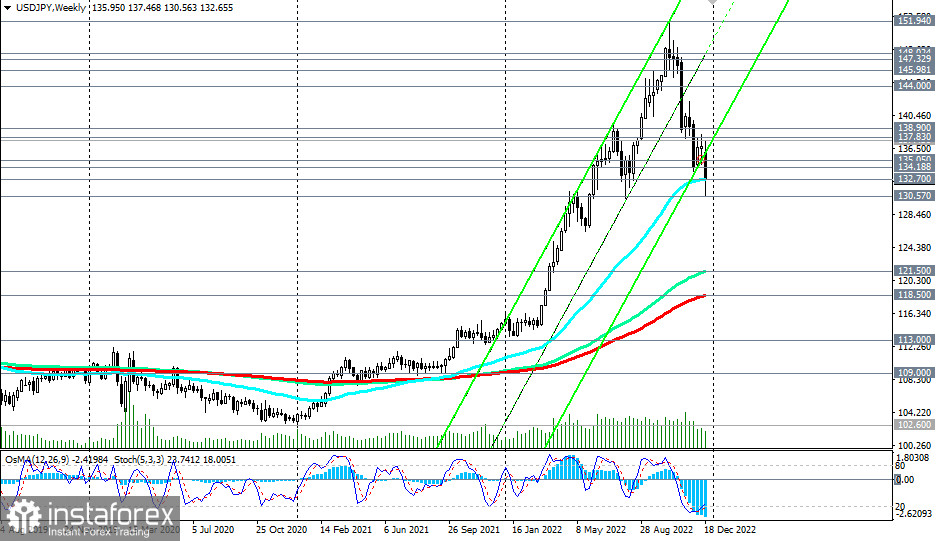

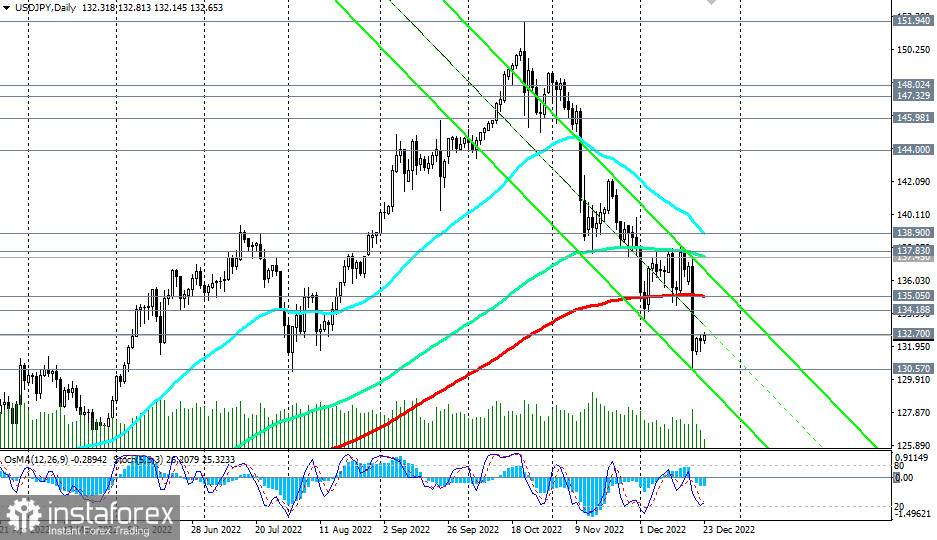

In our previous reviews published at the beginning of the week, we, like most market participants, probably expected USD/JPY to rise, referring to the assumption that the Bank of Japan is likely to keep the parameters of its ultra-loose monetary policy unchanged. But everything went according to an alternative scenario: after the breakdown of the 135.20 support level, the nearest target will be the 132.80 support level. The breakdown of the 132.80 long-term support level (50 EMA on the weekly chart) significantly increases the risks of breaking the pair's bullish trend. But most likely, this scenario can be considered if the BoJ decides to curtail its ultra-loose policy.

The targets set in the alternative scenario (Take-Profit 134.00, 133.00, 132.80) were achieved. Moreover, the plan was overfulfilled: the price dropped to 130.57. Today, the price has returned to the 132.80 level indicated by us: as of writing, the pair was trading near the 132.65 mark.

Also, market volatility, including USD/JPY, will pick up again as the latest data on Personal Consumption Expenditures (PCE) in the U.S. and orders for durable goods and capital goods will be released at 13:30 (GMT).

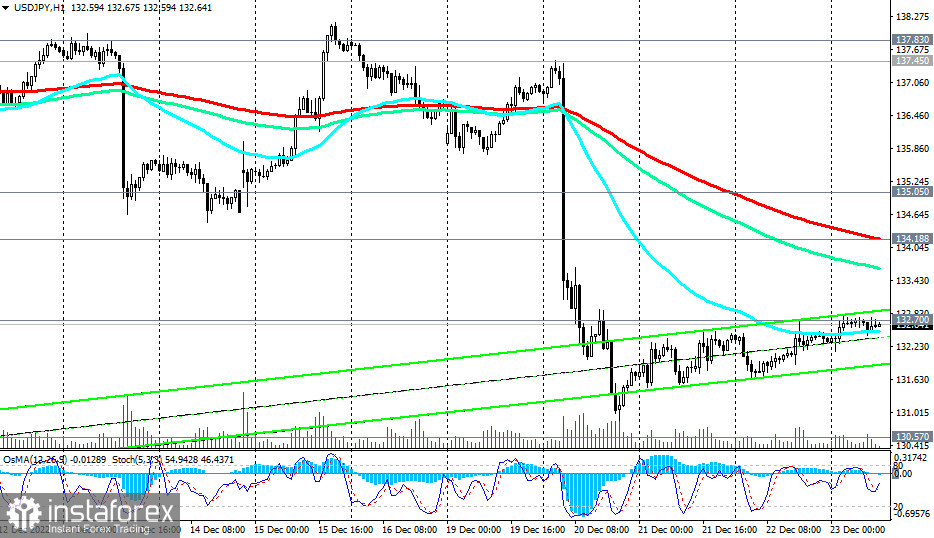

In this case, two scenarios will also be appropriate: the main one, which assumes the strengthening of the dollar, despite its weakening in the market today and in the DXY index, and the alternative one—the resumption of the decline in USD/JPY.

The breakdown of today's high at 132.81 will be a signal for purchases, while the breakdown of today's low of 132.15 will for selling.

In the first case, the target will be the key resistance level 135.05 (200 EMA on the daily chart), with intermediate targets at 133.00, 134.00, 134.18 (200 EMA on the 1-hour chart).

In case of a decline, the target will be a local intra-week low at 130.57, reached last Tuesday, with intermediate targets at 132.00, 131.00.

Support levels: 132.70, 132.00, 131.00, 130.57, 130.00

Resistance levels: 132.80, 133.00, 134.00, 134.18, 135.05, 137.45, 138.90

Trading Tips

Buy Stop 133.10. Stop Loss 131.90. Take-Profit 134.00, 134.18, 135.05, 137.45, 138.90

Sell Stop 131.90. Stop Loss 133.10. Take-Profit 131.00, 130.57, 130.00

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română