Trend analysis

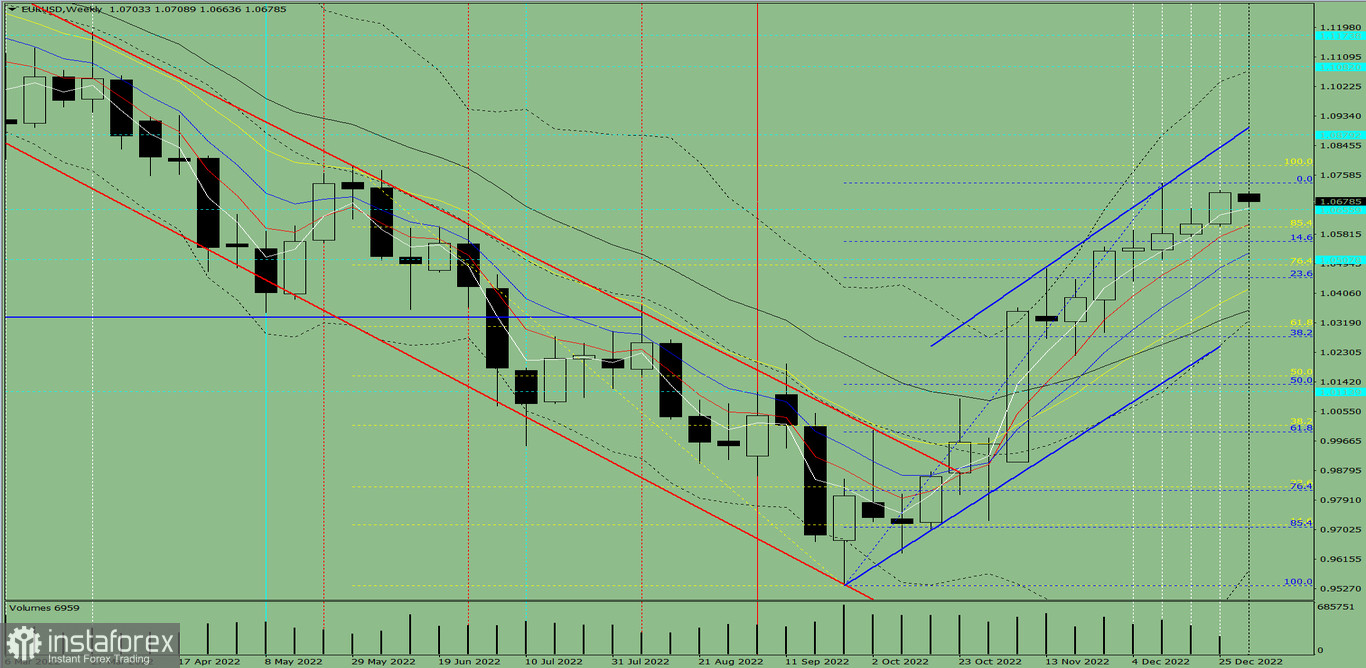

The market may begin heading lower this week from the level of 1.0706 (the close of the previous weekly candle), with a goal of 1.0560 and a retreat level of 14.6%. After achieving this level, keep moving forward.

Fig. 1 (weekly chart)

A comprehensive analysis

- Indicator analysis – down;

- Fibonacci levels – down;

- Volumes – down;

- Candle analysis – down;

- Trend analysis – down;

- Bollinger lines – up;

- Monthly chart - down.

The sophisticated analysis has an upward movement as its conclusion.

The first lower shadow of the weekly white candle (Monday - down) and the presence of the second upper shadow indicate that the price during the week is likely to have an upward trend. This is the overall result of calculating the candle of the EUR/USD currency pair according to the weekly chart.

The market may begin heading lower this week from the level of 1.0706 (the close of the previous weekly candle), with a target price of 1.0560 - a 14.6% decline level. After achieving this level, keep moving forward.

Alternatively, the pair might begin to decline from the level of 1.0706 (close of the most recent weekly candle), with the historical support level of 1.0656 being the eventual destination. The price may climb higher from here to test the upper fractal, or 1.0786. After achieving this level, keep moving forward.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română