After the Bank of Japan made a swift hawkish move that sent the yen to a four-month high and increased expectations of further policy tightening, Treasury bond yields increased and US stock index futures declined. Many people believed that the Japanese regulator would not change its policies at the beginning of the week, but it now appears that the islands have been affected by inflation, which is spreading across the globe.

The rise of stocks in the banking sector helped European stocks partially recover from their decline. As mentioned above, stock futures fell. The high-tech NASDAQ was down 0.1% at the time of writing but had recovered losses. The S&P 500 fell by 0.2%, but then recovered as well.

The yield on 10-year Treasury bonds increased by 8 basis points on the bond market, while bonds from Australia to Germany experienced a sharp sell-off, signaling investor confidence that central banks will maintain their aggressive policymaking. Analysts are also confident that the bonds will fall even further after the Japanese regulator changes the exchange rate, as the major holders of US and European debt obligations in Japan can now start sending money home in the hopes of finding a good yield.

Along with the Federal Reserve, the European Central Bank, and the Bank of England, many economists anticipate that the Bank of Japan will also raise interest rates in 2019.

Japan's 10-year bond yields increased to their highest level since 2015 against this backdrop, and the yen strengthened to 133.21 against the dollar, rising more than 3% at one point. Overall, the Japanese banking industry expanded by 5%.

It should be noted that up until this point, the Bank of Japan has stood out from other central banks, the majority of which have switched to a stricter stance. Today, it was revealed that the Monetary Authority of Japan had modified its yield curve control program, allowing the value of 10-year bonds to increase to about 0.5% from the previous maximum of 0.25%.

A declining dollar helped the price of gold on the commodity markets, and West Texas Intermediate crude oil futures increased above $75 per barrel.

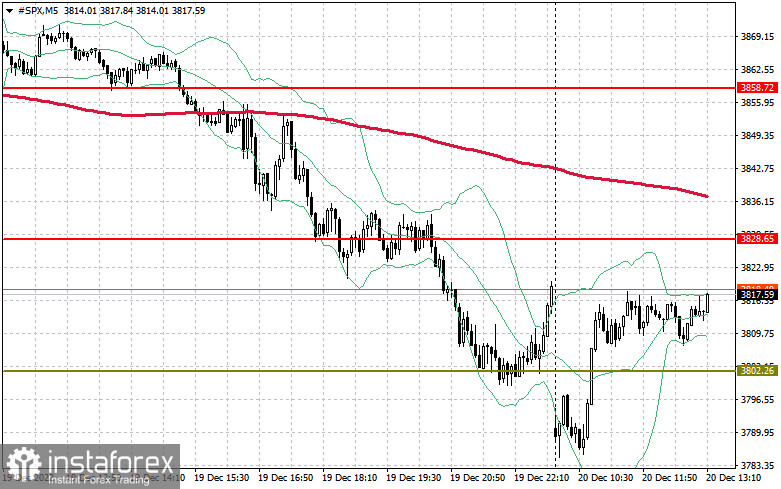

According to the S&P 500's technical picture, the index might keep declining. Today, securing $3,802 will be of utmost importance. We can anticipate a rise in demand as long as trading is done above this range. Additionally, this establishes favorable conditions for boosting the trading instrument to $3,828 and $3,858, with the potential to reach $3,891. The $3,923 level is a little higher; it will be challenging to surpass it. Buyers simply have to declare themselves around $3,802 in the event of a downward movement, as pressure on the index will rise below these levels. The trading instrument will quickly reach $3,773 on a breakdown, with the $3,735 region serving as the farthest target.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română