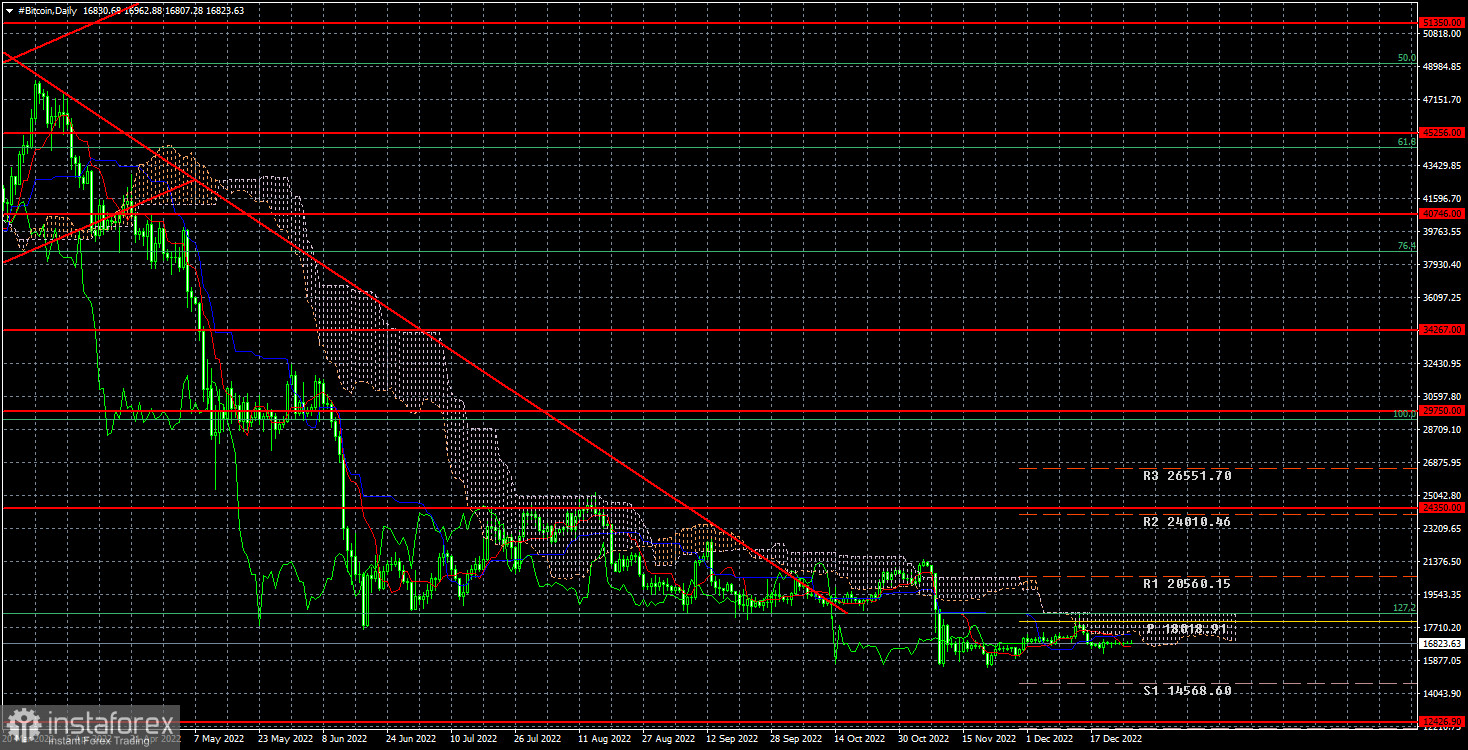

The price of the bitcoin cryptocurrency remains unchanged and is currently below the $18,500 mark. Remember that this is the exact scenario that we have discussed numerous times, so everything is now going as expected. The "bitcoin" may currently remain in the flat position for a few weeks or months, but eventually, we anticipate it to drop at least to the level of $12,426.

Just yesterday, we were talking about how bitcoin proponents were attacked rather "harshly" by billionaire Mark Cuban, who claimed that bitcoin is much better than gold. But, you know, if we had to choose between Cuban, who is a bitcoin investor himself, and a sizable organization like JP Morgan, we'd go with the latter. Additionally, according to JP Morgan's experts, the majority of institutional investors do not even recognize bitcoin as an asset class. Due to high volatility and a lack of internal profitability, which could be reflected in the reports and thereby justify the investment, they are not likely to invest in it anytime soon. According to JP Morgan, Bitcoin has not evolved into "digital gold" or a way to protect against inflation. We can also speak for ourselves when we say that bitcoin is not an analog of money, a replacement for money, or a substitute for cross-border payments. We can only conclude that it is still a high-risk, extremely volatile investment instrument after 15 years of its existence. This choice is suitable for some investors, so they purchase cryptocurrency.

Two very crucial factors were already brought to the traders' attention earlier on. First, why isn't bitcoin increasing if it has reached the "bottom"? Remember that every major trend eventually shifts sharply and strongly in the opposite direction as market players start to close a large number of profitable transactions. It is also true in the case of bitcoin that many people would like to purchase it at the current "very low" price levels. But for some reason, nobody is pressing to make a purchase. The second is that almost no market participants are prepared to invest in it because they anticipate an even bigger fall because the fundamental background for "bitcoin" is still very difficult. Why buy bitcoin now if almost everyone (aside from Michael Saylor) is anticipating a new decline in its price? Therefore, we still anticipate it to drop to the $12,426 minimum. According to many experts, it is quite capable of demonstrating movement up to $5,000 per coin.

The "bitcoin" quotes over the past 24 hours have remained below the level of $18,500. From our perspective, the future decline may continue, with a target of $12,426. This might not occur soon enough, though, as each new collapse was followed by a flat period, which we are currently experiencing. This does not, however, indicate that the bearish trend is over.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română