Risky assets, including Bitcoin, really wanted a holiday for Christmas, but it looks like Santa Claus isn't going to give them gifts this year—BTCUSD has not gone far from its two-year low in November. The pair have lost two-thirds of its value since the beginning of the year amid tightening monetary policy by the Federal Reserve, the collapse of the Terra/Luna ecosystem and the bankruptcies of hedge fund Three Arrows Capital and the FTX exchange. Will the cryptocurrency leader be able to recover in 2023? Or will the decline into the abyss continue?

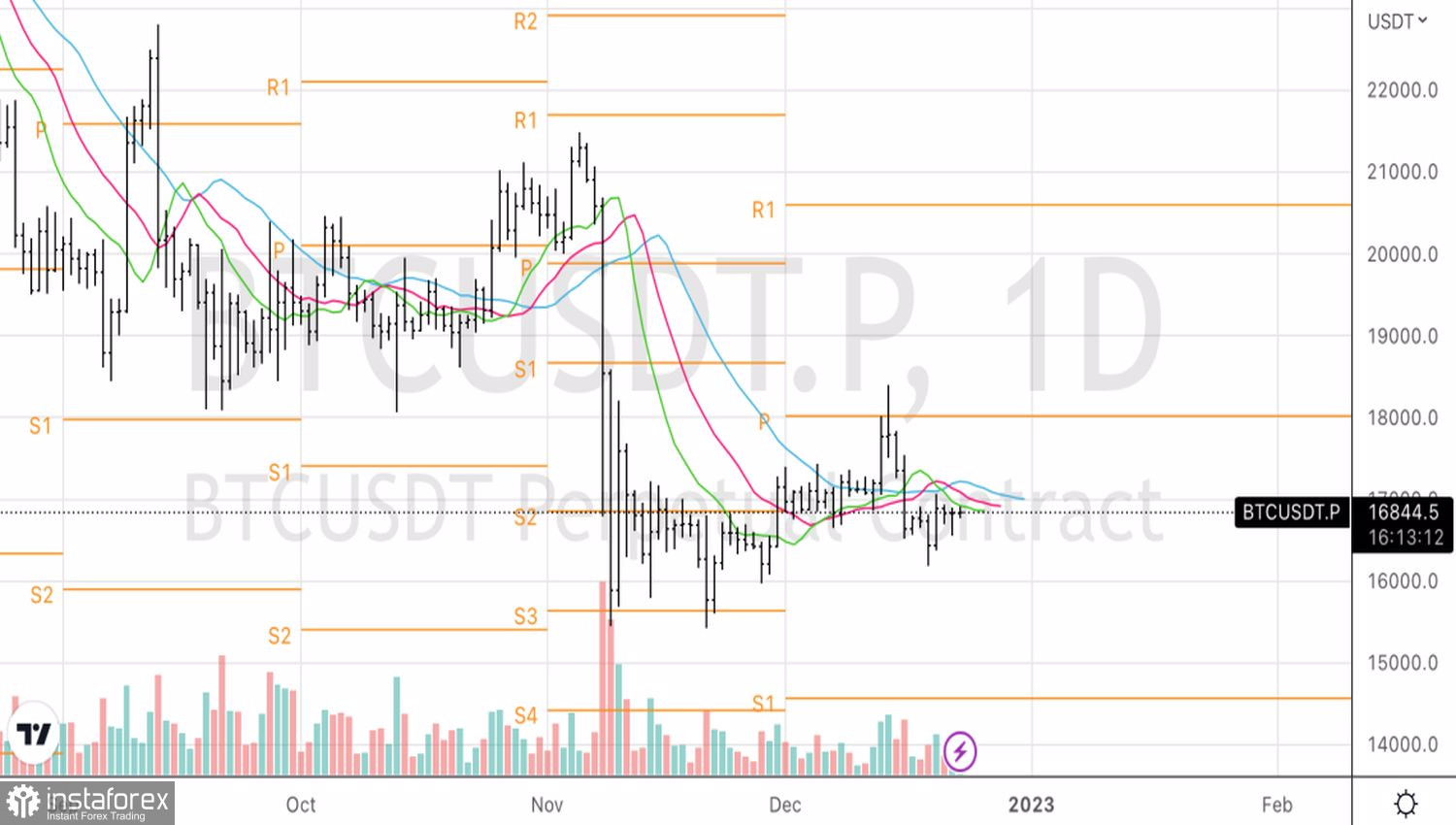

According to Fairlead Strategies, the inability of Bitcoin to cling to important levels in the 17,000–18,000 range indicates the bulls' weakness. The company expects quotes to fall to 15,600 in the coming weeks and 13,900 in the medium term. Standard Chartered issues a shocking forecast for BTCUSD to fall to 5,000. Not only will the crypto winter not end, but it will gain momentum.

In fact, to clarify the fate of the leader of the cryptocurrency sector, you need to look at the U.S. stock market. Yes, their paths in 2022 diverged from time to time. However, this is related to the news from the world of the crypto industry and is normal. Assets of the same class move in sync most of the time, but can move in opposite directions if unique drivers emerge. But discrepancies are usually temporary.

Bitcoin and S&P 500 Dynamics

Bitcoin is a risky asset, and the wind for risky assets is created by stock indices. Their outlook remains rather bearish. The Fed continues to raise the federal funds rate, the U.S. economy is losing steam, and corporate profits are deteriorating. All this suggests that, at least in the first quarter, the S&P 500 and the like will remain under pressure.

In the meantime, the stock market has retained the old patterns. For most of the second half of the year, it fell on good news about the U.S. economy and rose on bad news. In the latter case, investors believed that the approaching recession would force the Fed to slow down its tightening of monetary policy, if not stop it altogether. That is why the broad stock index fell in response to better-than-expected jobless claims and an upward revision of U.S. GDP for July–September to 3.2%. The S&P 500 fell, and so did Bitcoin.

In my opinion, their close interaction will continue in 2023. However, there are still a few days left until the end of 2022, which can bring with them the Christmas Rally. Usually in December, the broad stock index has risen by an average of 1.5% since 1950. Now it has collapsed by 5%. If Santa Claus gets down to business, as before, BTCUSD quotes can rise.

Technically, the downward trend for BTCUSD remains in place. The strategy of sales from 18,000 announced in previous materials with profit taking at the level of 16,500 worked out with a bang. The inability of Bitcoin to overcome the resistances at 17,200 and 17,400 is a reason for the formation of shorts.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română