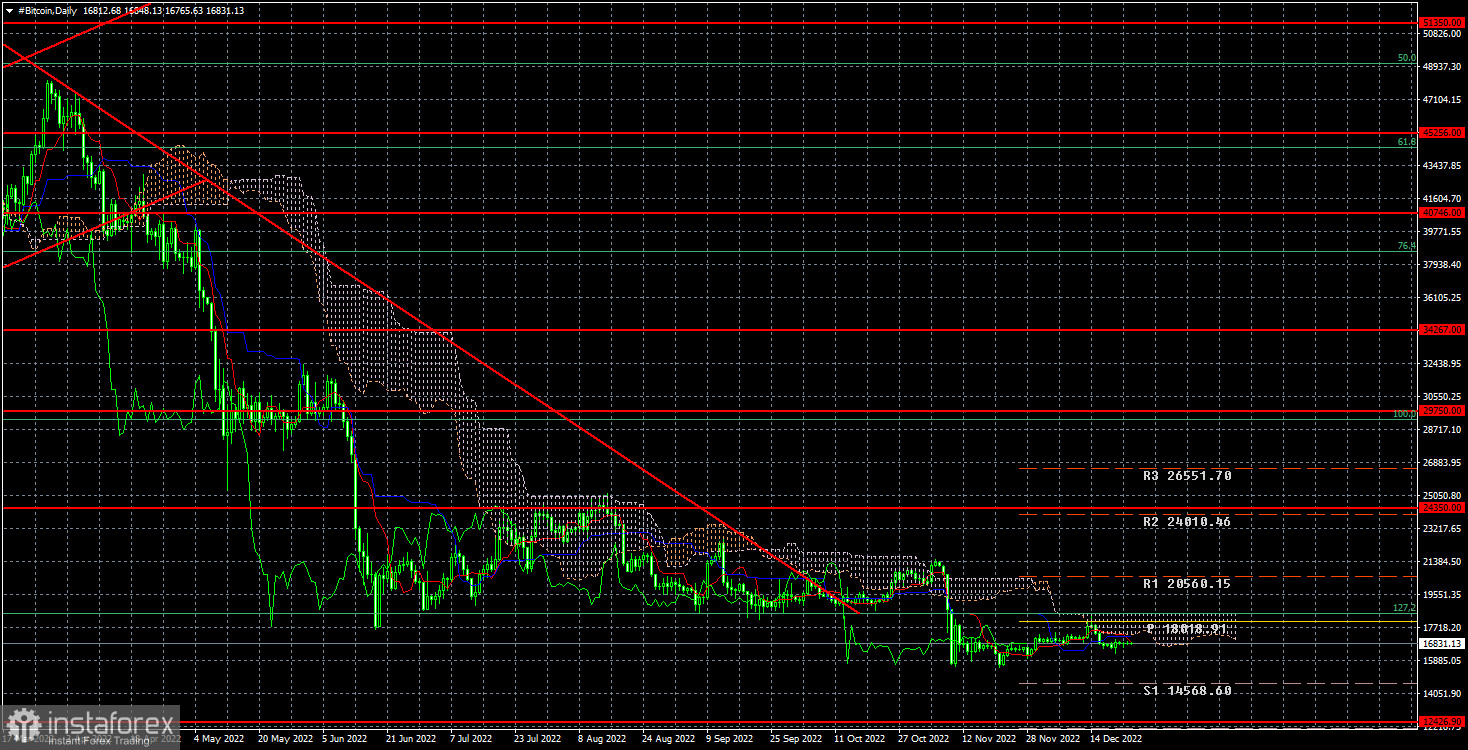

The bitcoin cryptocurrency is still trading in absolute flat below the $18,500 mark. Remember that this is the exact scenario that we have discussed numerous times, so everything is going as expected. Although "bitcoin" may currently remain in the flat position for a few weeks to several months, in the end, we anticipate it to at least drop to the level of $12,426.

It's hard to say that 2022 was a good year for bitcoin as it draws to a close. Its price reduction of 75% over this year (and a few months in 2021) came as no real surprise. Nobody is surprised by the fact that a cryptocurrency can lose up to 90% of its value during a "bearish" trend. With only a 75% loss, bitcoin still managed to get off very easily. Of course, all cryptocurrencies failed due to the fundamental environment of the current year. To combat high inflation, which in some countries has reached 40 to 50-year highs, central banks around the world have started to tighten monetary policy. When too much money started to leave the economy, safe assets started to become more profitable. Because of this, the first cryptocurrency and numerous others both fell.

But we shouldn't lose sight of the fact that this bitcoin is purely a speculative asset. With plantains, we've already illustrated. The price of plantain will increase even though it is just a common grass that grows almost everywhere if the majority of people on the planet concur that it makes an excellent investment or that they can exchange goods for goods using its dried leaves. With bitcoin, the situation is the same. Since it is merely a piece of code with no useful functions, its growth can only mean that it is being purchased. And they only purchase it to later sell it for a higher price and profit from it. Only a small portion of bitcoin owners use it for payments or international transfers, and since they won't be keeping it on their balance sheet for years, they are uninterested in the bitcoin exchange rate. Everyone else is attempting to buy for less money and sell for more. No one is in a rush to purchase because the price is currently declining. The "crypto winter" will likely last for a while as crypto exchanges are starting to experience issues and mining companies are lowering production levels.

The "bitcoin" quotes over the past 24 hours have remained below the level of $18,500. From our perspective, the fall could continue with a $12,426 goal. As we previously stated, since the price was concurrently in a side channel, crossing the downward trend line does not signify the end of the "bearish" trend. Bitcoin is now located below this channel, allowing the quotes to move southward.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română