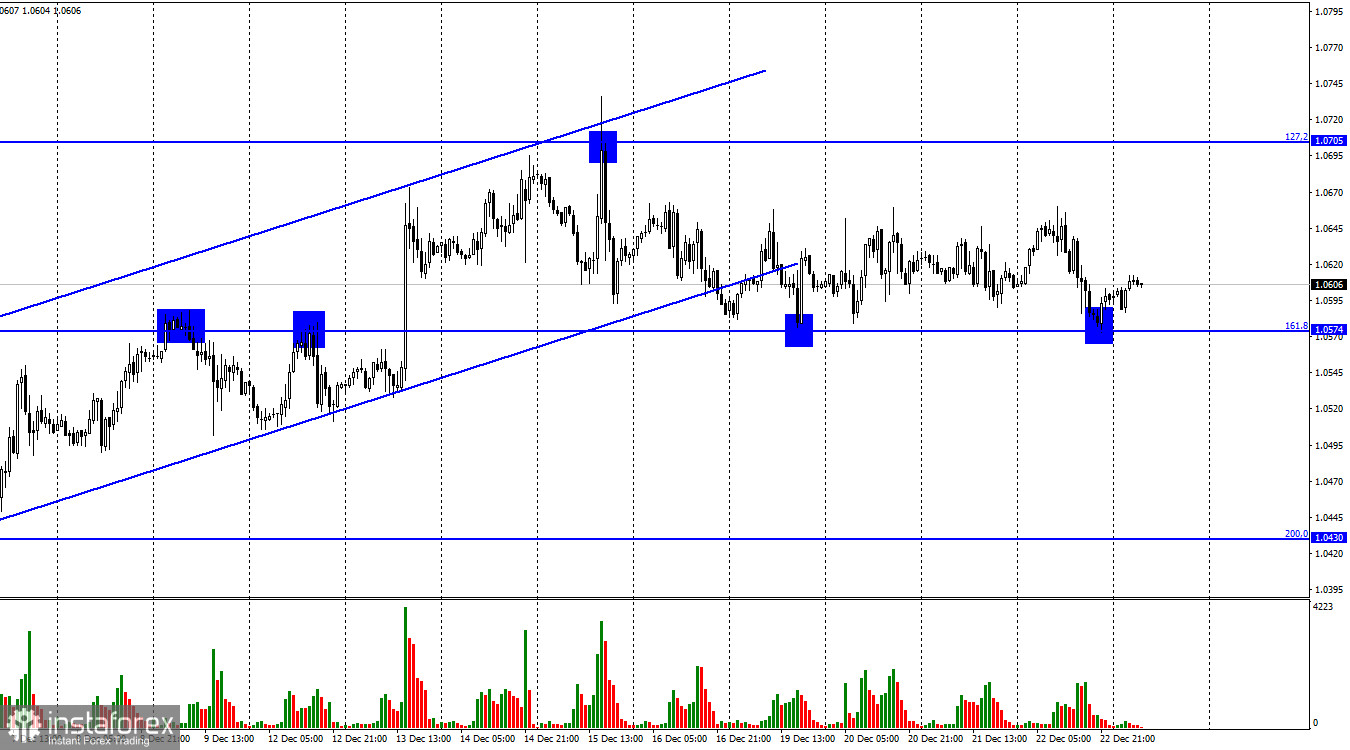

Hi, dear traders! On Thursday, EUR/USD bounced off the retracement level of 161.8% at 1.0574 upwards. It is the second sounch rebound, and the pair has touched it many times before. However, EUR/USD continues to move sideways, and the pair could move up by 60-70 pips after this bounce. If EUR/USD closes below 1.0574, it could then fall towards the Fibo level of 200.0% at 1.0430.

According to the latest US GDP data, the US economy increased by 3.2% q/q after falling by 0.6% in the second quarter. However, traders ignored it.

Bloomberg's analyst Simon White has predicted that the Fed might in fact stop interest rate hikes in the near future. The US regulator is currently expected to increase interest rates twice in 2023 - by 0.50% and by 0.25%. Simon White noted that since 1972, the last rate hike amid high inflation occurred 22 weeks after inflation hit its peak. This year, the 9.1% peak was reached in July - 22 weeks have passed since then. White also pointed out that the first rate cut after a tightening cycle typically occurred 16 weeks later. If his calculations are correct, the Fed might make its first rate cut next April. Of course, such an outlook has not been confirmed by the Fed and its representatives, who still argue that interest rates will continue to rise and that inflation remains too high. However, it should not be dismissed as a fantasy. The Fed may surprise the markets in February 2023, if inflation cools down to the point where there is no need for a rate hike.

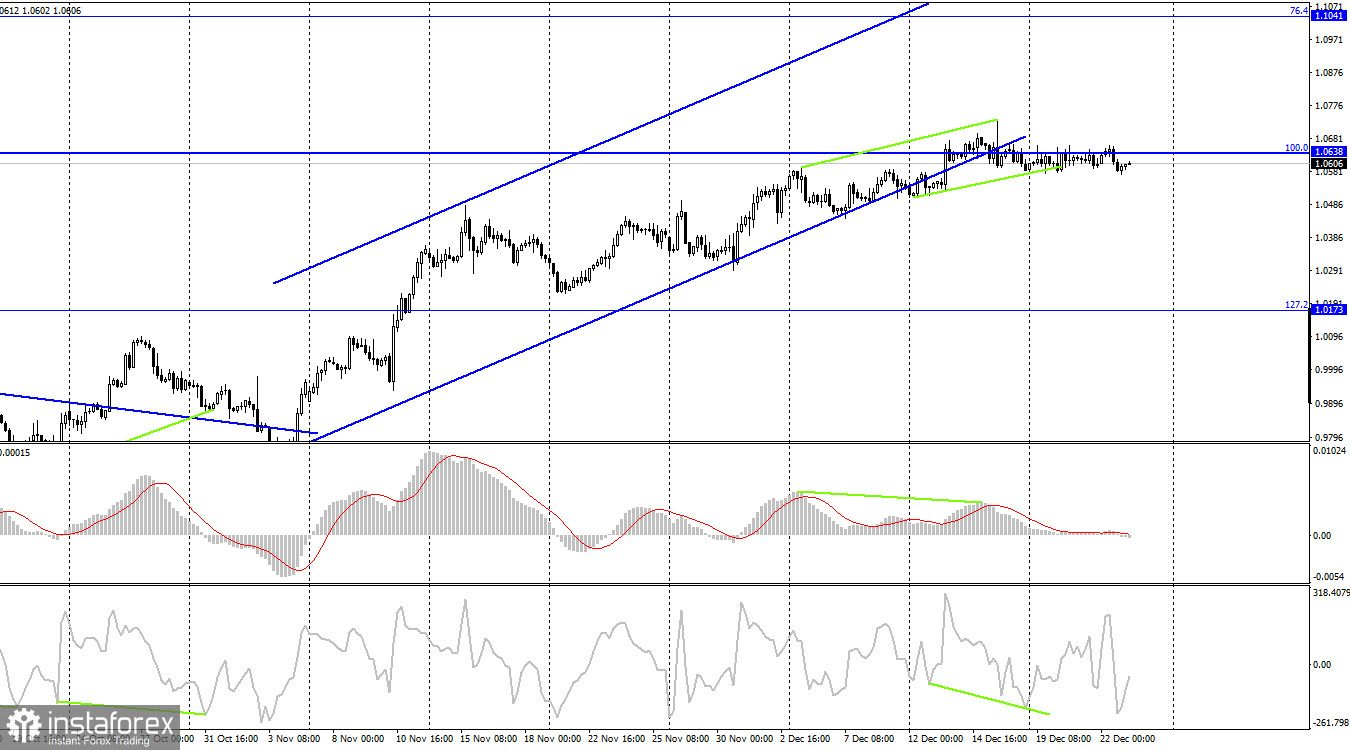

According to the H4 chart, the pair reversed downwards after it formed a bearish MACD divergence and consolidated under the 100.0% Fibo level. This suggests that the pair may continue to decline. Furthermore, it also closed below the ascending corridor. Over the past few days a bullish divergence in the CCI indicator has been emerging. It could bring the bulls back to the market, but for now, the pair prefers to move sideways.

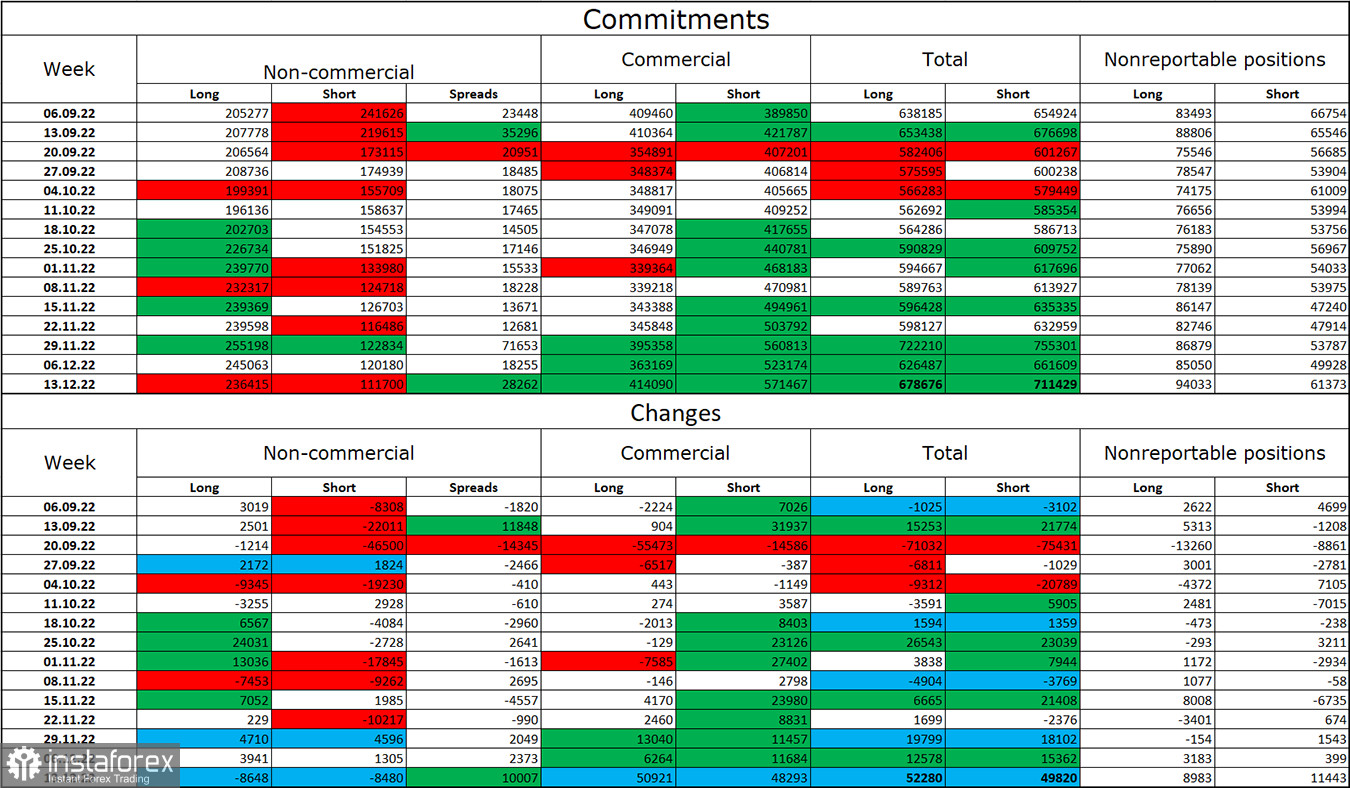

Commitments of Traders (COT) report:

Last week, traders closed an almost equal number of positions – 8,648 Long contracts and 8,480 Short contracts. That is almost equal amount. The mood of major traders remains bullish, and it did not change during the last week covered by the report. The number of open Long positions now stands at 236,000 versus 111,000 Short positions. The euro is currently on the rise, which is in line with the COT reports, but at the same time the number of Long positions is already two times higher than the number of Short positions. In the last few weeks EUR has been growing steadily, but now this begs the question if EUR has grown too much. After a long losing streak, the euro's situation continues to improve, so its outlook remains positive. However, if it moves out of the ascending corridor on the H4 chart, the positions of bears might get stronger in the short term.

US and EU economic calendar:

There are no important events on the economic calendar today that could influence traders.

Outlook for EUR/USD:

Traders are recommend to sell the pair if it consolidates below 1.0574 on the H1 chart with 1.0430 being the target. New long EUR positions can be opened if EUR/USD bounces off 1.0574 on the H1 chart targeting 1.0430. However, it may likely rise by only 60-70 pips.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română