The euro consolidated its gains above the price of 1.1189, reaching its highest level since last year, as weaker-than-expected US inflation data heightened expectations that the Federal Reserve is approaching the end of its current policy tightening. At the same time, investors believe that the European Central Bank still has work to do in addressing inflationary pressures within the Eurozone, despite data indicating a slowdown in economic growth and easing inflation across the region.

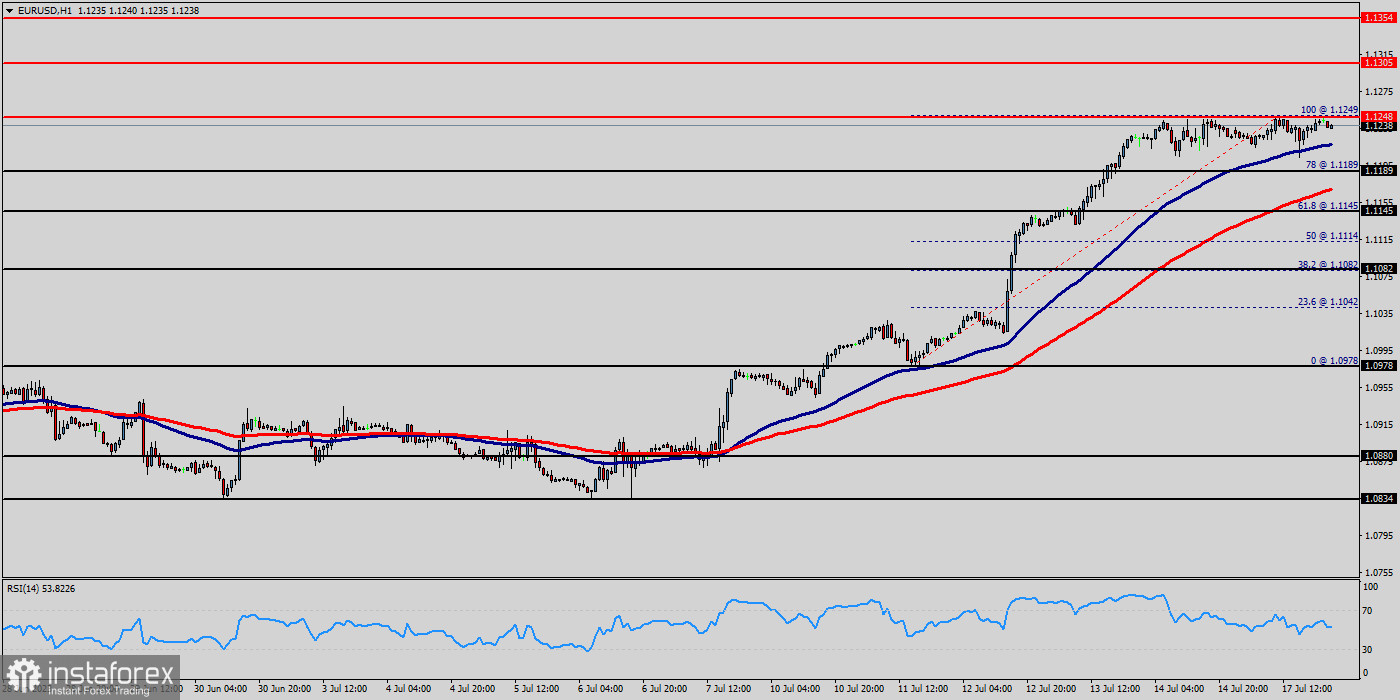

On the downside, 1.1189 (20-period Simple Moving Average (SMA), psychological level) aligns as first support ahead of 1.1189 (upper-limit of the ascending regression channel). Close below the latter could open the door for an extended slide toward 1.1000 (1 USD)(psychological level, mid-point of the ascending channel).

In the Eurozone, inflation has decreased to a half year low of 4% in July, but the core rate remained significantly above the ECB's target of 1%. Currently, interest rates in the bloc stand at 2%. However, pricing in derivatives markets suggests that traders anticipate rates peaking at just below 43% by year-end.

The EUR/USD pair develops far above all its moving averages, with the 20 Simple Moving Average (SMA) accelerating north above the longer ones. The mentioned SMA stands below the 1.1000 threshold, reflecting buyers' strength. At the same time, the Momentum indicator turned marginally lower but remains well above its midline, while the Relative Strength Index (RSI) indicator consolidates around 50.

The Relative Strength Index (RSI) indicator on the one-hour chart stays in the overbought territory above 50 for the third straight trading day on Monday, suggesting that the pair could struggle to gather bullish momentum.

The EUR/USD pair rose from the level of 1.1189 to top at 1.1248 yesterday. Today, the EUR/USD pair has faced strong support at the level of 1.1189. So, the strong support has been already faced at the level of 1.1189 and the pair is likely to try to approach it in order to test it again and form a double bottom.

Hence, the EUR/USD pair is continuing to trade in a bullish trend from the new support level of 1.1189; to form a bullish channel. According to the previous events, we expect the pair to move between 1.1189 and 1.1354. Also, it should be noted major resistance is seen at 1.1354, while immediate resistance is found at 1.1300. Then, we may anticipate potential testing of 1.1354 to take place soon.

Moreover, if the pair succeeds in passing through the level of 1.1248 , the market will indicate a bullish opportunity above the level of 1.1248. A breakout of that target will move the pair further upwards to 1.1354. On the other hand, if the EUR/USD pair fails to break out through the support level of 1.1145; the market will decline further to the level of 1.1000 (daily support 2).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română