Who is stronger, the Federal Reserve or Santa Claus? The Christmas rally in the U.S. stock market since the 1960s has occurred 75% of the time, regardless of what policy the Fed pursued - stimulating or restraining. Five days before the end of the year, on average, lifted the S&P 500 1.3% since 1969. If Santa was showing his power over the market, the broad stock index added 10.9% in the year after December, if not, then his success was a much more modest 4.1%. Expectations of a Christmas rally and hawkish rhetoric from European Central Bank officials made it possible for the EURUSD bulls to fend off a counter attack on support at 1.0575.

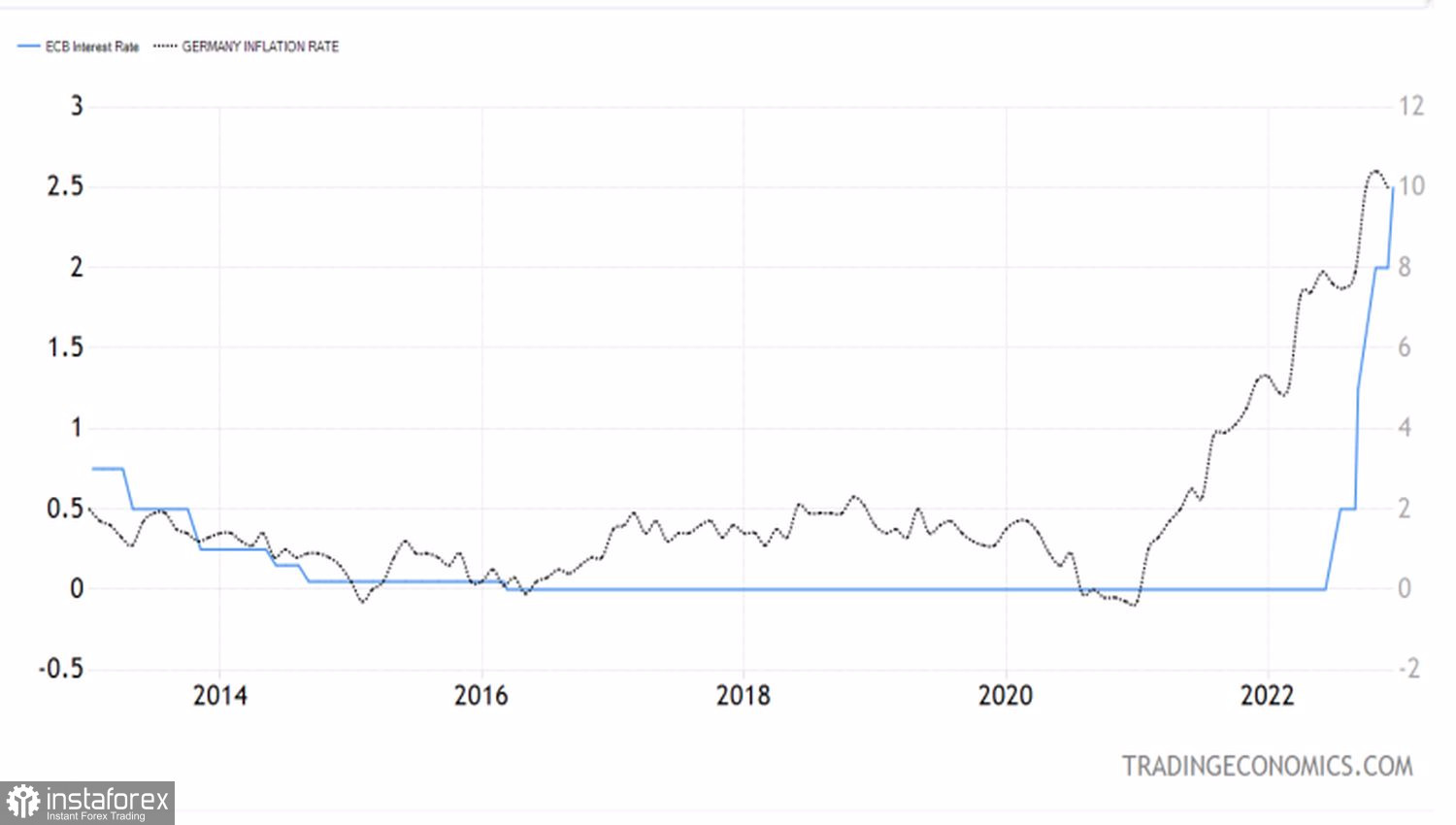

According to economic advisors advising the German government, inflation in Germany will remain at elevated levels for at least another two years. It will continue to be a problem in 2024. This view echoes that of the Bundesbank, which believes that the recent drop in energy prices is not enough to bring inflation down from double digits. Germany's harmonized CPI hit 11.3% in November, the highest since the 1950s.

Inflation in Germany and the ECB rate

Under such conditions hawkish rhetoric of ECB officials looks quite logical. Member of the Governing Council Isabel Schnabel said that the ECB will continue to increase the cost of borrowing. Eventually it may exceed the levels that the futures market currently expects to see. Investors' forecasts for the peak deposit rate is 3.4%. The head of the central bank of the Netherlands Klaas Knot claims that the ECB will keep raising rates as 'second half' of the tightening cycle begins. Since the start of the monetary tightening cycle, borrowing costs have been raised by 250 bps and assuming that's only half of it, the deposit rate could rise to 4.5% in 2023. This is good news for EURUSD.

At the same time, inflation in the US is slowing. This can be seen in the drop in annual inflation expectations from the University of Michigan from 4.9% to 4.5% in December as well as in the PCE. The Fed's preferred inflation indicator, the Personal Consumption Expenditures (PCE) Index, declined in November from 6.1% to 5.5% y/y and from 0.4% to 0.1% m/m. The core indicator -5% to 4.7% y/y and from 0.3% to 0.2% m/m. Yes, consumer confidence and spending are up in America, which is keeping U.S. stock indices in check. After all, they are used to the fact that good news from the economy is bad for the stock market.

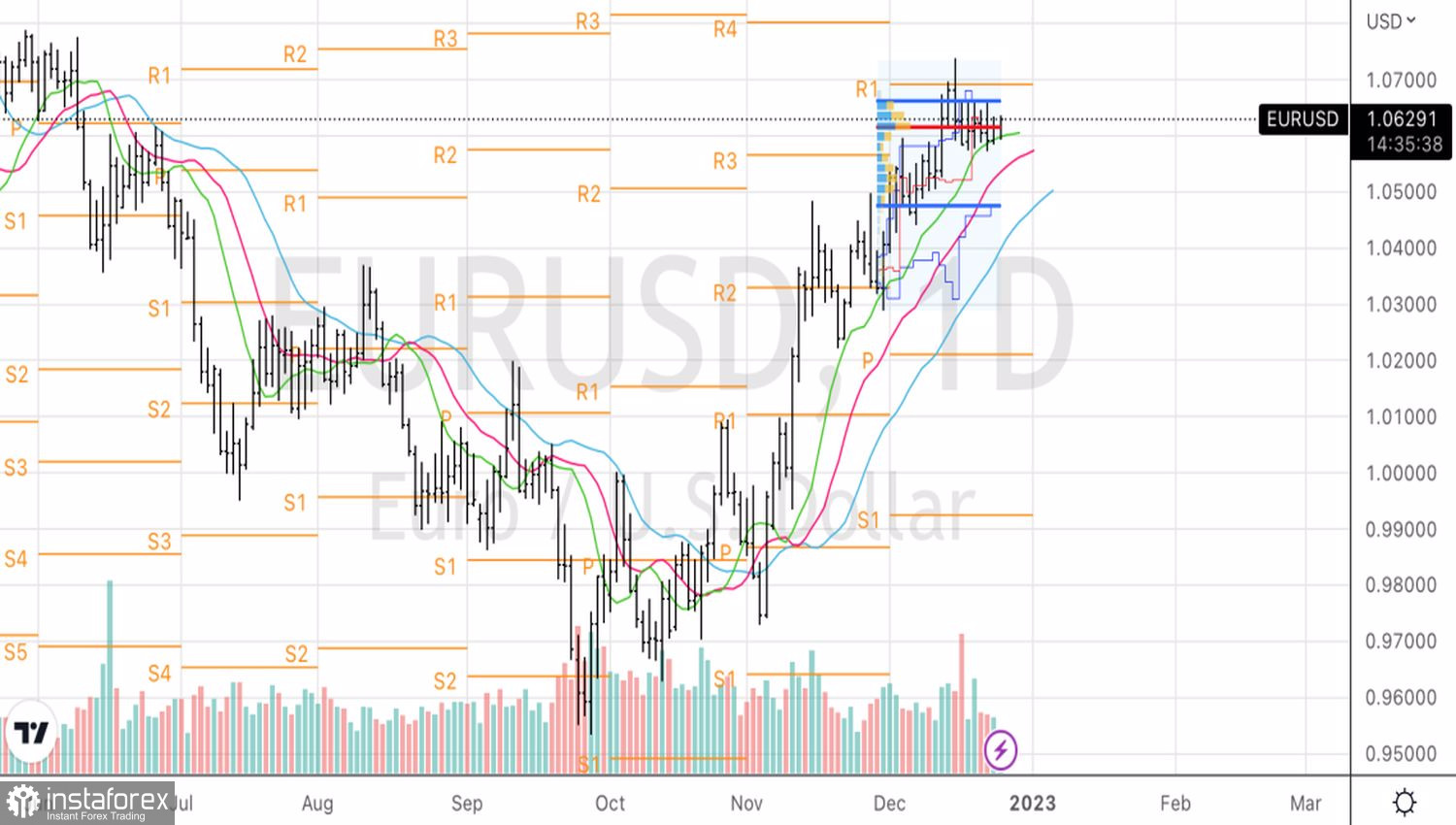

Nevertheless, the Santa Claus rally risks turning everything upside down. The increase of the global appetite for risk together with the hawkish attitude of the ECB is fraught with the growth of EURUSD quotes in the direction of 1.07-1.08.

Technically, there is a Splash and Shelf pattern on the EURUSD daily chart. Crossing the lower limit of the consolidation range at 1.0575-1.0655, or the so-called shelf, is a reason to form short positions. On the contrary, a successful attack on resistance at 1.0655 is a reason to buy the main currency pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română