The unexpected decision of the Bank of Japan to raise the upper limit of the base interest rate from 0.25% to 0.50% caused a commotion in global financial markets. Since 2016, the Japanese central bank has set a target yield range for 10-year Japanese government bonds close to zero, with a maximum rate of 0.25%. As other major central banks began raising interest rates this year, the Bank of Japan has kept its base rate cap near zero.

According to Reuters News, the Bank of Japan shocked markets on Tuesday with an unexpected change in its bond yield controls that allows long-term interest rates to rise even more, a move to reduce some of the costs associated with prolonged monetary easing. The central bank maintained its target yield unchanged and said it would sharply increase bond purchases, a sign that the move was a fine-tuning of the existing ultra-loose monetary policy, not a stimulus withdrawal.

The actions of the Bank of Japan stunned financial markets around the world. The value of the Japanese yen soared to a four-month high against the U.S. dollar, which, in turn, led to a strong increase in prices for precious metals.

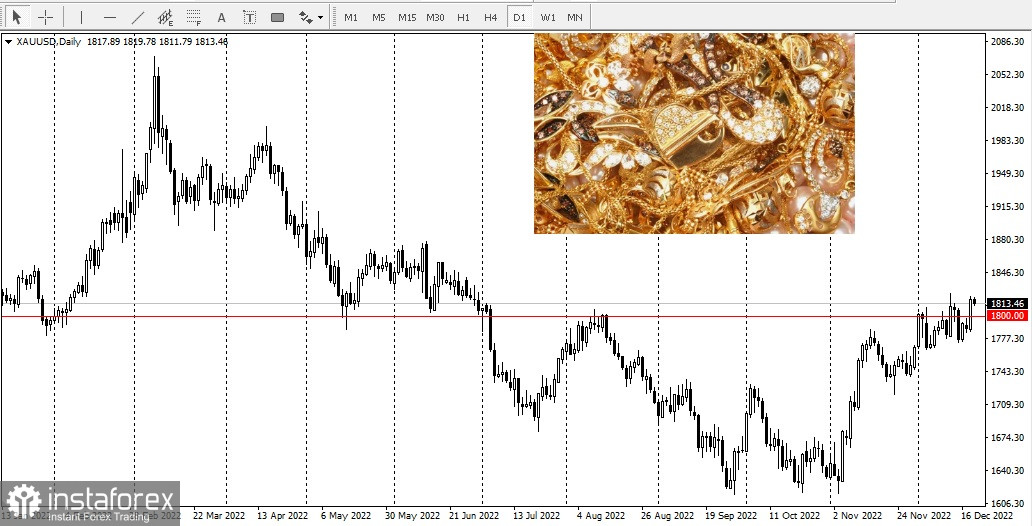

Gold has risen in price by about 1.7%:

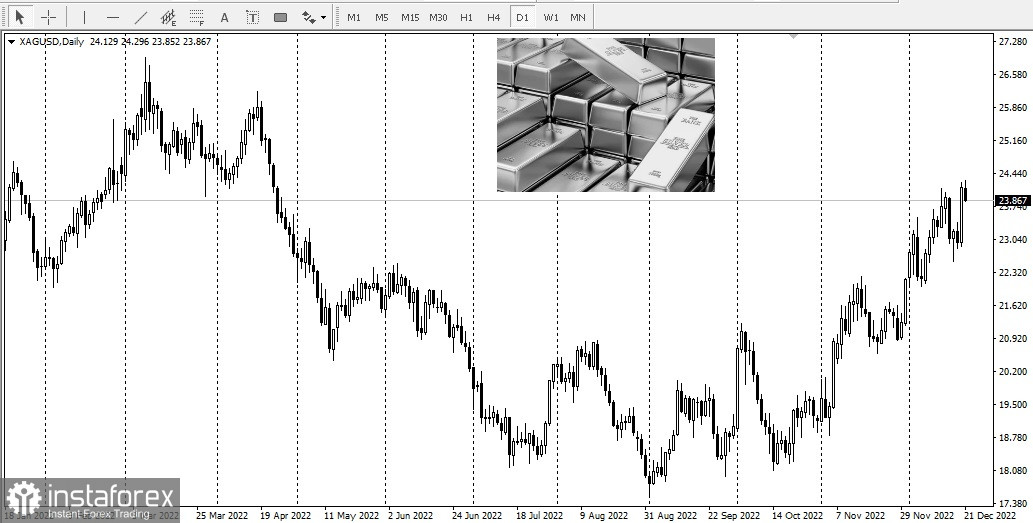

Silver up by 5.22%:

Palladium by 3.79%:

Platinum by 2.53%:

The rally in precious metals prices was also partly due to the weak dollar, but the vast majority of yesterday's movements were the result of active buying in the markets.

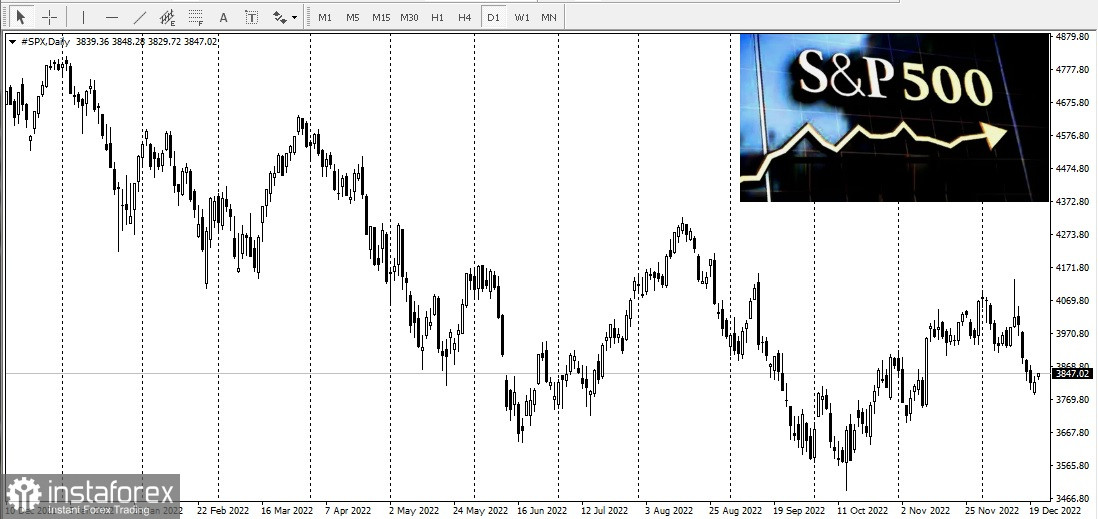

The major stock market indices narrowly avoided losses for the fifth straight day thanks to an intraday recovery that helped the S&P:

Dow:

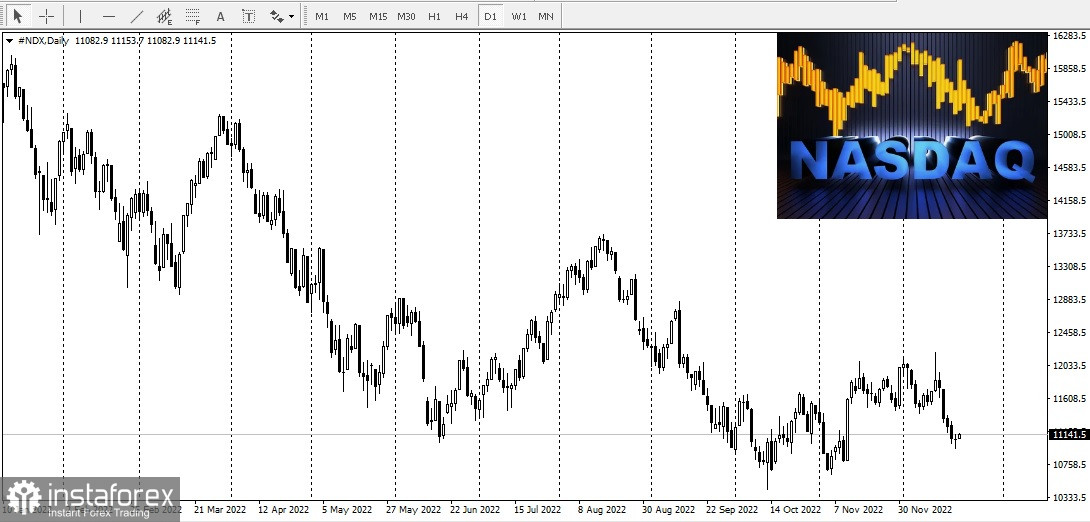

Nasdaq:

They end the trading in positive territory, rising by 0.10%, 0.28% and 0.01%, respectively.

Bitcoin was not left out either, the upward movement was a welcome sight for many, but it did little to change the overall picture for Bitcoin. Neither the bulls nor the bears have a short-term technical advantage:

This suggests that traders will continue to see more choppy and sideways trading on the daily chart until the end of the year, barring any major fundamental turmoil in the market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română