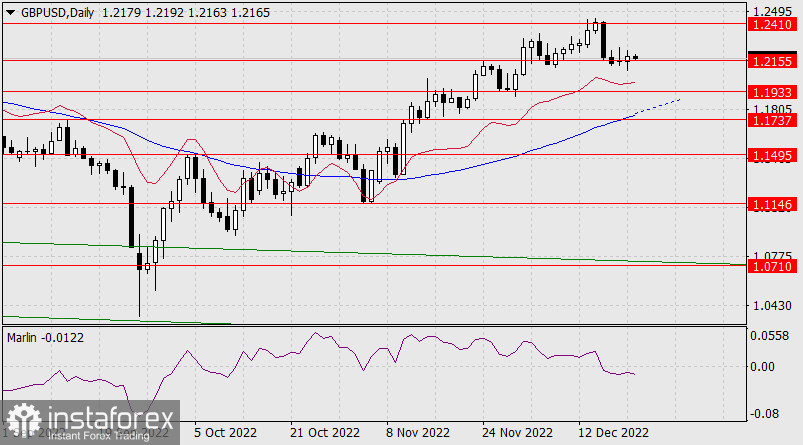

The British pound continues to move along the target level of 1.2155, the Marlin oscillator is moving horizontally, but still in the territory of the downtrend. Settling under 1.2155 will be the main condition for reaching the nearest target at 1.1933 (June 14 low).

The upward movement is possible, but is an alternative scenario. In order for it to progress, it is necessary to close today's daily candle above support at 1.2155. Also, the Marlin oscillator should show growth for such a daily close. We will consider an additional growth condition on the four-hour chart.

There is a resistance in the form of the MACD indicator line around 1.2250. Therefore, closing the day above 1.2155 is only an initial condition. Pulling back from the area under the support will strengthen the downtrend.

Today, we expect pessimistic indicators for the UK. Public sector net borrowing for October is expected to rise to 14.6 billion pounds against 12.7 in September, retail sales volumes from CBI for December may show decline from -19 to -24 points. Perhaps the data will help the bears on the pound.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română