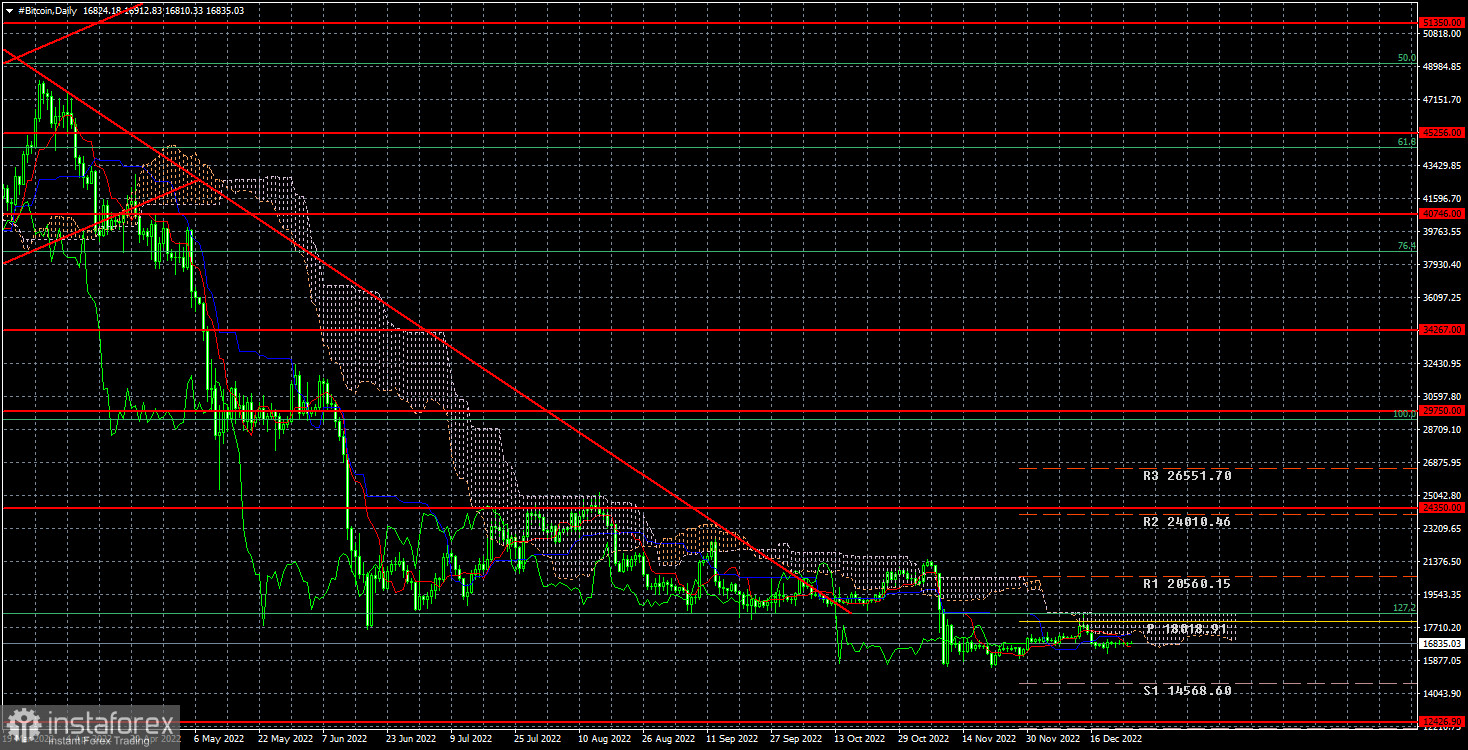

Bitcoin cryptocurrency continues to trade in absolute flat below the $18,500 mark. Remember that this is the exact scenario that we have discussed numerous times, so everything is going as expected. Although "bitcoin" may currently remain in the flat position for a few weeks to several months, in the end, we anticipate it to at least drop to the level of $12,426.

The year 2022 is slowly coming to an end, and traders don't appear to be motivated to engage in active trading at this time. However, this is a good time to reflect on the past year and attempt to predict what will happen in the following one. Traders and analysts occasionally seek out the opinions of experts, millionaires, and investors, many of whom are eager to share their insights and counsel. However, there are times when their perspectives diverge greatly. For instance, renowned investor Peter Schiff frequently disparages bitcoin and claims that it will never "rise from its knees." In the opinion of Cathie Wood and Michael Saylor, the first cryptocurrency has a bright future, but we still need to be patient. Elon Musk is placing his bets on alternative cryptocurrencies. Everyone has an opinion, so you should try to think for yourself rather than just blindly accepting the views of various experts and "experts," since everyone has an opinion in general.

Remember that we have nothing against bitcoin's price beginning to rise once more. We simply don't see any reason for it to grow at the moment. Since there are no growth factors, it is therefore nearly impossible to predict when bitcoin will start to form a new "bullish" trend. However, it may start next year or in two years. Generally speaking, we can now predict the development of "bitcoin" based on just one factor. The Fed will stop raising the key rate in a few months, which can be seen as the start of reducing monetary pressure on the economy. The rates will nevertheless stay high for at least another year. Naturally, many investors will attempt to profit from the fact that the assets with the lowest risks will continue to have high returns for the foreseeable future. Even if these assets have a rate of return of around 4%, that rate will still be higher than inflation, which is expected to drop back to 2% in the future. Even with inflation now at or above 4%, if you invest in treasury bonds for a period of 5 to 10 years, you can still come out ahead. As a result, we don't think the demand for bitcoin will increase anytime soon.

The "bitcoin" quotes over the past 24 hours have remained below the level of $18,500. From our perspective, the fall could continue with a $12,426 goal. As we previously stated, since the price was concurrently in a side channel, crossing the downward trend line does not signify the end of the "bearish" trend. Bitcoin is now located below this channel, allowing the quotes to move southward.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română