Monday seems to be a rather dull day. There hasn't been much background information over the past two weeks; this week, things will start to change a little, but significant reports and news will still have to wait until the end of the week. Both the US nonfarm payroll data and the European Union's December inflation report will be released on Friday. Naturally, these findings will be at the center of traders' attention this week. Let me remind you that the current situation of the labor market and inflation is very important for both the ECB and the Fed. Both central banks have already started to slacken their PEPP policies, but the Fed is doing so after nearly six months of declining inflation, while the ECB is doing so after a drop in just one month. Therefore, I think the euro may depreciate against the dollar in January since the Fed's strategy is entirely reasonable whereas the ECB's strategy is not. Less optimism exists about the state of the European economy.

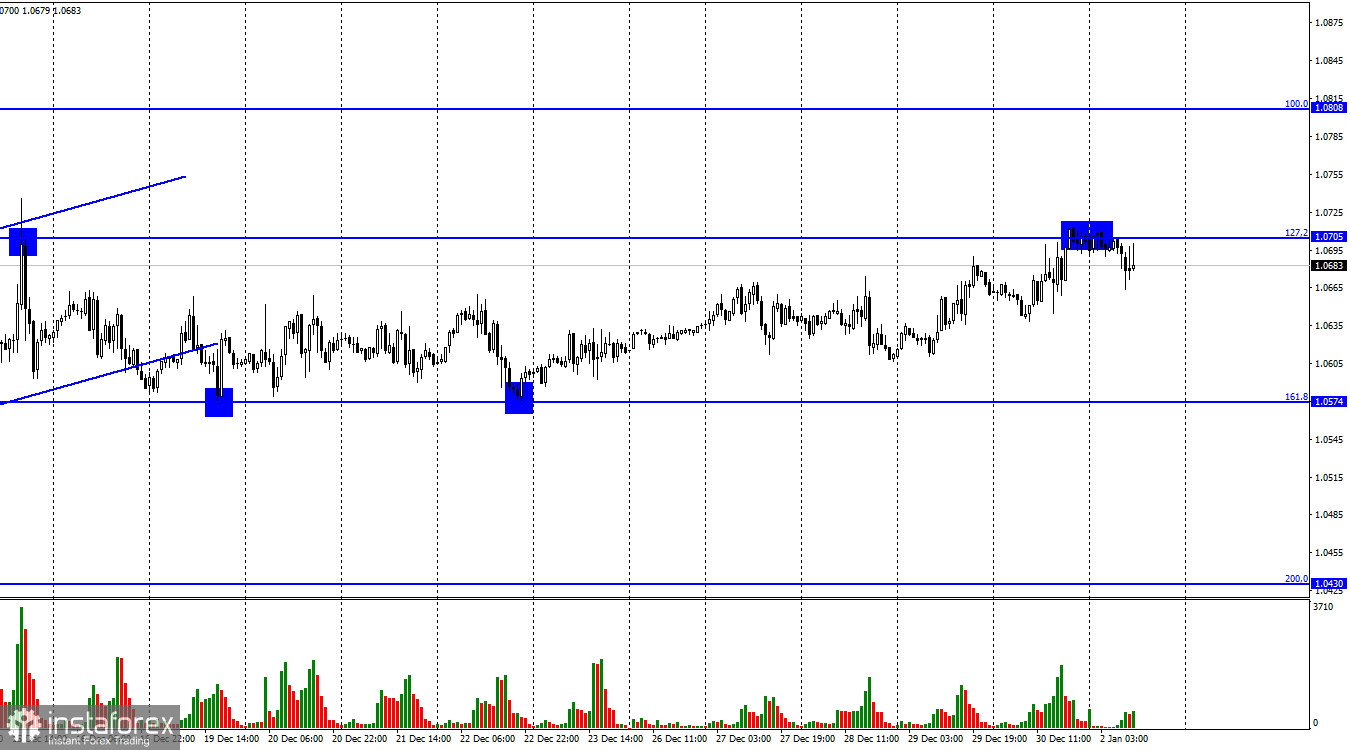

Beginning in 2023, the European currency can only be saved by a dismal labor market report or desperate traders' unwillingness to buy the dollar, as we have seen in recent weeks and months. Closing over the level of 1.0705, the top line of the side corridor can signal the beginning of new euro purchases. I anticipate a decline to 1.0574, at least until Friday. A stronger fall is ideal.

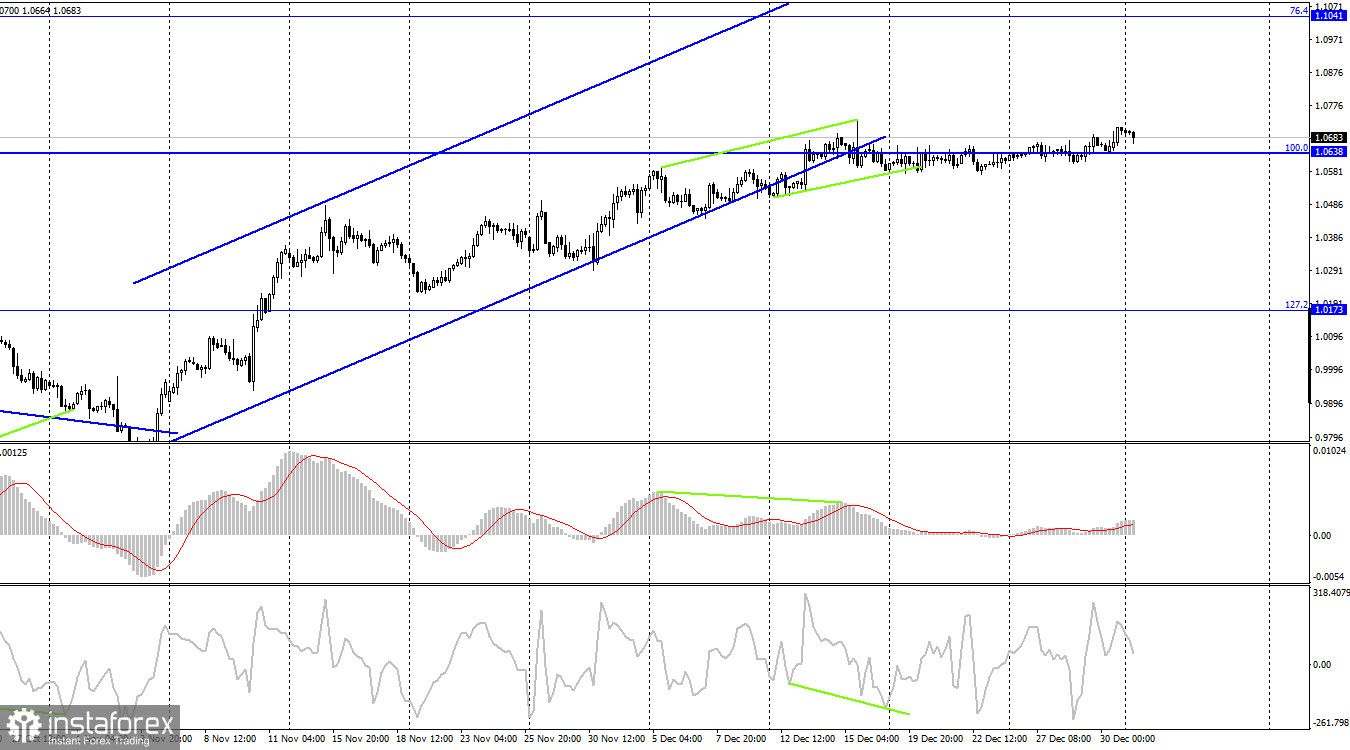

The pair prefers to move horizontally on the 4-hour chart. Closures above or below the 100.0% (1.0638) correction threshold are therefore not signals at this time. Divergences that occasionally form lack force, too. The hourly chart's side corridor is the only thing being looked at.

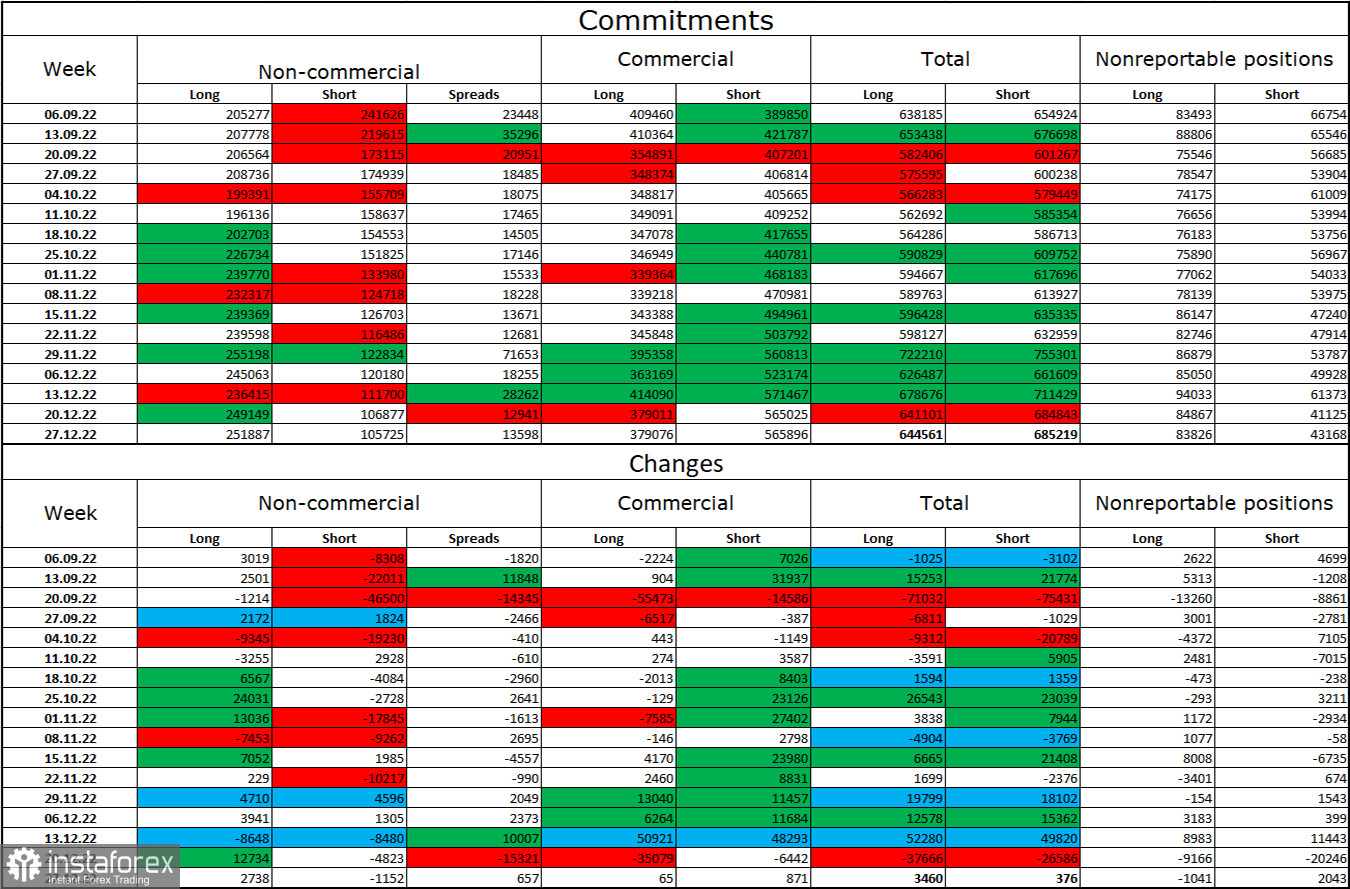

Report on Commitments of Traders (COT):

Speculators opened 2,738 long contracts and closed 1,152 short contracts over the previous reporting week. The positive sentiment among large traders is still present and getting stronger. Speculators now have 252 thousand of long contracts, while just 106 thousand short contracts are concentrated in their hands. According to COT statistics, the euro is currently rising, but I also notice that the number of long positions is already 2.5 times higher than the number of short positions. The likelihood of the euro currency increasing has been steadily increasing over the past few weeks, but I now wonder if it has increased too quickly. After a protracted "dark time," the situation is now improving for the euro, so its prospects are still good. On the hourly and 4-hour charts, however, breaking through the ascending corridors may indicate a strengthening of "bearish" positions in the short term.

The United States and the European Union's new schedules:

EU's manufacturing sector business activity index

The calendars of business activities in the US and the EU are almost empty on January 2. Only the EU business activity index was made public. Today's traders won't be affected by the information background's sentiment.

Forecast for EUR/USD and trading suggestions:

On the hourly chart, I advise selling the pair when it anchors under 1.0574 with a target of 1.0430. With a goal of 1.0574, you can also sell when the price is rebounding from 1.0705. On the hourly chart, I suggested buying the euro when it recovered from 1.0574, with a target of 1.0705 in mind. This objective has been completed. When closing above 1.0705 with a goal of 1.0808, make new purchases.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română