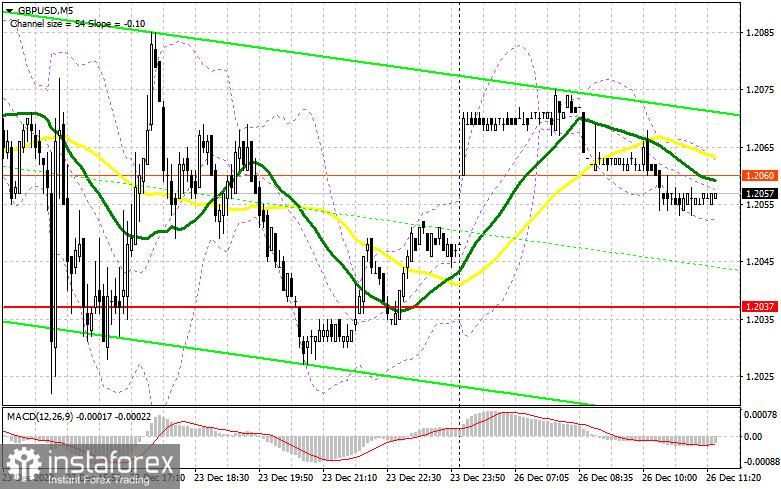

I focused on the 1.2037 level in my morning forecast and suggested making decisions about entering the market there. Let's analyze the 5-minute chart to determine what transpired there. Due to the extremely low volatility of the market, neither a test of the nearest support level of 1.2037 nor signals for entering the market were able to be seen. Because there is no point in changing anything technically, it appears that the second half of the day will proceed exactly as planned.

To open long positions on GBP/USD, you need:

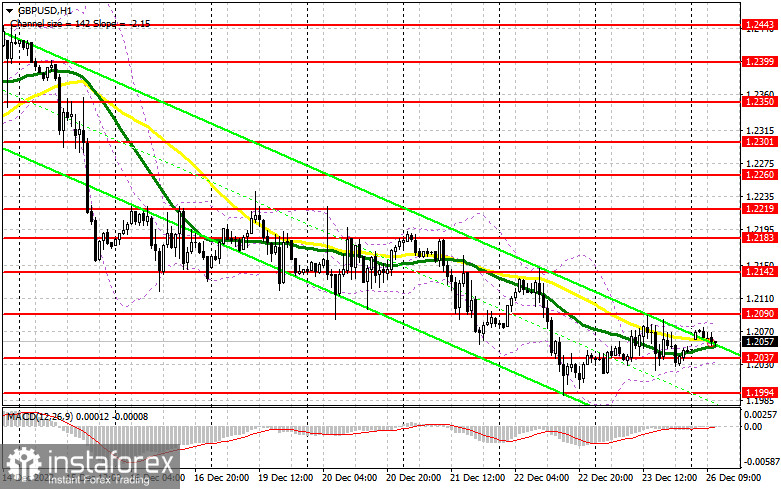

Since there are no statistics during the American session (a holiday-related day off), you can safely avoid the market because you shouldn't anticipate any of the parties moving more sharply than usual. The formation of a false breakdown in the vicinity of 1.2037, where the moving averages are favoring buyers, will be the ideal scenario for initiating long positions. This will enable the pair to retrace its steps to 1.2090, the resistance created by last Friday's outcomes. We can anticipate a sharp upward jump and an update of the level of 1.2142, where sellers of the pound will once again enter the market if there is a breakthrough and consolidation above this range against a backdrop of an absence of data. The growth prospects at 1.2183, where I advise fixing profits, will be opened up by an exit above 1.2142 with a comparable test. I advise you not to rush into purchases if the bulls are unable to complete the tasks assigned and miss 1.2037. Instead, you should open long positions on a decline and a false breakdown near the weekly minimum of 1.1994. I advise purchasing GBP/USD right away in anticipation of recovery from 1.1949 to gain 30-35 points in a single day.

To open short positions on GBP/USD, you need:

At the end of this year, sellers will undoubtedly leave and are unlikely to attempt to violate the monthly minimum. Only a false breakout at the nearest resistance level of 1.2090 would constitute a good sell signal at this time, with the expectation that the bear market would persist and that prices would repeatedly fall to a minimum of 1.2037. With a move to 1.1994, the only way to enter a sell position is through a breakout and reverse test from the bottom up of this range. The area of 1.1949, where I advise fixing profits, will be the target that is the farthest away. The pressure on the pound will weaken even more at the start of the week due to the possibility of GBP/USD growth in the afternoon and the lack of bears at 1.2090, giving the bulls a great opportunity for a correction. In this instance, the only entry point into short positions to move down is a false breakout in the vicinity of 1.2142. If there is no activity there, I advise you to sell GBP/USD right away at the highest price of 1.2183, but only if you are counting on the pair to fall back by 30-35 points during the day.

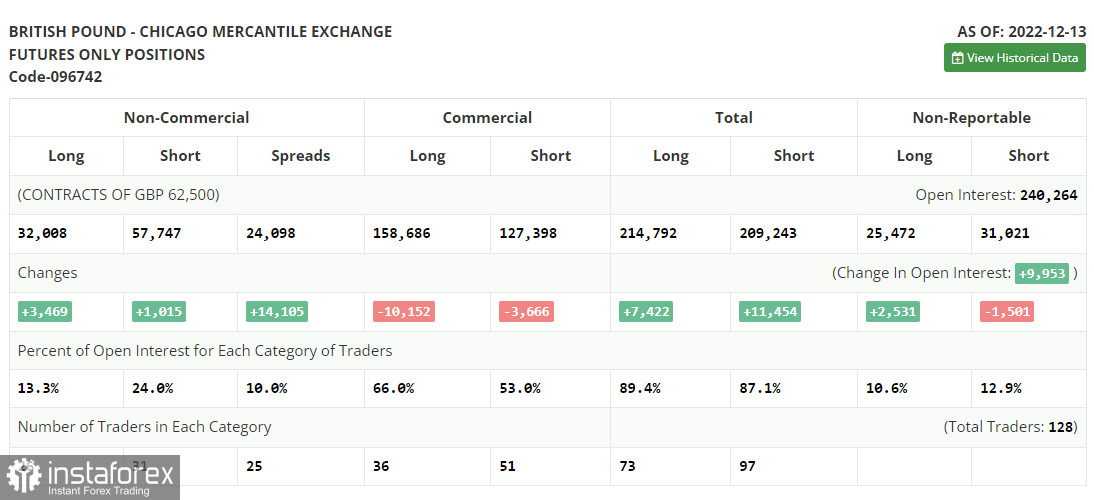

Both long and short positions increased in the COT (Commitment of Traders) report for December 13. We can infer with certainty that there are people who want to purchase the pound at the current high prices because there were significantly more of the former. This is especially true in light of the Bank of England's announcement last week that it would maintain its aggressive approach to combating high inflation, which barely decreased last month. It is important to keep in mind, however, that this type of policy is already causing many economists to speculate about the start of a recession in the UK, which will continue to restrict the pound's upward potential. This makes it wiser to hold off on purchases for the time being and wait for the expected, sizable downward correction at year's end. According to the most recent COT report, long non-commercial positions increased by 3,469 to a level of 32,008, while short non-commercial positions increased by 1,015 to a level of 57,747, which resulted in a decrease in the non-commercial net position's negative value to -25,739 from -28,193 a week earlier. In contrast to 1.2149, the weekly closing price increased to 1.2377.

Signals from indicators

Moveable Averages

The fact that trading occurs around the 30 and 50-day moving averages suggests that the market is lateral.

Note that the author's consideration of the period and cost of moving averages on the hourly chart H1 differs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's lower limit, which is located around 1.2037, will serve as support in the event of a decline.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română