After being under strong pressure yesterday, the dollar index (DXY) recovered slightly today, strengthening by 13 points to the closing price of yesterday's trading day. As of writing, DXY futures are trading near the 103.73 mark, still higher (by 67 points) than the local (since July) low of 103.06 reached last week, when the results of the Fed meeting became known. As we recall, the Fed raised interest rates by 0.50% (after four consecutive hikes of 0.75% in June, July, September, November). Although Fed Chairman Jerome Powell said that despite the observed decline in inflation, "much more evidence is needed to be sure" of this, and "there is a certain way to go to raise rates," while "the FOMC continues to consider the risks to inflation as upward," the market took the results of the December Fed meeting as a signal to start curtailing the super tight monetary policy cycle.

Yesterday, the DXY index fell sharply, primarily due to the weakening of the dollar against the euro (its share in DXY is about 57%) and the yen (its share in DXY is about 14%). In turn, the sharp strengthening of the yen on Tuesday was facilitated by the results of the Bank of Japan meeting and its decision, which is regarded by economists and market participants as a weakening of control over the 10-year bond yields. Now it can be 0.50% (previously, it was limited to 0.25%). Although the interest rate was kept at -0.10% and Governor Haruhiko Kuroda reiterated the mantra that the bank's management "would not hesitate to continue to ease monetary policy if necessary," the market took such actions as the beginning of a possible abandonment of ultra-loose monetary policy.

Since the 1990s, the Bank of Japan has aimed to fight deflation by keeping interest rates in negative territory and bond yields near zero. Now market participants are seriously counting on the fact that the BoJ can tighten its rhetoric in April next year, when current governor will step down and soon, after that, will begin to wind down the stimulus policy.

Today, the focus of market participants is the publication at 13:30 GMT of consumer price indices in Canada—consumer prices account for the majority of headline inflation, and an assessment of the inflation rate is important for central bank management in setting the parameters of the current monetary policy. And at 15:00, the Conference Board report on U.S. Consumer Confidence Index—consumer confidence in the country's economic development and in the stability of its economic position is a leading indicator of consumer spending, which accounts for most of the overall economic activity.

Obviously, during this period of time, another increase in market volatility is expected, primarily in the quotes of the Canadian and U.S. dollars. In this regard, the new trading opportunities in the USD/CAD pair will probably be of the greatest interest to market participants.

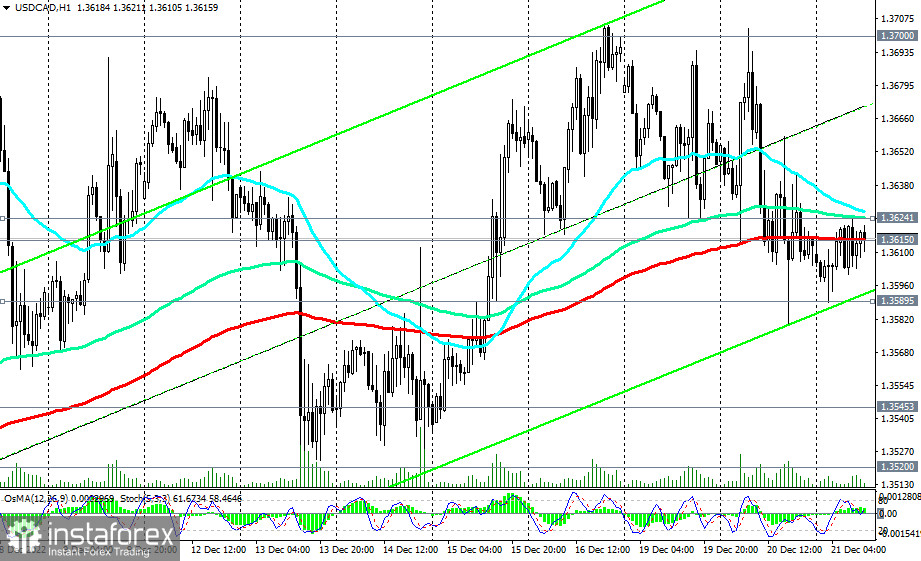

As of writing, the USD/CAD pair was trading near 1.3615, at an important short-term support level, remaining in the bull market zone.

Given the overall upward dynamics of the pair, we expect its further growth, and the publication of the above macro data may become a catalyst for this movement, but if it turns out to be positive for USD and negative for CAD. In any case, when planning a trade, do not forget about limiting stops. At the moment, the range between the levels 1.3625 and 1.3590 is highlighted. The breakdown of these levels will open the way for the pair in one direction or the other.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română