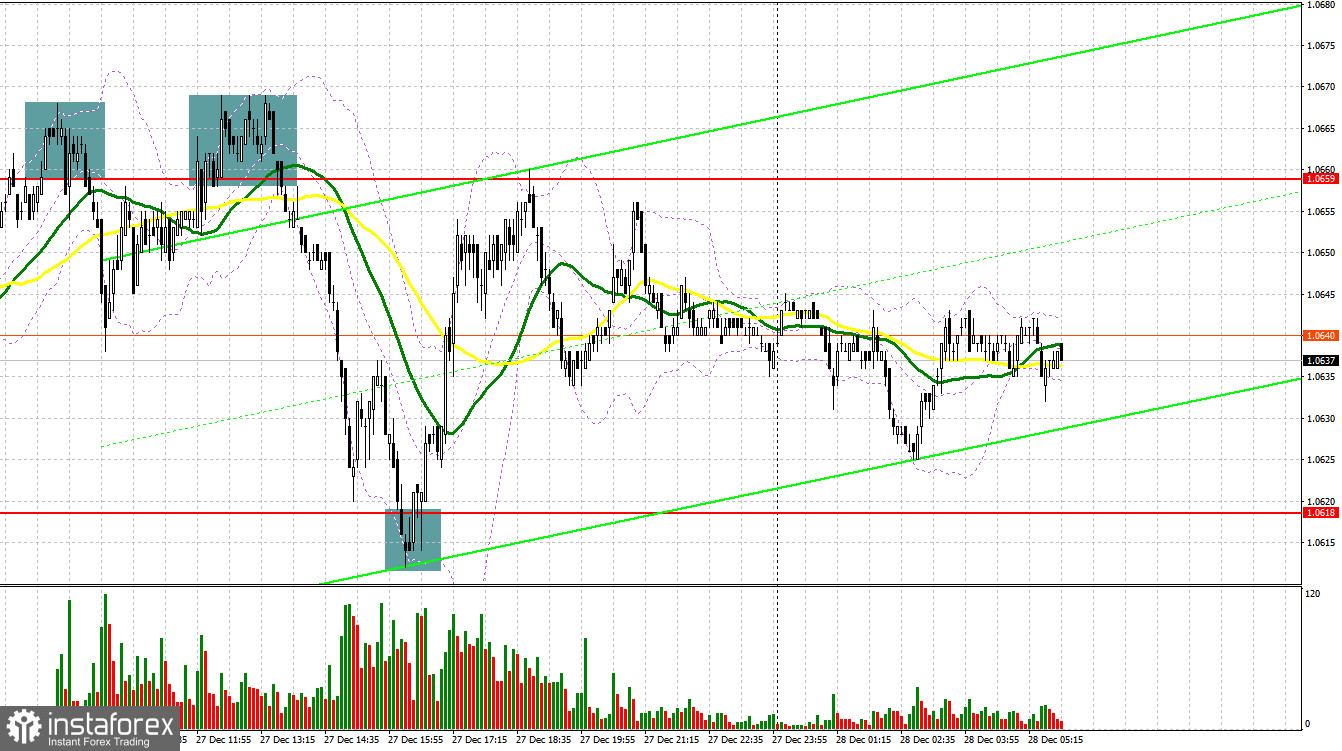

Yesterday, several signals for entering the market were formed. I advise you to examine the 5-minute chart and determine what transpired. I focused on the 1.0659 level in my morning forecast and suggested making decisions about entering the market there. Growth and the development of a false breakdown at 1.0659 in the morning gave excellent warning to sell the euro, but after a 20-point decline, trading moved back to the region of the resistance above. We received a similar sell signal in the afternoon at 1.0659, where the price had already fallen more than 40 points. Following the pair's decline, the bulls quickly held the level of 1.0618, enabling them to purchase the euro and causing a reverse rebound up by an additional 40 points.

If you want to trade long positions on EUR/USD, you will need:

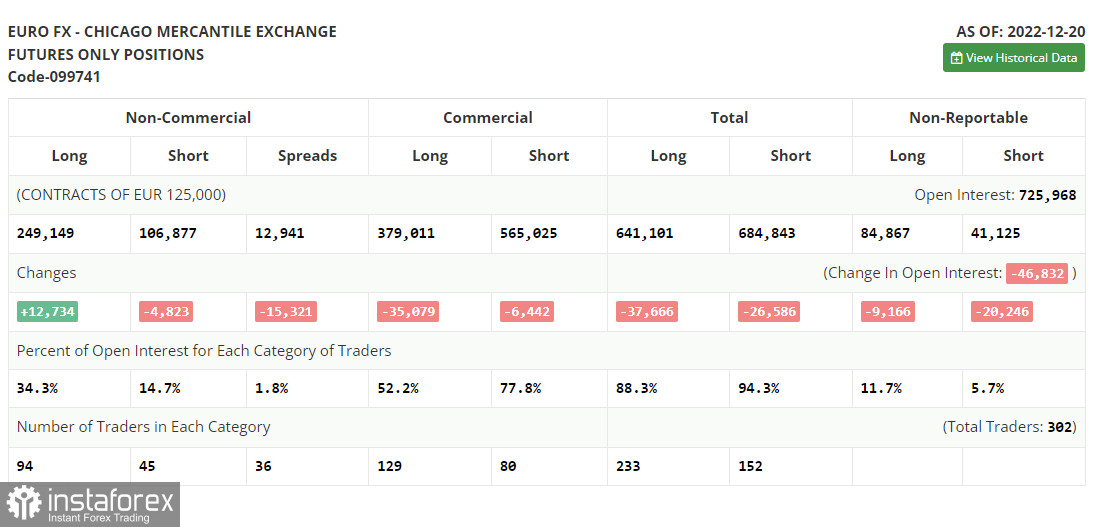

Let's take a look at what transpired in the futures market and how the positions of Commitment of Traders have changed before discussing the prospects for the EUR/USD movement in the future. The increase in long positions and the decline in short ones were noted in the COT report (Commitment of Traders) for December 20. The central bank meetings at the end of the year and the favorable statistics on the eurozone and Germany that were released last week prompted traders to increase their purchases of the euro. The power dynamic was not significantly altered by this, and we are still trading inside the channel we established last week. The US dollar continues to be in demand as traders anticipate further tightening of monetary policy due to the risks of maintaining high inflationary pressure next year. Strong data on US GDP growth in the third quarter of this year and the labor market also support this expectation. It is unlikely that you will have a strong desire to purchase risky assets once the recession is added to the list. According to the COT report, the number of long non-commercial positions increased by 12,734 to 249,149, while the number of short non-commercial positions decreased by 4,823 to 106,877. The total non-commercial net position increased significantly for the week, rising from 122,247 to 142,279 in value. This shows that despite their concerns, investors are still buying euros in anticipation of the ECB raising interest rates more dramatically in 2019. But a new fundamental justification is required for the euro to continue its positive growth. In contrast to 1.0342, the weekly closing price increased to 1.0690.

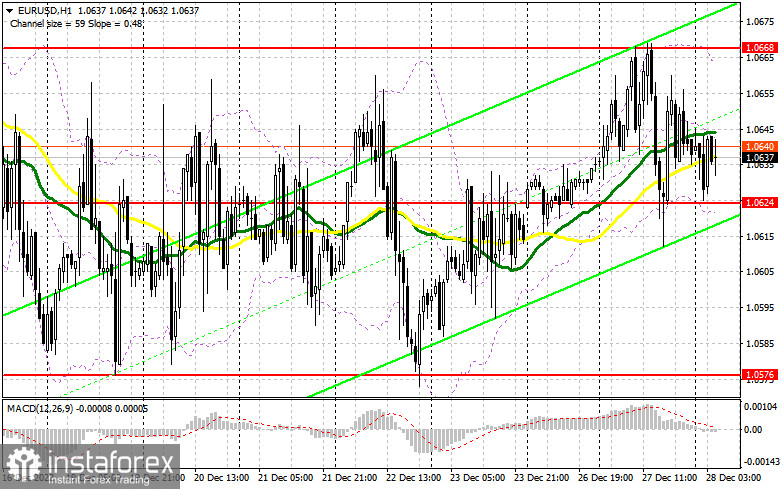

The new side channel's middle, which has shifted slightly to the level of 1.0624, needs to be protected by the bulls today as trading is still taking place within it. Trading is done within the parameters of this indicator, and the moving averages are slightly higher, both of which point to the side channel's preservation. Given that we have no fundamental statistics to report today, things could go in the opposite direction from yesterday if the sellers of the euro take the initiative. Only the development of a false breakdown in the vicinity of the nearest support of 1.0624, created by yesterday's results, will justify initiating long positions in anticipation of the continuation of the upward trend and updating the nearest resistance of 1.0668, which also serves as the channel's upper boundary. You can reach the maximum in the vicinity of 1.0703 with a breakout and top-down test of this range, which increases the likelihood of a larger upward movement to 1.0741. The most distant objective, despite being unattainable, will be a new monthly high of 1.0772, from which the continuation of the bullish trend will be signaled. There, I advise fixing profits. The situation will spiral out of control for buyers if there are no buyers at 1.06241 and the EUR/USD has the potential to decline. The euro can only be purchased if there is a false breakout in the vicinity of the next support level at 1.0576. To profit from a rebound only from support at 1.0535, or even lower, near 1.0495, I advise you to open long positions on the EUR/USD immediately. Your goal should be an upward correction of 30-35 points within a day.

If you want to trade short positions on EUR/USD, you'll need:

As mentioned above, the pair is currently trading in a side channel, and sellers' current focus is on keeping control of the mid-1.0624. If the bulls make another attempt to establish their presence at the end of the year, the protection of the 1.0668 area may be put to the test. The best scenario for selling would be a false breakdown at this level, which would cause the euro to move in the direction of 1.0624. An additional signal to enter short positions with the demolishment of buyers' stop orders would be a breakdown and consolidation below this range, as well as a reverse test from the bottom up. This would push the pair to the lower border of the 1.0576 side channel, where I would recommend fixing the profits. Only after seeing positive data on the US economy and housing market with an eye toward testing 1.0535 can we anticipate moving past this level. The bulls will take back control of the market if the EUR/USD rises during the European session and no bears are present at 1.0668. In this situation, I suggest delaying sales until 1.0703, an intermediate resistance level. A new entry point for short positions will be the formation of a false breakout there. If the price of EUR/USD rises above 1.0741 or even 1.0772, you can sell it right away with an eye toward a 30- to 35-point correction to the downside.

Signals from indicators

Moveable Averages

Trading occurs between the 30 and 50 moving averages, which highlights the market's lateral nature.

Notably, the author considers the period and prices of moving averages on the hourly chart H1 and departs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's lower limit, which is located around 1.0624, will act as support in the event of a decline. The indicator's upper limit, which is located around 1.0668, will serve as resistance in the event of growth.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română