The minutes of the June meeting of the Federal Reserve System (Fed) of the United States became available to the public the day before. The content of the document suggests that the regulator intends to raise the rate in 2023 due to the rapid inflation growth. Moreover, the Fed forecasts a possible recession in the US economy by the end of 2023, predicting a decrease in the country's GDP in the fourth quarter of the current year and the first quarter of the next year.

Meanwhile, global markets are closely evaluating fresh macroeconomic statistics published on Thursday. The number of new applications for unemployment benefits in the US for the week ending July 1 increased by 12 thousand and reached 248 thousand. This exceeds the expectations of analysts, who anticipated an increase to only 245 thousand from the initial value of 239 thousand last week. As a result, the US Department of Labor revised the figure for the past week, setting it at 236 thousand.

Rising above the dark clouds of macroeconomic statistics, a bright side is demonstrated by ADP, a company specializing in payroll processing. In June, it noted an increase of 497,000 jobs in the private sector, significantly exceeding economists' forecasts. For comparison, the growth in May was only 228,000 and 267,000 jobs.

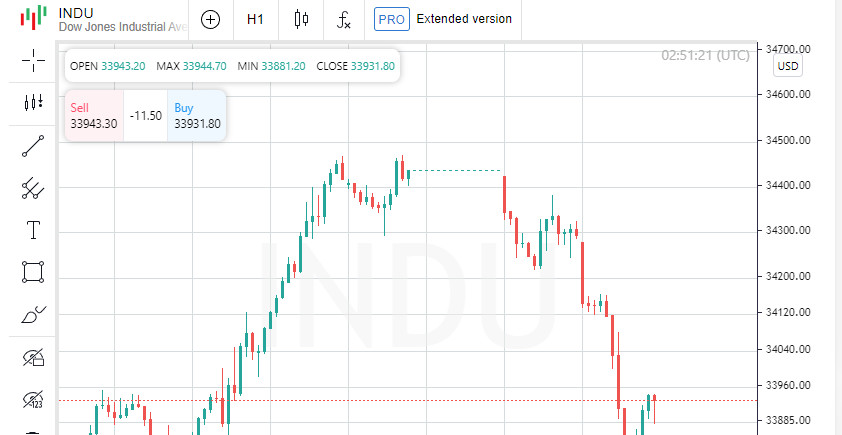

The closing of trading on the New York Stock Exchange left a grim trail: the Dow Jones index lost 1.07% of its value, the S&P 500 index fell by 0.79%, and the NASDAQ Composite index was 0.82% lower.

However, not all market participants dipped into the red zone. Among the Dow Jones index components, shares of Microsoft Corporation (NASDAQ:MSFT) proved themselves as strong players, appreciating by 3.12 points (0.92%) and closing at 341.27. Apple Inc (NASDAQ:AAPL) also did not stand aside and added 0.48 points (0.25%), ending trading at 191.81. Procter & Gamble Company's (NYSE:PG) stocks, despite being cheaper by 0.25 points (0.16%), still maintained stability, closing at 151.99.

Unfortunately, some stocks fell into the shadows, showing a negative trend. The leader of the fall among the Dow Jones index components was Home Depot Inc's (NYSE:HD) stocks, which lost 8.78 points (2.83%) and closed at 302.02. 3M Company's (NYSE:MMM) shares added 2.32 points (2.35%), ending the day at 96.31, and American Express Company's (NYSE:AXP) shares depreciated by 4.03 points (2.30%), closing trading at 170.94.

While on the S&P 500 index field, the day announced itself with new growth leaders. Among them are shares of BorgWarner Inc (NYSE:BWA), which jumped 3.96% to 44.89. Also on the rise were shares of Sealed Air Corporation (NYSE:SEE), gaining 2.47% and closing at 40.28, and shares of Garmin Ltd (NYSE:GRMN), which grew by 2.05%, ending the day at 107.41.

However, among the S&P 500 index participants, there were also those who lost their positions. For instance, Moderna Inc's (NASDAQ:MRNA) shares fell by 4.25%, closing the session at 118.29. PayPal Holdings Inc's (NASDAQ:PYPL) shares lost 3.94% and ended at 66.14. Caesars Entertainment Corporation's (NASDAQ:CZR) shares depreciated by 3.87%, reaching 47.33.

In the ranks of NASDAQ Composite, on the contrary, those who managed to get ahead prevailed. EdtechX Holdings Acquisition Corp II's (NASDAQ:EDTX) shares skyrocketed an incredible 94.05%, reaching 22.95. Caribou Biosciences Inc's (NASDAQ:CRBU) shares added 45.59%, closing at 5.94. Finally, Mullen Automotive Inc's (NASDAQ:MULN) shares rose by 29.02%, ending the day at 0.22.

Today was a tough day for some companies on the stock market. Here are the most striking examples of declines: shares of Allarity Therapeutics Inc (NASDAQ:ALLR) dropped significantly, falling by 53.99% and closing at 3.81. VBI Vaccines Inc (NASDAQ:VBIV) also faced difficulties, losing 51.24% and ending the day at 1.18. And Alpine Summit Energy Partners Inc's (NASDAQ:ALPS) shares dropped by 48.52% to 0.29.

On the New York Stock Exchange, the overall picture also left something to be desired: the number of shares that ended in the red (2531) noticeably exceeded those that ended the day in the green (459). In addition, the quotations of 42 shares remained unchanged. A similar situation was observed on NASDAQ: shares of 2669 companies fell in price, while only 860 companies can boast growth. And the shares of 149 companies held their positions.

It is worth noting in particular that shares of Allarity Therapeutics Inc (NASDAQ:ALLR) hit a historical low, depreciating by 53.99%, or 4.47 points, and closing at 3.81. VBI Vaccines Inc's (NASDAQ:VBIV) shares also fell to a low, depreciating by 51.24%, or 1.24 points, and closing at 1.18. Alpine Summit Energy Partners Inc's (NASDAQ:ALPS) shares fell to a record low, losing 48.52%, or 0.27 points, and closing at 0.29.

Today brought some changes to the commodities market and volatility indexes.

The CBOE Volatility Index, which reflects market sentiment in relation to the S&P 500 index, soared up by 8.89% and reached 15.44, setting a new monthly record.

As for the commodities market, gold futures for delivery in August experienced a slight decline, yielding 0.57%, or 11.00, and landing at $1,00 per troy ounce. Meanwhile, there was mixed dynamics in the oil market. Thus, the prices for WTI crude oil futures for delivery in August slightly rose by 0.13%, or 0.09, reaching $71.88 per barrel. However, Brent oil futures for delivery in September slightly fell by 0.12%, or 0.09, ending at $76.56 per barrel.

The situation in the Forex currency market also attracts attention. Thus, the EUR/USD pair only slightly changed its positions, falling by 0.34% and reaching the level of 1.09. However, there was a more noticeable decline in the USD/JPY pair: the quotations fell by 0.36%, falling to the level of 144.12.

Changes also affected futures on the US dollar index, which fell by 0.21% and reached the level of 102.82. This fact is another indicator of a complex situation on the global currency market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română