In 2023, Bitcoin is trading within the range of $15,500-$17,400. The price movement of the cryptocurrency is accompanied by low volatility and trading volumes.

During the last 24 hours, BTC has increased by 0.64% and reached $16,700. We did not see the New Year's rally in cryptocurrency prices, which once again confirms the low investment attractiveness of digital assets.

Despite pessimistic forecasts triggered by the global economic downturn and the mass withdrawal of funds from the stock market, Bitcoin still has a chance to resume growth. According to the history of BTC prices, the asset closes one year with a decline and the next three years with growth.

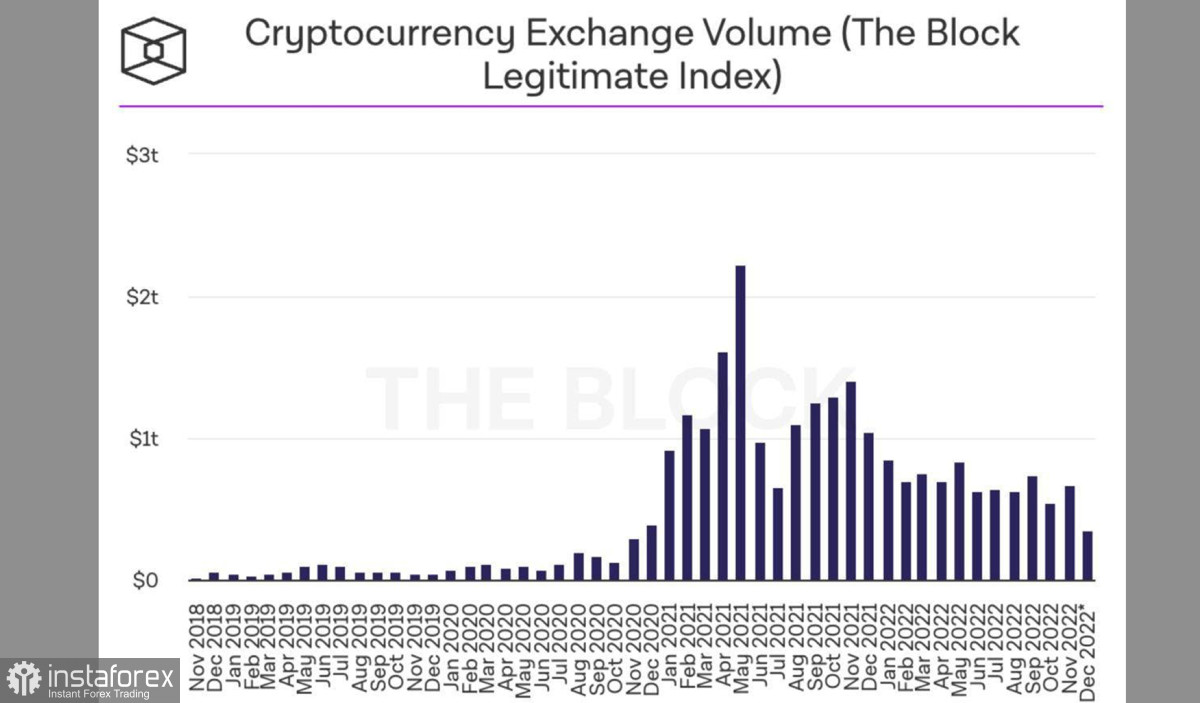

Most likely, Bitcoin may start the first stage of the upward movement in 2023. However, it is unlikely to happen in the first or second quarter of the year, as the market is rather pessimistic. At the same time, crypto market trading volumes dropped to two-year lows in December.

Apparently, it will take some time for trading activity to recover. Meanwhile, it is important to understand that investors will have to adjust to the consequences of a key rate hike. The Fed plans to raise the rate until spring 2023, which means we should not expect significant changes until then.

Bitcoin and SPX

The SPX index soared and BTC followed suit. However, this price movement cannot be called a New Year's rally. Investors understand the consequences of the key rate hike and are withdrawing funds from high-risk assets in advance.

The world's leading banks reported that SPX will decline to $3,400-$3,500 this year. The correlation between the cryptocurrency and the stock index remains high, and therefore Bitcoin may also decline.

BTC/USD analytical review

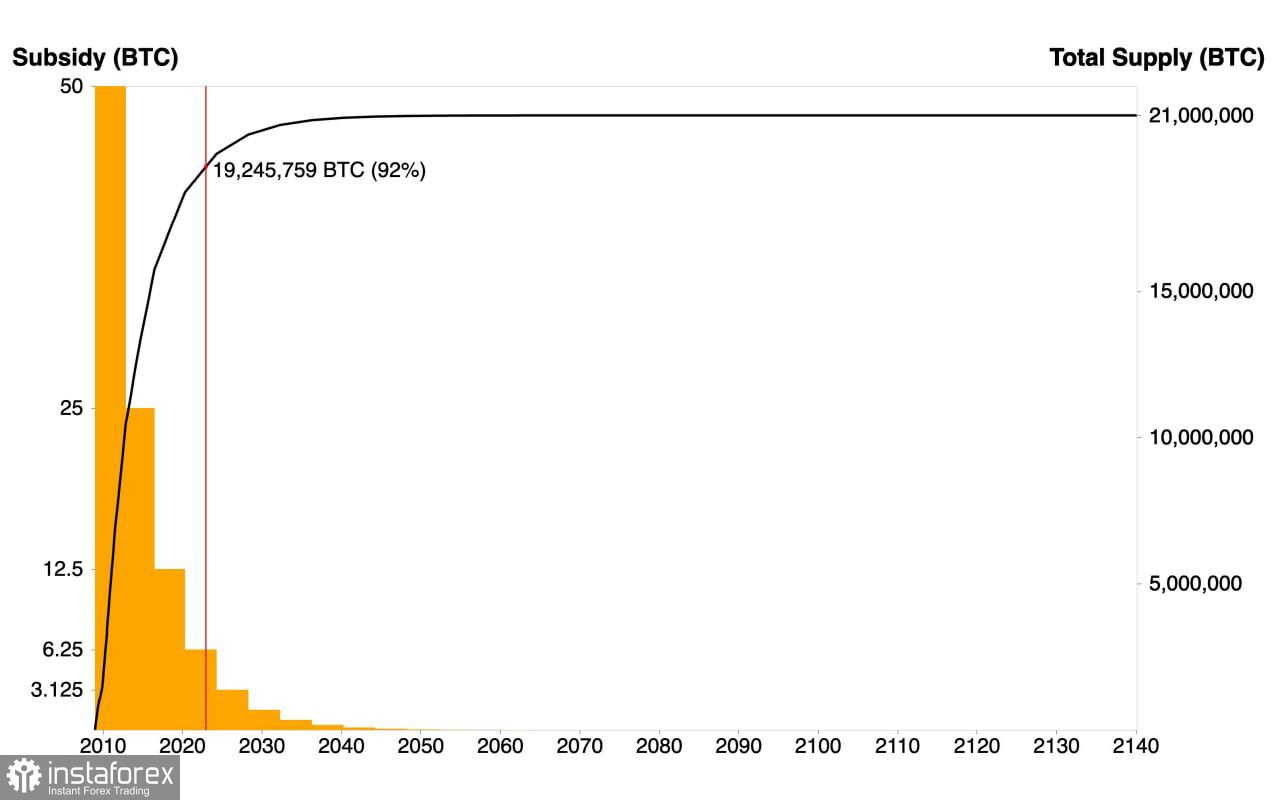

However, the situation may change if the cryptocurrency restores its status as a risk-hedging instrument during difficult times for the global economy. On January 2, 2023, Bitcoin issuance is 92% complete, with 19.245 million BTC coins out of 21 million mined.

Demand for Bitcoin will begin to grow as the current period of consolidation and accumulation ends. Under such conditions, the price of the asset may continue to rise, and cryptocurrency could become a means of capital preservation. However, given the current state of the crypto market, it will take months to realize such prospects.

Conclusions

After a period of calm trading during the New Year holidays, trading activity in the crypto market starts to grow. Most likely, the BTC price will continue to consolidate this week. At the same time, the asset may reach $16,900. Bitcoin may need a consolidation near $16,900, but the main targets of the uptrend remain the same.

If BTC rises to $16,900, the next target will be located at $17,400. If the price fails to settle above $16,900, it may test $16,400 again. In the current week, we should not expect sharp price movements from Bitcoin, because the consolidation period is not over.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română