At last, traders began to receive interesting fundamental data. They had to wait for Thursday when the US GDP report for the third quarter came out. Today the information background will be much more extensive, we can expect one more day of active trading. Notably, US GDP grew stronger than traders had expected, which allowed USD to grow even more against GBP.

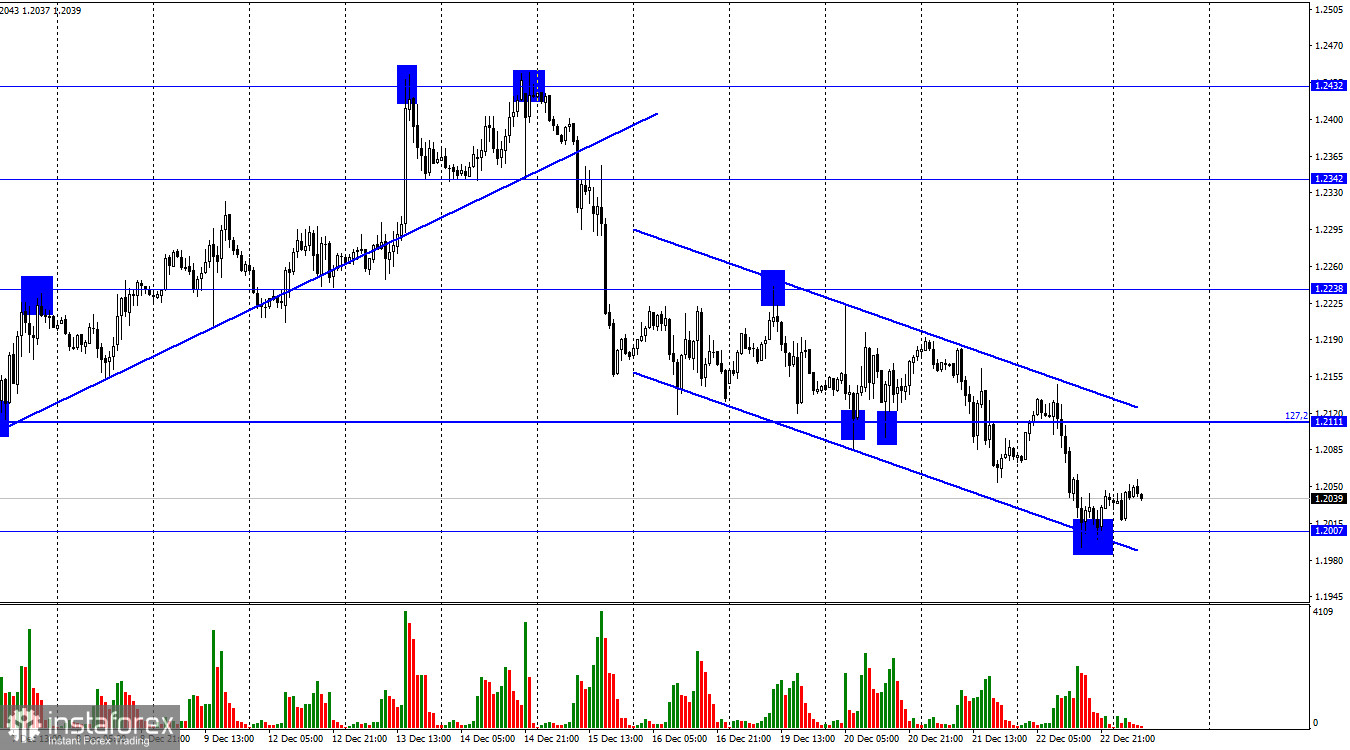

Today, the market will be focusing on the following reports. First, the Consumer Sentiment Index from the University of Michigan. This index has been rising strongly in the last few months, having started its movement from 50.0. A new rise could lead to a surge in the US dollar. Second, the durable goods orders report is expected. It may be down 0.5% at the end of November, but the forecast may be exceeded, supporting the US currency. Third, the US personal income and spending data as well as the core PCE price index. These three reports should be taken as a whole. If the values are higher than traders' expectations, it will also support the US dollar. Today bears have a great opportunity to continue the bearish trend. If the statistics disappoint, the pair still has a good chance to maintain its bearish sentiment. At the same time, the price needs to fix above the trading channel and above the level of 1.2111 to change the sentiment.

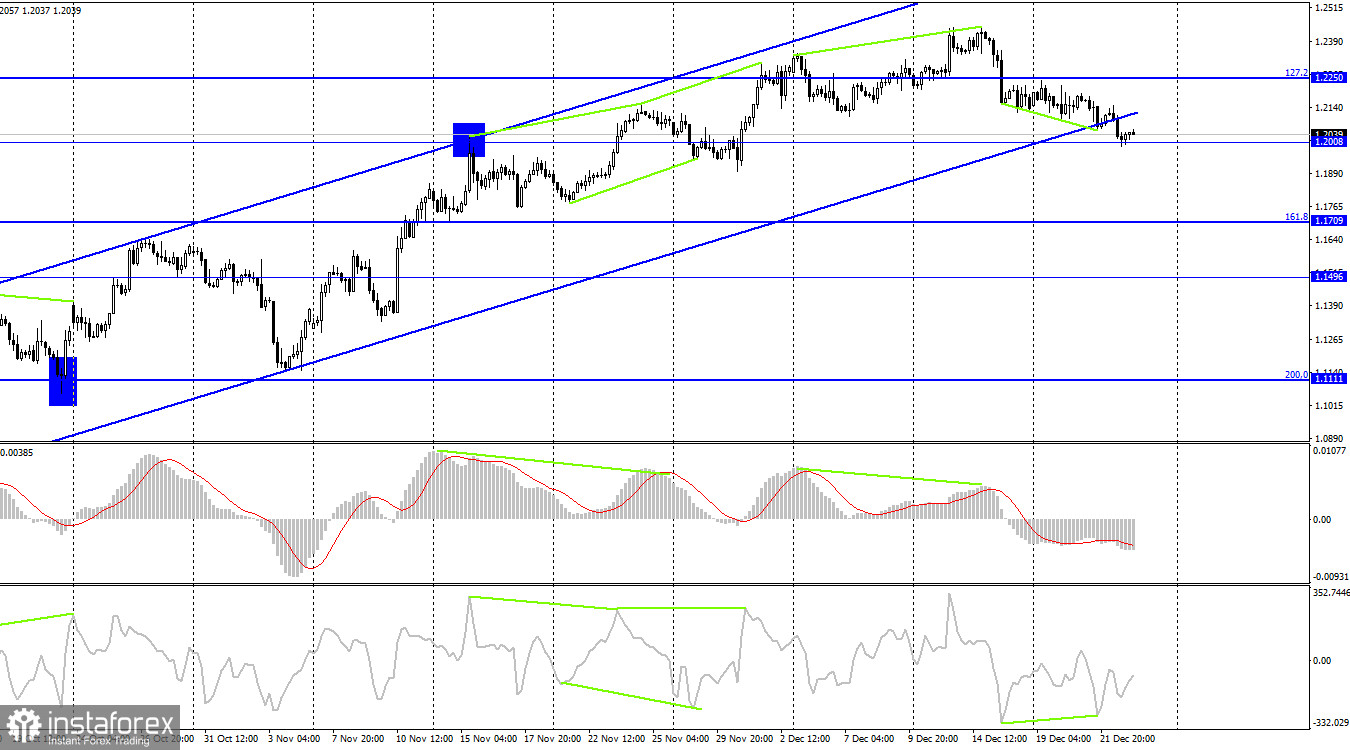

On the 4-hour chart, the pair closed below the ascending trading channel. This is extremely important. The channel has been intact for almost 3 months, during which the British pound rose. Now it could be the time, when the US dollar may grow. If the pair closes below 1.2008, it may decline to the 161.8% retracement level of 1.1709.

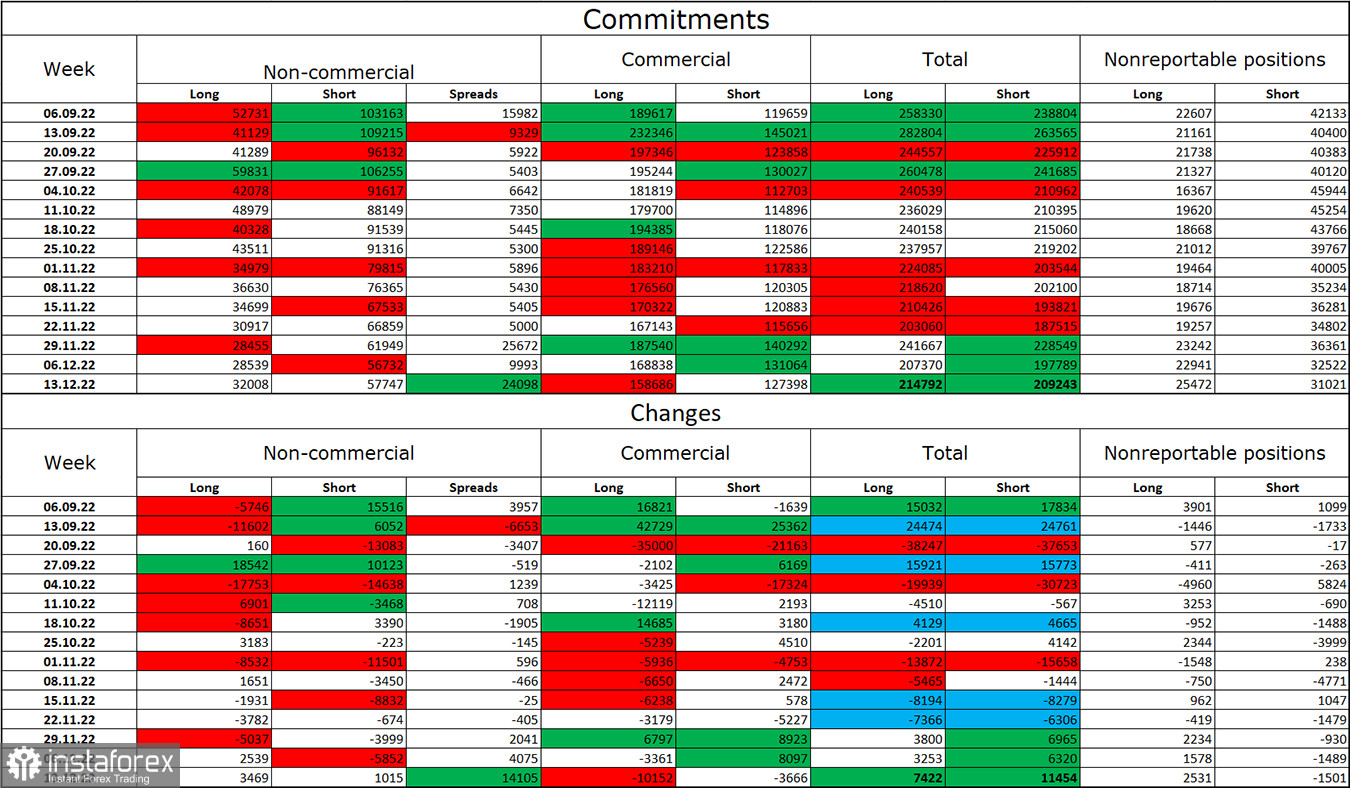

COT report:

Last week, the sentiment of non-commercial traders became less bearish than the week before. The number of long contracts of speculators grew by 3,469, and the number of shorts increased by 1,015. The general sentiment of big players remains bearish, and the number of short contracts is still very much higher than the number of long contracts. Thus, big traders continue to remain in the sales on the British pound for the most part, and their sentiment has been gradually changing towards bullish in recent months. However, this may take a lot of time. It has been going on for months, and still the number of sales is twice as high. The British pound might continue rising, because the graphical analysis, especially the trading channel on the 4-hour chart, is supporting it. The informational background still shows a vague picture as there are also reasons for the growth of the US currency. Nevertheless, now we see the growth, which was expected for many months.

US and UK economic calendars:

US - Durable Goods Orders (13-30 UTC).

US - Core PCE price index (13-30 UTC).

US - UoM Consumer Sentiment (15-00 UTC).

On Friday, the US economic calendar contains several medium-strength releases. The influence of the information background on the market sentiment today may be weak to medium in strength.

GBP/USD forecast and recommendations for traders:

One may sell GBP with the targets of 1.2007 and 1.1883 if the pair closes below 1.2111 on the hourly chart or below the trading channel on the 4-hour chart. The first target has been reached. The open trades can be held open. It will be possible to buy the British pound after the price closes above the trading channel on the hourly chart with the targets at 1.2238 and 1.2342.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română