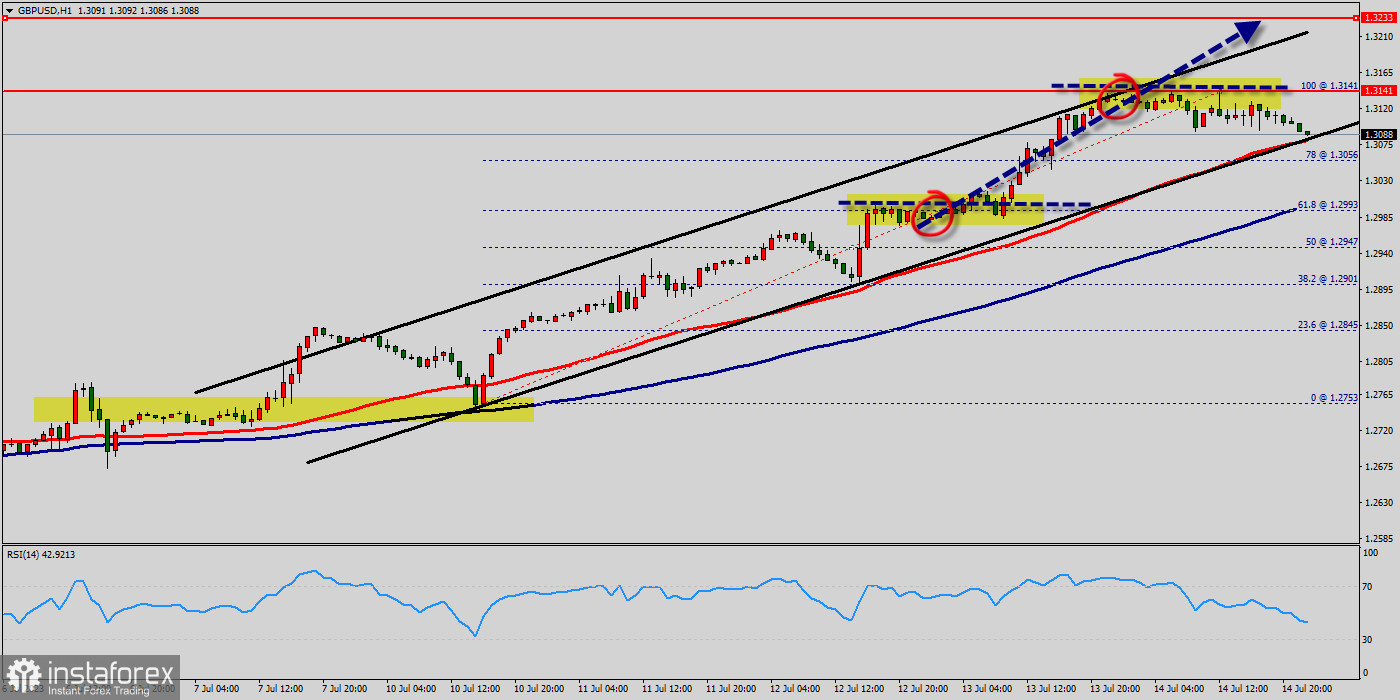

The British pound continues to rally against the US dollar. GBP/USD has risen to 1.3140. The pound hit a two weeks high earlier today and is up 1.66% this week. The pound has continued to trend higher against the dollar on the back of the data in recent days, breaking through a big psychological barrier in the process.

The break of 1.2997 is a very bullish move after what has already been a strong couple of weeks for the currency. Today, the GBP/USD pair has broken resistance at the level of 1.2997 which acts as support now. Thus, the pair has already formed minor support at 1.2997.

The strong support is seen at the level of 1.2997 because it represents the weekly support 1. The European Central Bank and the Bank of England, the two key central banks in Europe, have announced their intention to maintain a hawkish monetary policy.

The Bank of England's decision is primarily driven by the high inflation figures, which reached 8.7% year-on-year (consumer) and 5.1% year-on-year (core) based on May readings. Equally important, the RSI and the moving average (100) are still calling for an uptrend.

Therefore, the market indicates a bullish opportunity at the level of 1.3078 in the H1 chart. Also, if the trend is buoyant, then the currency pair strength will be defined as following: GBP is in an uptrend and USD is in a downtrend. Buy above the minor support of 1.3078 with the first target at 1.3078, and continue towards 1.3141 (the weekly resistance 1).

Last this week :

In case the GBP/USD pair manages to sette above the support 1.2803 level, it will have a good chance to climb above 1.2803, although it should be noted that the current move has already pushed the GBP/USD pair into the overbought territory.

Holding above 1.2803 is important to continue the expected rise, as breaking it will push the price to decline and visit 1.2803 areas before any new positive attempt. The expected trading range for today is between 1.2803 support and 1.2997 resistance.

The expected trend for today: Bullish. The GBPUSD pair rallied upwards strongly to succeed achieving our second waited target at 1.2934, noticing that the price is affected by RIS positivity to show positive trades now, and it might test 1.2827 and might extend to 1.2703 before turning back to rise again.

We expect the continuation of the main bullish trend domination in the upcoming period, supported by the EMA100 that carries the price from below, reminding you that our next target reaches 1.2910, while achieving it requires holding above 1.2803. Some technical fundamental analysis shows that The US Dollar is falling sharply across the board. It resumed the decline after the ECB meeting and following mixed economic reports from the US.

Initial Jobless Claims remain at the highest level since 2021 at 2662K, against expectations of a decline. On the positive side, Retail Sales rose by 0.25% in June, while consensus pointed to a 0.1% decline. Industrial Production fell 0.26% in May, while the NY Empire State Manufacturing Index jumped to 5.6 in July, largely above expectations. Next week targets 1.3141, 1.3225 and 1.3275.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română