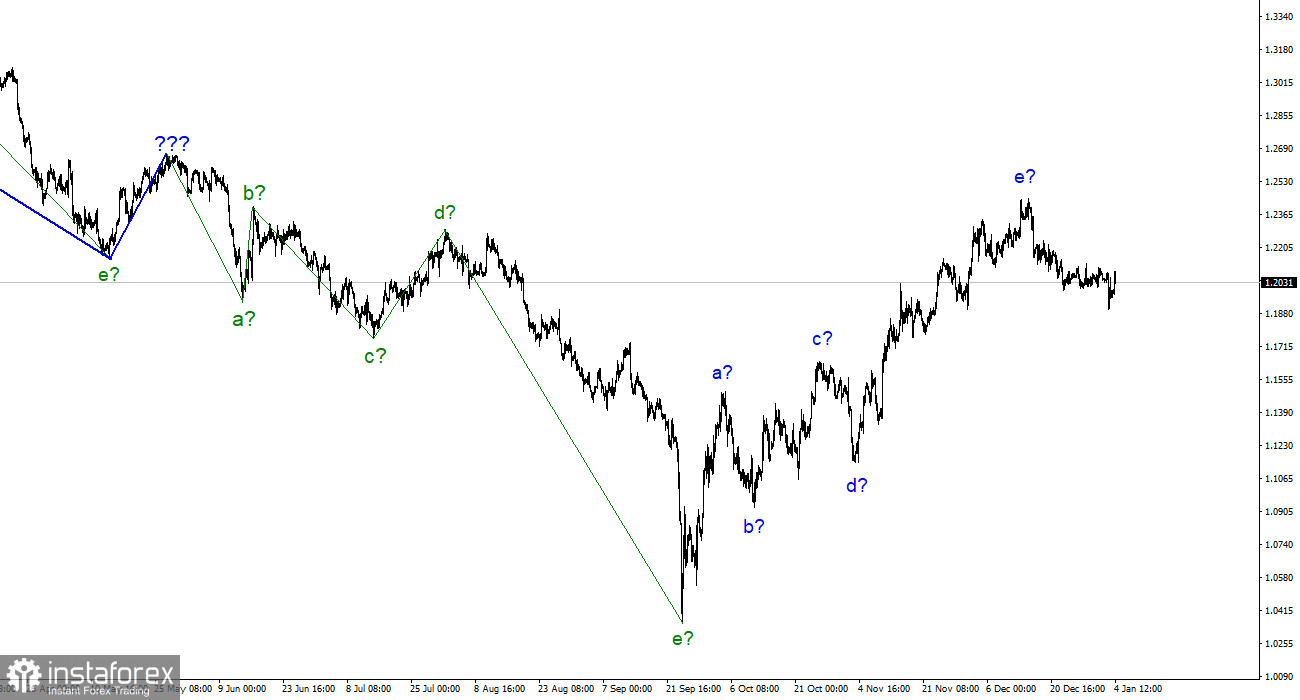

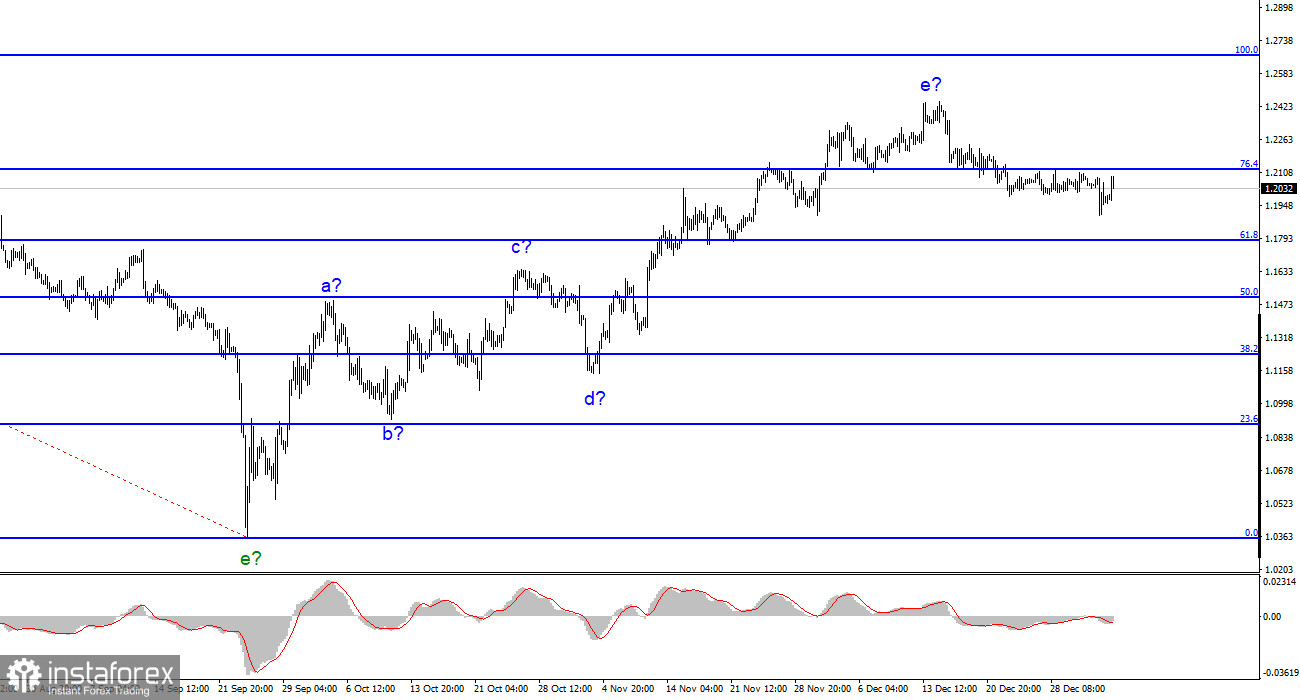

Although the wave marking for the pound/dollar instrument now appears extremely complex, clarifications are not necessary. The five-wave upward trend segment has the form a-b-c-d-e, and may already be finished. British quotes continue to actively move away from the previously set highs, increasing the likelihood of finishing the rising trend section in that market. As a result, I can say that the downward part of the trend has started to take shape and will include at least three waves. In actuality, it can handle a five-wave pulse as well. The trend's previous segment was corrective, thus the following one may be anything. However, since only one downward wave has been formed thus far, the British pound should continue to fall. Naturally, the rising portion of the trend can continue for an indefinite amount of time and have any duration. However, because it is not a typical scenario, it can be challenging to predict. I continue to attempt to expand upon the conventional wave structures, which can be utilized for both work and prediction.

On Tuesday, the pound/dollar instrument's exchange rate fell by 80 basis points, but the loss quickly resumed as the magnitude dramatically increased. Regarding the euro/dollar exchange rate, I do not think that the British pound's decrease was caused by the news that was reported yesterday. At least because it was successful in expanding yesterday, and because despite the absence of any news throughout the morning hours, it did so again today. The only interesting news to be revealed in America in an hour will be the ISM manufacturing sector index, which may be around 49 points. However, this morning, the business activity index for the services sector in the European Union surprisingly rose and nearly reached the critical level of 50.0. I, therefore, do not rule out the possibility that the ISM index will shock the market. The instrument may continue to rise if it turns out to be weaker than market forecasts.

The minutes of the December Fed meeting will be released that evening. I can't say that this technique has ever piqued the markets' interest to the point where it was obvious how they were reacting. The number of votes "for" and "against" a rate rise of 50 basis points in December may be disclosed in this document, though. This information allows us to comprehend the makeup of the majority of FOMC members. Although Jerome Powell and others have frequently discussed the need to continue tightening monetary policy to continue driving inflation to decline, I believe the answer to this question is now obvious. As a result, the "hawkish" attitude should persist, which may help sustain demand for the US dollar. There won't be much background news tomorrow, and Friday will be a chaotic day with American payrolls, European inflation, and the ISM service sector index. I'm hoping that the dollar will benefit from this news.

Conclusions in general

The building of a downward trend section is still assumed by the wave pattern of the pound/dollar instrument. Right now, I still suggest sales with objectives near the level of 1.1508, which corresponds to a 50.0% Fibonacci. The upward portion of the trend is probably over, however, it might yet take a longer form than it does right now.

The euro/dollar instrument and the picture seem extremely similar at the larger wave scale, which is fortunate because both instruments should move similarly. Currently, the upward correction portion of the trend is almost finished. If this is the case, a downhill portion will likely be built for at least three waves, with a potential decline in the vicinity of the 15th figure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română