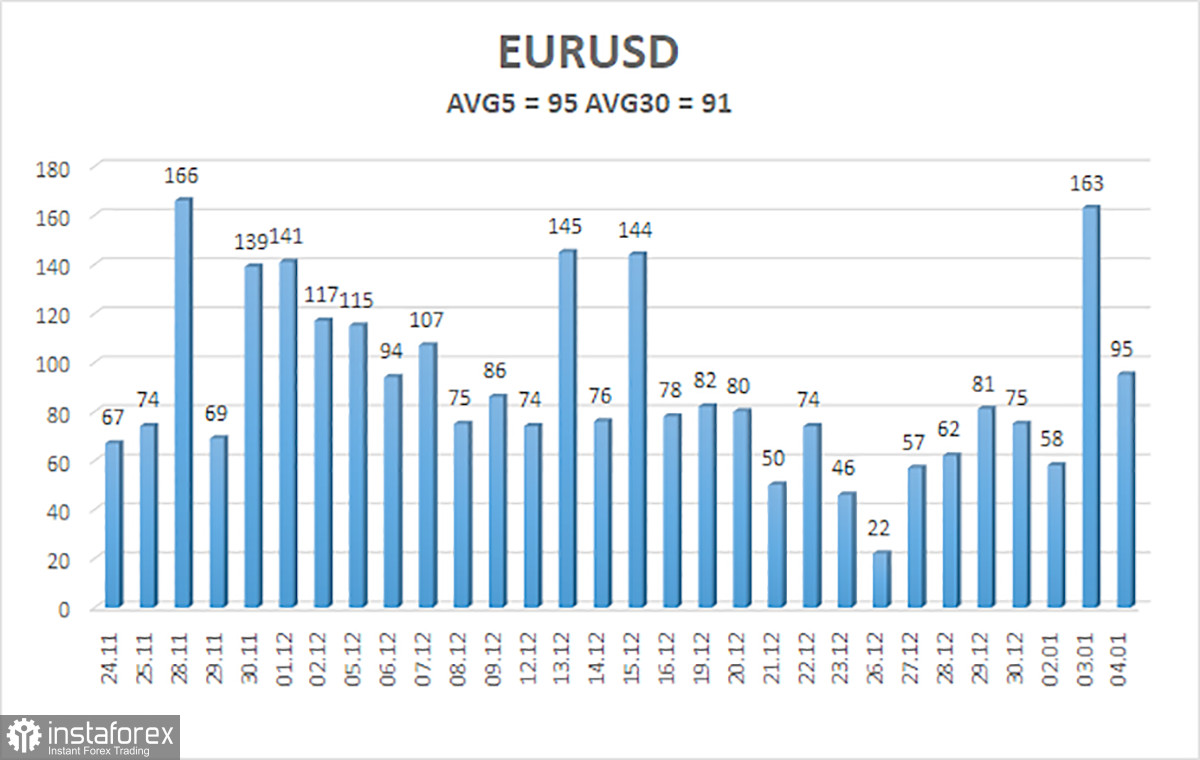

As of January 5, the euro/dollar currency pair's average volatility over the previous five trading days was 95 points, which is considered to be "high." So, on Thursday, we anticipate the pair to fluctuate between 1.0518 and 1.0708 levels. The Heiken Ashi indicator's downward turn will signal the continuation of the downward trajectory.

Nearest levels of support

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest levels of resistance

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trading Suggestions:

The EUR/USD pair has finally resumed its trend movement. At this point, additional short positions with objectives of 1.0518 and 1.0498 ought to be taken into account if the Heiken Ashi signal reverses downward or the price recovers from the moving average. With goals of 1.0708 and 1.0742, long trades should be initiated whenever the price is fixed above the moving average.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română