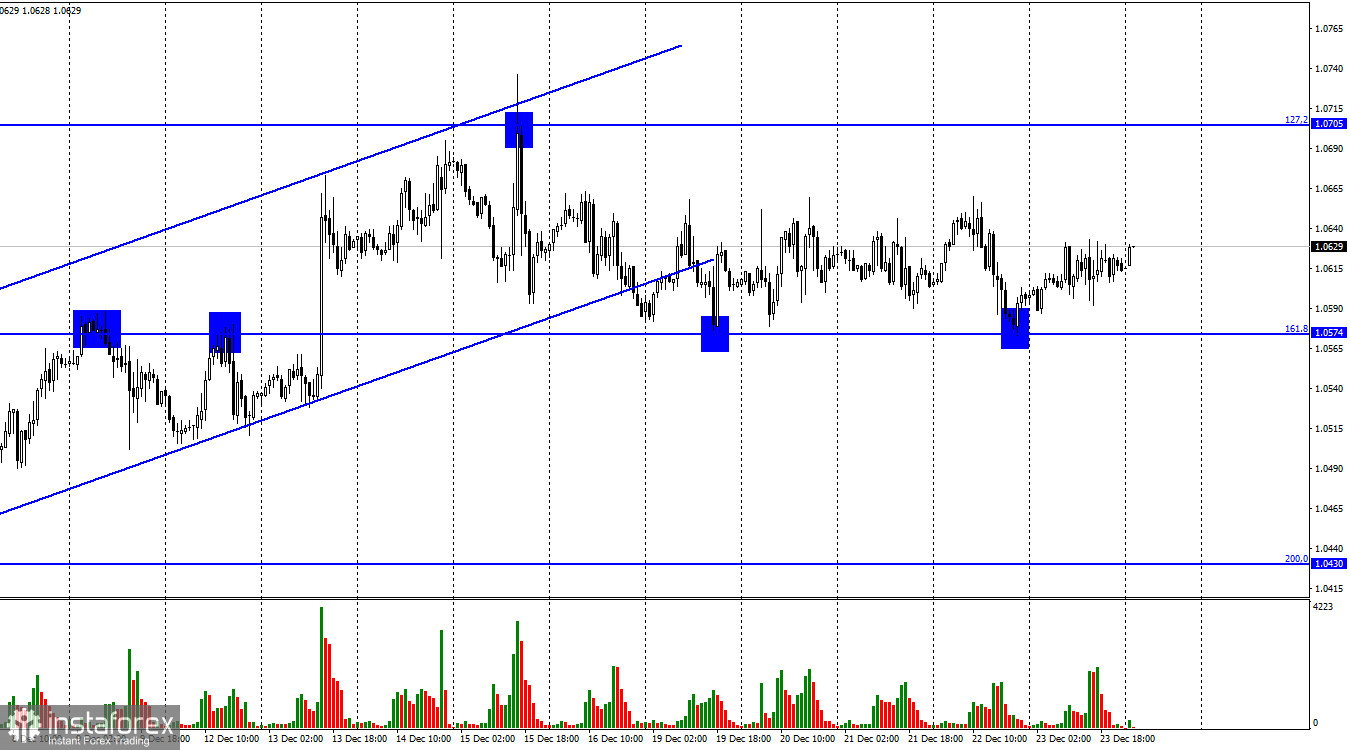

Hi everyone! The EUR/USD pair showed moderate growth on Friday after rebounding from 1.0574, the Fibonacci correction level of 161.8%. I have already motioned that it will be extremely difficult for the pair to rise to 1.0705. It may climb only by 60-70 pips but not more. Thus, today or tomorrow, the pair may return to the 1.0574 level with a subsequent rebound from it. The movement remains horizontal.

Last Friday, there were several economic reports. They did not significantly affect the market sentiment although some of them were rather crucial. Let's start with the Federal Reserve's preferred inflation gauge - the Personal Consumption Expenditures price index. At the end of November, the reading climbed by 0.1% on a monthly basis and 5.5% on an annual basis. This is one of the slowest paces of growth over the year. It indicates that consumer spending is cooling. This is what the Fed is trying to achieve with its aggressive tightening. Consumer spending is 2/3 of inflation. In order to curb inflation, it is necessary to lower demand. The Fed has been hiking the interest rate for almost a whole year. It significantly reduces the volume of lending, increasing demand for government bonds. Therefore, the slowdown in consumer spending signals a decline in inflation.

For the US currency, this is not good news. The Fed may move away from aggressive tightening if inflation starts dropping steadily. However, the ECB has also begun to slow down the pace of monetary tightening. In my opinion, the euro and the dollar are now in an approximately equal position. Trading volumes remain low amid the Christmas holidays. This is why it is now quite difficult to make any predictions as the market is flat.

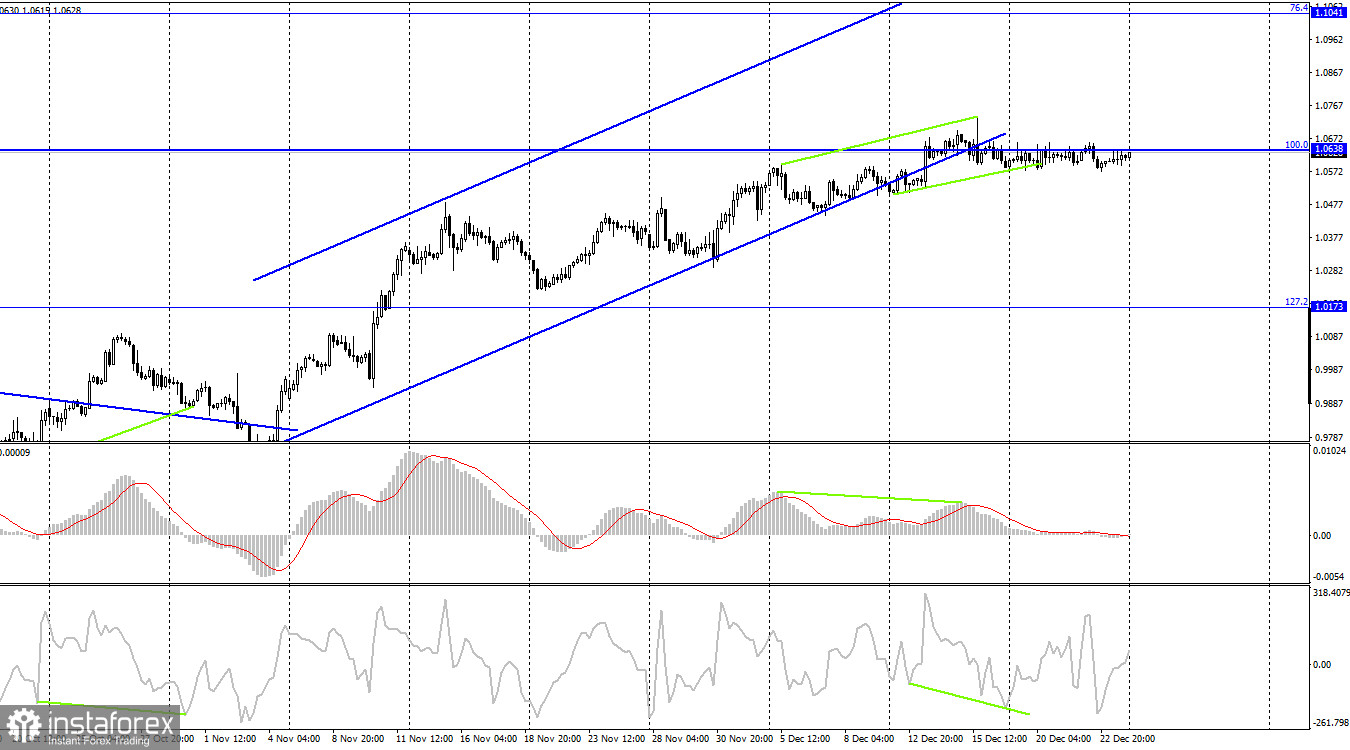

On the 4-hour chart, the pair performed retreated after the formation of a bearish divergence at the MACD indicator and a decline below the Fibo level of 100.0%. For this reason, a further decline looks likely. The pair also settled below the ascending channel. However, it is still moving horizontally.

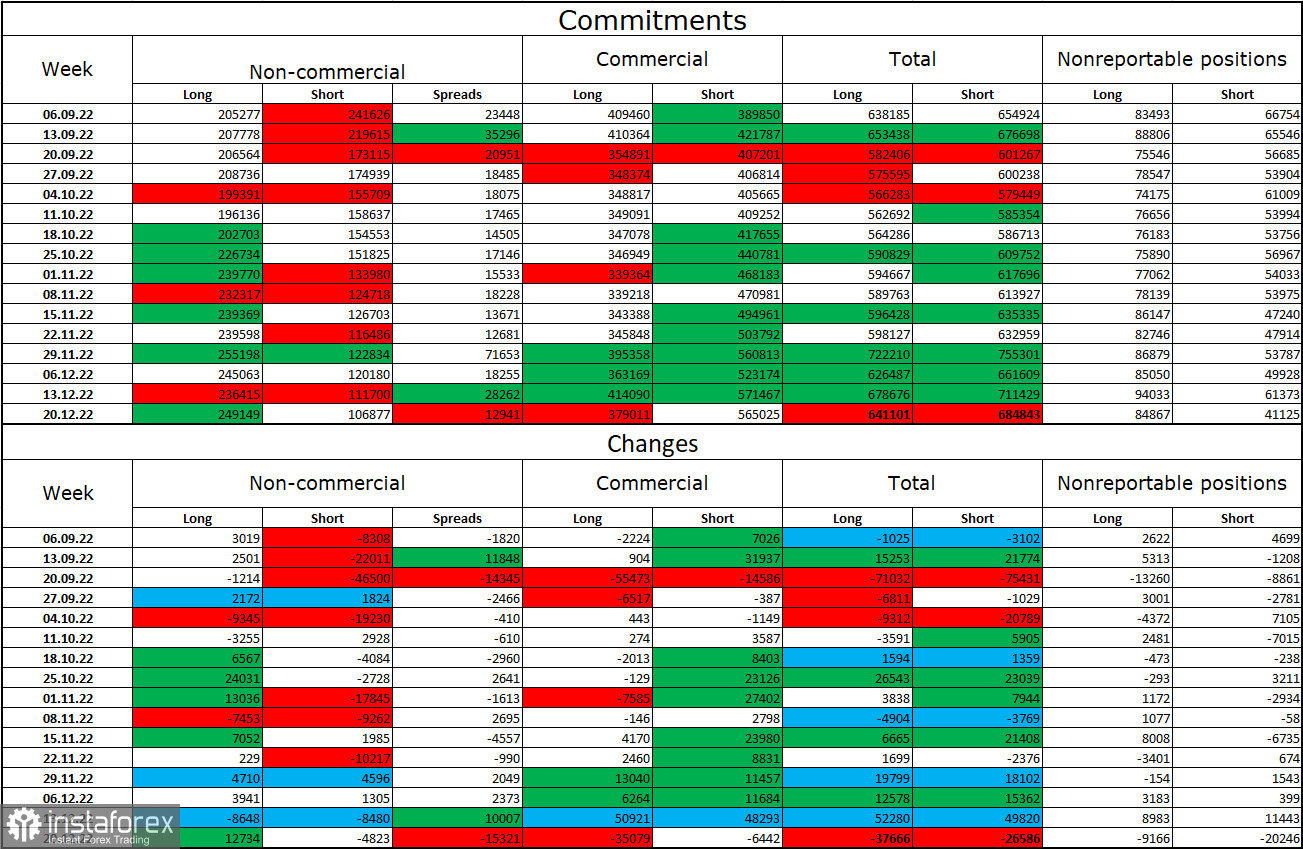

Commitments of Traders (COT):

Last week, speculators opened 12,734 long positions and closed 4,823 short ones. The mood of large traders remains bullish. The total number of long contracts amounts to 249,000 and short contracts to 106,000. The European currency is currently growing, which is in line with the COT reports. At the same time, bear in mind that the number of long positions is significantly higher than the number of short ones. In the last few weeks, the euro has been constantly rising. Some analysts are rather suspicious of such a rapid increase. Nevertheless, fundamental factors remain positive for the euro. After a long period of decline, it has finally resumed an upward movement. However, if it falls below the ascending channel on the 1H and 4H charts, bears may enter the market.

Economic calendar for US and EU:

On December 26, both economic calendars are uneventful. The impact of fundamental factors on the market sentiment will be weak today.

Outlook for EUR/USD and trading recommendations:

It is better to sell the euro if it drops below 1.0574 on the hourly chart with a target level of 1.0430. It would be wise to go long if the euro rises to 1.0574 on the hourly chart with a target of 1.0705. However, it is likely to grow by only 60-70 pips.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română