M5 chart of GBP/USD

On Tuesday, GBP/USD had a tendency to move down, but this type of movement seems more like a flat. It is not surprising that we see such movement ahead of the Christmas and New Year holidays. Traders leave the market, volatility drops and there is no macroeconomic and fundamental background. So we may see a similar movement for another week or two. Basically, there is nothing to analyze in the currency market now, you can only rely on "bare technique". At the moment, the pound is between 1.2106 and 1.2185, but these levels cannot be considered as the limits of a horizontal channel. If we have a fairly clear channel for the euro, then there's nothing like that for the pound. As a consequence, there may be more false signals for the GBP/USD pair.

Oddly enough, there were almost no false signals on Tuesday. Only the first sell signal on crossing 1.2106-1.2120 had failed. The price did not even manage to pass 20 points in the right direction after the signal appeared, so the deal closed with a loss. The next buy signal was much better, and the pair managed to reach the nearest target level of 1.2185, which made a profit of about 35 pips. The rebound from 1.2185 should have been worked out, too, by a short position, which brought about another 30 pips profit, as the price dropped to the target area of 1.2106-1.2120. And formed another buy signal in it, which also made it possible for traders to make profit, as the price moved up for the rest of the day. As a result, three profitable deals and one losing one - not bad for a flat.

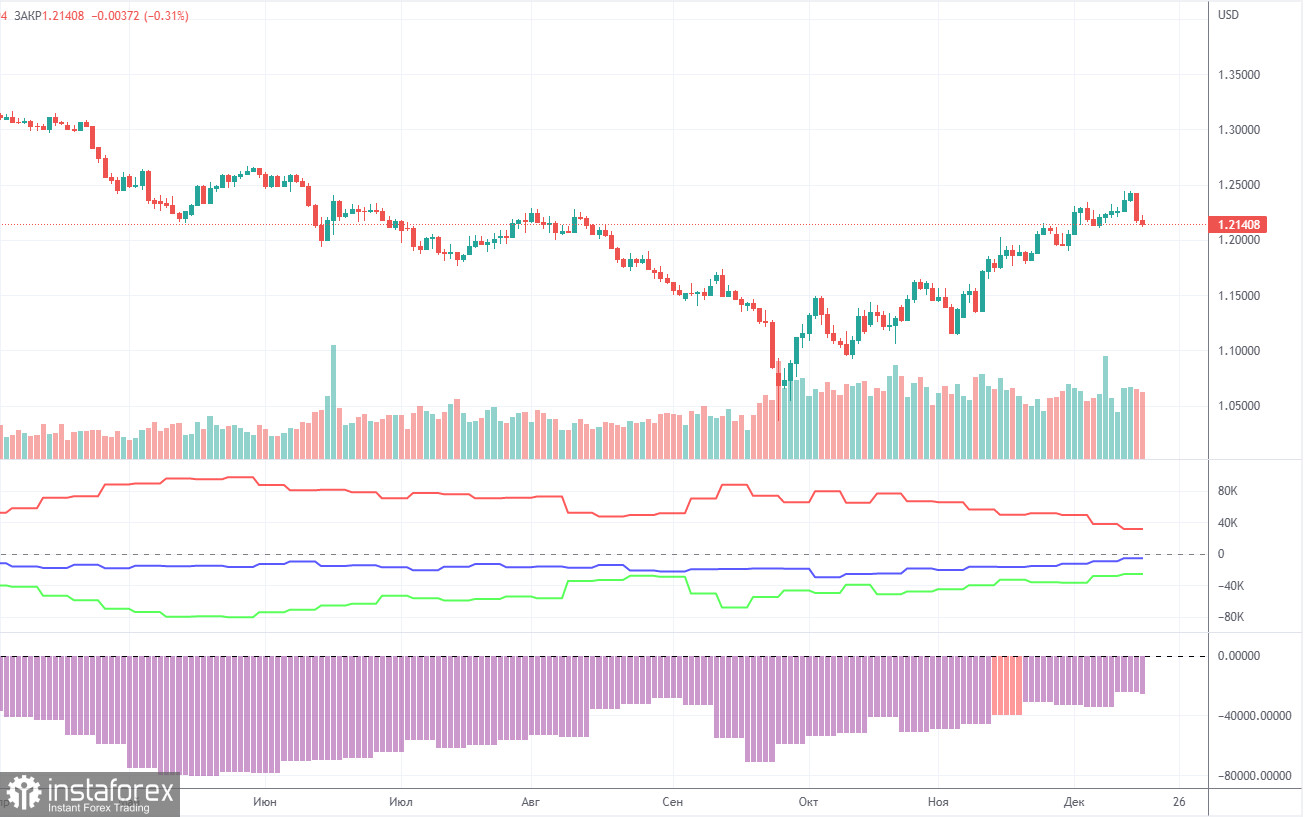

COT report

The latest COT report showed a decrease in bearish sentiment. During the given period, non-commercial traders opened 3,500 long positions and 1,000 short positions. The net position grew by about 2,500. This figure has been on the rise for several months. Nevertheless, sentiment remains bearish, and GBP/USD is on the rise for no reason. We assume that the pair may well resume the downtrend soon. Notably, both GBP/USD and EUR/USD now show practically identical movement. However, the net position on EUR/USD is positive and negative on GBP/USD. Non-commercial traders now hold 58,000 short positions and 32,000 long ones. The gap between them is still wide. As for the total number of open longs and shorts, the bulls have a 5,000 advantage here. Technical factors indicate that the pound may move in an uptrend in the long term. At the same time, fundamental and geopolitical factors signal that the currency is unlikely to strengthen significantly.

H1 chart of GBP/USD

On the one-hour chart, GBP/USD fell below the lines of the Ichimoku indicator. In normal conditions, this would've helped in continuing the downward movement, but now this may not mean anything since the pair could be in a flat for quite some time. On Wednesday, the pair may trade at the following levels: 1.1874, 1.1974-1.2007, 1.2106, 1.2185, 1.2259, 1.2342, 1.2429-1.2458. The Senkou Span B (1.2274) and Kijun Sen (1.2256) lines may also generate signals. Pullbacks and breakouts through these lines may produce signals as well. A Stop Loss order should be set at the breakeven point after the price passes 20 pips in the right direction. Ichimoku indicator lines may move during the day, which should be taken into account when determining trading signals. In addition, the chart does illustrate support and resistance levels, which could be used to lock in profits. There are no important events planned for today in the UK and the US, so there is a high probability that the flat will persist.

What we see on the trading charts:

Price levels of support and resistance are thick red lines, near which the movement may end. They do not provide trading signals.

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, moved to the one-hour chart from the 4-hour one. They are strong lines.

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT charts reflects the net position size of each category of traders.

Indicator 2 on the COT charts reflects the net position size for the non-commercial group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română