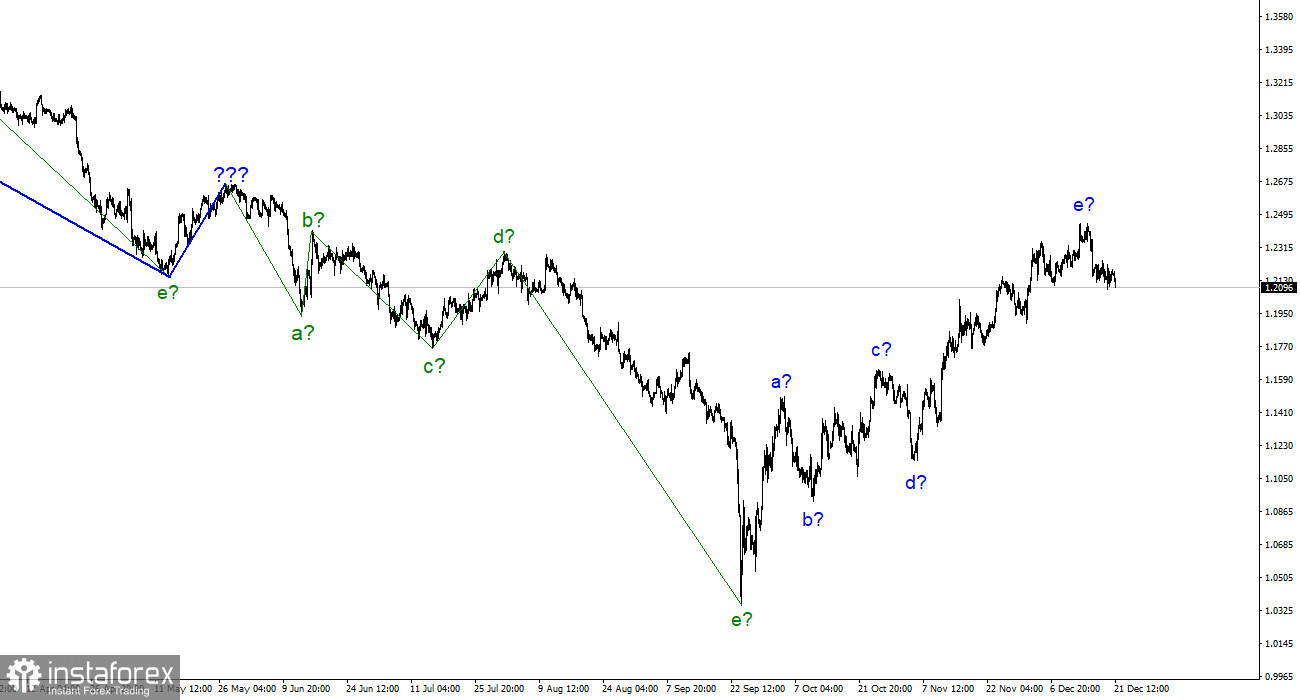

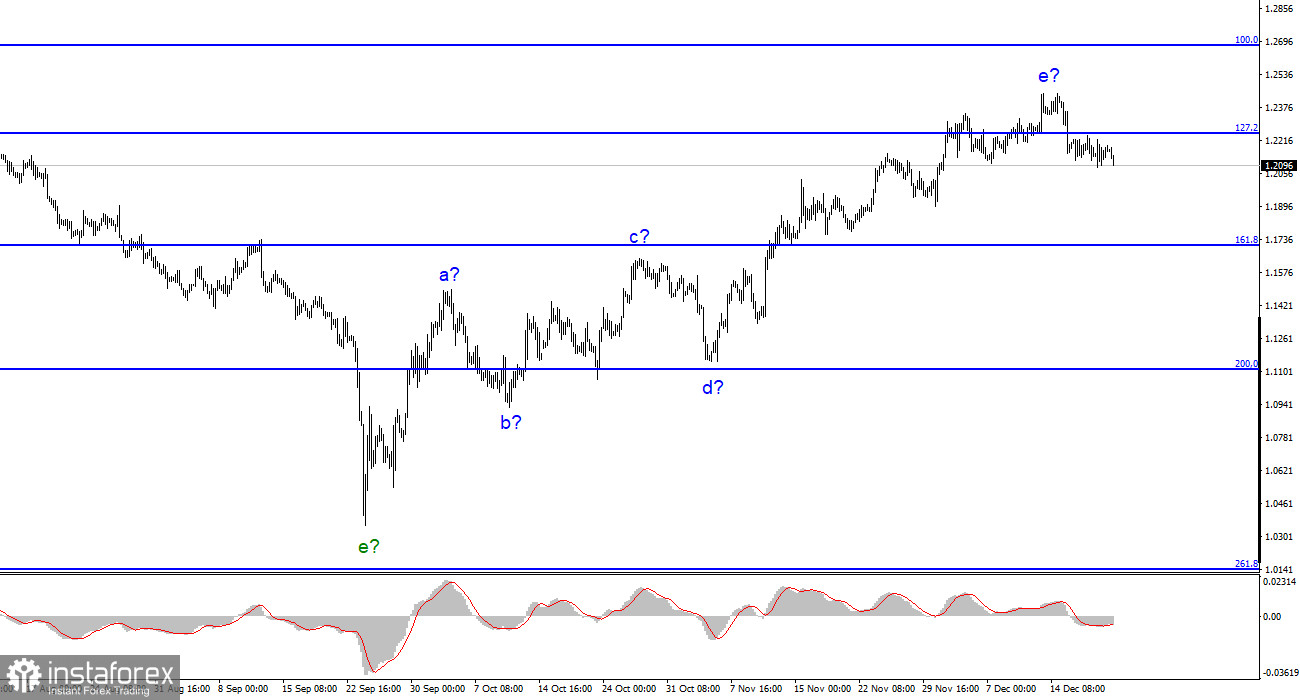

The wave marking for the pound/dollar instrument currently appears quite confusing, but it still does not call for any clarifications. e have a five-wave upward trend section, which has taken the form a-b-c-d-e and may already be complete. Given the weaker-than-expected departure of quotes from reached highs, I believe both instruments are still forming an upward trend segment. A mutual reduction, which could take several months, should start after this section is finished. It is challenging to sum up the British pound's recent news background in a single word because it is both robust and diverse. The British pound had sufficient justifications at this point to rise and fall. As you can see, it primarily chose the first option and still does so today. The proposed wave e has become more complicated as a result of the rise in quotes over the past few weeks. It has already evolved into a sufficiently developed form at this point to be finished. For the time being, I am still anticipating the decline of both instruments, but this scenario may be adjusted due to the impending holidays, when market activity will undoubtedly decline. For both instruments, the wave marking permits the completion of the construction of the ascending section at any time.

No news is available, and the market is idle.

On Wednesday, the pound/dollar instrument's exchange rate displayed an amplitude of 55 basis points, which is still quite a bit. There were roughly 70 items yesterday. This leads me to the conclusion that only the pound sterling is valuable and that the market is most definitely not in place. Nevertheless, the instrument has been slightly declining over the past few days (after last Thursday, when demand for the British dollar dropped precipitously against the backdrop of meetings of the Fed and the Bank of England), which indicates the formation of a downward wave. If my assumption regarding the wave markup is correct, we are currently witnessing the formation of the first wave of a new downward trend section. The only thing that is perplexing about this is that the European is not declining at the same time, even though both instruments frequently display comparable dynamics. When the British build a downward section and the European continues the upward one, it is unlikely that a picture will result.

The current state of the news background is hopeless. There are only two reports left this week: the US and UK GDP reports, whose values are already known and do not pique my interest, as well as the US index of personal consumption expenditures and orders for long-term goods, which will be released on Friday. These reports, in my opinion, can give the market a little breathing room after it prematurely celebrated Christmas and New Year's. However, I do not anticipate a strong instrument movement with high amplitude in just one direction.

Conclusions in general

The construction of a new downward trend segment is still predicted by the wave pattern of the pound/dollar instrument. I can currently recommend selling with stops around the 1.1707 level, or 161.8% Fibonacci. Although wave e might end up being longer than it is right now, it is most likely finished.

The euro/dollar instrument and the picture look very similar at the larger wave scale, which is good because both instruments should move similarly. Currently, the upward correction portion of the trend is almost finished. If this is the case, a downward section will likely be built for at least three waves, with the possibility of a decline in the region of figure 15.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română