Long-term outlook.

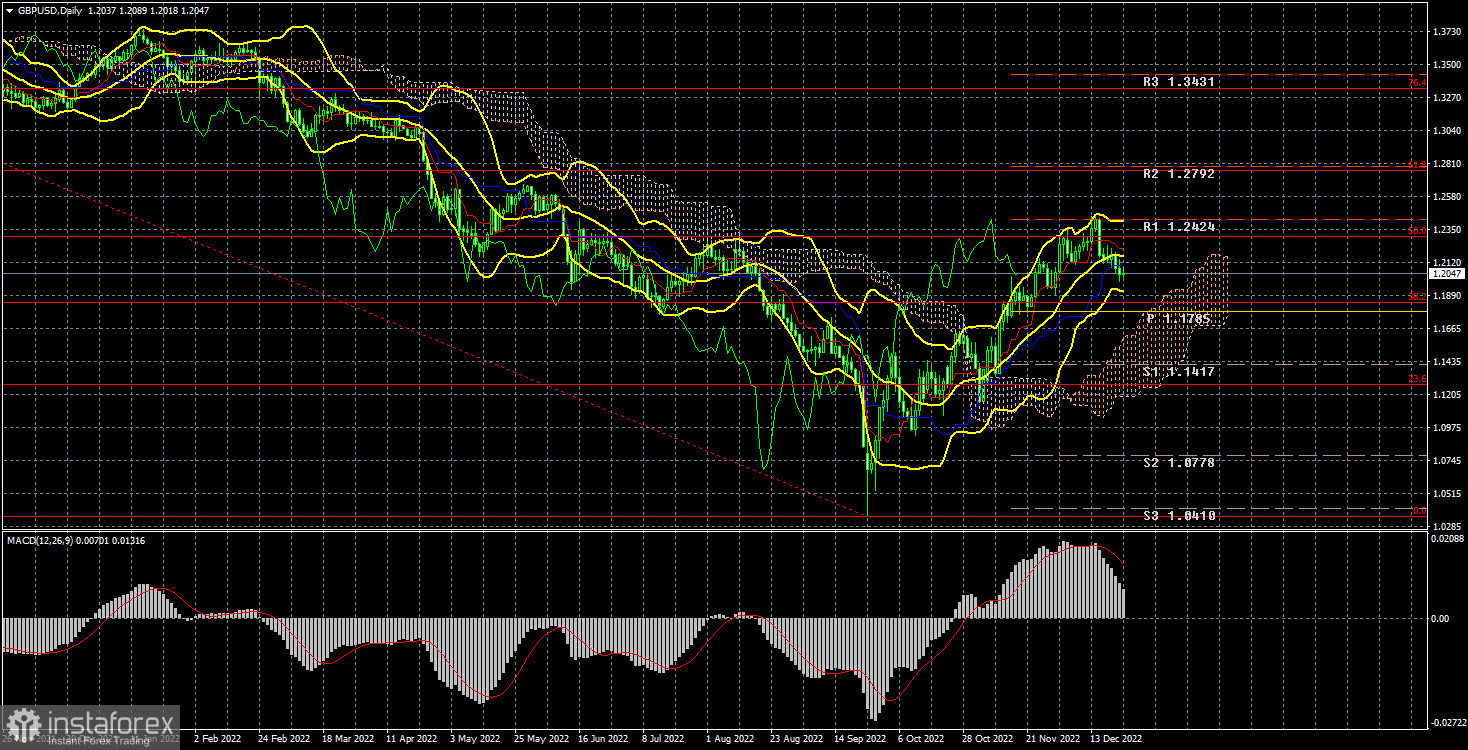

During the current week, the GBP/USD currency pair has started to adjust. About three weeks have passed while we have been waiting for the correction to start, and the British pound has been steadily declining during that time. Even though the market is geared toward long-term purchases of the pound, it is important to realize that adjustments must be made downward to resume the upward trend later. That is, regardless of the intentions of market participants, a downward correction is necessary. The price is currently fixed below the 24-hour TF's critical line, giving it the chance to keep falling until it reaches the Senkou Span B line. From a technical standpoint, the pound is currently moving perfectly logically, and this past week, the macroeconomic backdrop also supported its decline. Remember that the third quarter GDP report for the US was higher than expected and the third quarter GDP for the UK was lower? We cannot say that the pair's fall was particularly strong, but given the festive atmosphere of the market, we should be glad that there is at least now such a movement.

In the upcoming weeks, we anticipate that the pound may continue to decline. But we also consider the possibility of the pair going flat. The following week will be taken into consideration if the current week has not yet been fully deemed festive. More traders will consequently leave the market and take vacations. There won't be many significant macroeconomic statistics and hardly any background in the fundamentals. Keep in mind that Fed or ECB officials are also people who take vacations and observe holidays. It is unlikely that we will see their performances the following week.

COT evaluation.

The "bearish" sentiment significantly declined, according to the most recent COT report on the British pound. The non-commercial group opened 3.2 thousand buy contracts and closed up to 16.8 thousand sell contracts over the week. As a result, the net position of non-commercial traders has increased exactly by $20,000, which is a significant increase for the pound. The net position indicator has been steadily increasing over the past few months, and major players' attitudes may soon turn "bullish." Even though the pound sterling is rising against the dollar, it is very challenging to explain why from a fundamental standpoint. Since there is a need to at least adjust, we do not rule out the possibility that the pound will continue to decline in the near future. There shouldn't be any concerns because, on the whole, COT reports in recent months have tracked the movement of the pound sterling. Purchases could continue for several months, as the net position is still not even bullish. A total of 40.8 thousand contracts have now been opened by the non-commercial group, along with 35.2 thousand contracts for purchases. We can see that the difference is already negligible. While there are technical reasons for this, geopolitics does not support such a strong and quick strengthening of the pound sterling, so we continue to be skeptical about the currency's long-term growth.

Examination of fundamental occurrences

The GDP report, which we have already discussed, was the only event this week in the UK. In the USA, there were more statistics. First, the same GDP report. Second, information on long-term product orders as well as American citizens' income and spending patterns. This data is not likely to pique traders' interests very much, as we stated on Thursday. The pair's extremely low volatility on Friday indicates that traders aren't particularly interested in trading, at the very least. Only the data for long-term goods orders, which decreased by 2.1% despite much more optimistic forecasts, stand out among Friday's statistics. The market's response, if any at all, was very meager. Although the University of Michigan's consumer sentiment index has risen a few points, in general, it is not a significant indicator.

1) The pound/dollar pair started to adjust and consolidate below the critical line during the trading week of December 26–30. As a result, it is not advised to think about making new purchases of the pair on the 24-hour TF at this time. As of right now, the lower Ichimoku cloud boundary may be reached before the pound stops falling. Since the upward trend is still in place when a buy signal appears, long positions can then be considered.

2) The pound is still forming what appears to be a new upward trend. It now has solid grounds for growth, but since it grew by nearly 2,000 points in just two months, this is a correction. While we continue to wait for a significant correction in the vicinity of the Senkou Span B, sales are currently irrelevant. Given that the price has settled below the moving average line on the 4-hour TF, sales can be taken into account.

Explanations for the illustrations:

Fibonacci levels, which serve as targets for the beginning of purchases or sales, and price levels of support and resistance (resistance/support). Take Profit levels may be close by.

Bollinger Bands, MACD, and Ichimoku indicators (standard settings) (5, 34, 5).

The net position size of each trading category is represented by indicator 1 on the COT charts.

The net position size for the "non-commercial" group is represented by indicator 2 on the COT charts.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română