Macroeconomic calendar on December 26

Yesterday's trading activity was subdued as the main stock exchanges were closed due to Christmas.

The absence of key players in the market led to reduced trading volumes, which had a negative impact on volatility.

Overview of trading charts on December 26

The EUR/USD pair has completed another movement cycle within the sideways range of 1.0580/1.0660. As a result, the price returned to the upper boundary of the range. Notably, the pair has been standing still for a week and a half. This means that the price may well gain momentum and break out of the range.

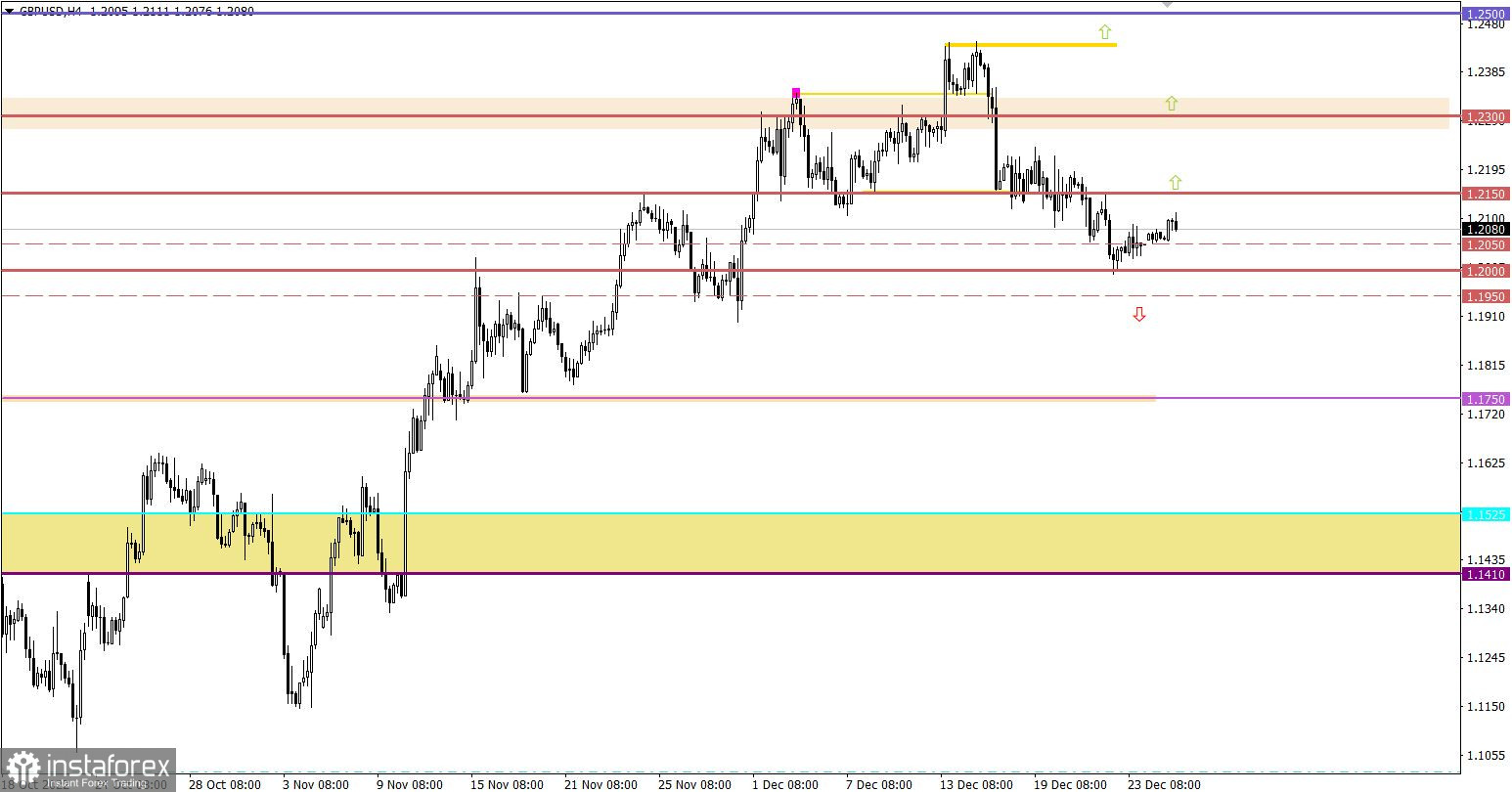

The GBP/USD pair is currently pulling back from the psychological level of 1.2000. The British pound has already added about 90 pips. Currently, it is holding steady above 1.2050.

Macroeconomic calendar on December 27

While traders are gradually returning to the market, the UK, Australia, New Zealand, and Canada are enjoying an extra day off.

Today's macroeconomic calendar includes data on wholesale inventories in the US as well as the house price index.

According to forecasts, statistics are expected to be rather downbeat.

EUR/USD trading plan for December 27

Given that the quote has crept up to the upper boundary of the sideways range, traders are considering two possible scenarios: a breakout of the sideways range from the bottom up and a price rebound as it was the case a few days ago.

The breakout method is considered the most interesting strategy as it may lead to more significant price changes.

A bullish scenario will be considered by traders if the price consolidates above 1.0670 on the four-hour chart. In this case, the volume of long positions will increase, and the price will have a chance of hitting a new local high.

A bearish scenario will be relevant if the price fixes below 1.0570 on the four-hour chart. In this case, the price will return to the level of 1.0500.

GBP/USD trading plan for December 27

The current corrective move from the local high is still relevant in the market. However, the situation can change if the price rises above the level of 1.2150 on the four-hour chart.

In this scenario, an increase in the volume of long positions will lead to a gradual recovery in the pound sterling.

As for the next downward move as part of its correction, a technical signal of a continued slide will come after the price fixes below 1.1950 on the four-hour chart.

What's on trading charts

The candlestick chart shows graphical white and black rectangles with lines from above and below. While conducting a detailed analysis of each individual candlestick, one can notice its features intrinsic to a particular time frame: the opening price, the closing price, as well as the highest and lowest prices.

Horizontal levels are price levels, at which the price may stop or reverse. They are called support and resistance levels.

Circles and rectangles are highlighted examples where the price reversed in the course of its history. This color highlighting indicates horizontal lines, which can exert pressure on the quote in the future.

Up/down arrows signal a possible future price direction.

Traders are recommended to read the following article:

EUR/USD and GBP/USD: trading plan for beginners on December 26, 2022

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română