The unexpected shift of the Bank of Japan to hawkish surprised global markets as the decision paves the way for policy normalization. The bank raised the yield cap on 10-year bonds to around 0.5%, causing Japanese government bonds and treasuries to fall, while yen rose. US stock indices were also affected, similar to the Australian dollar and gold.

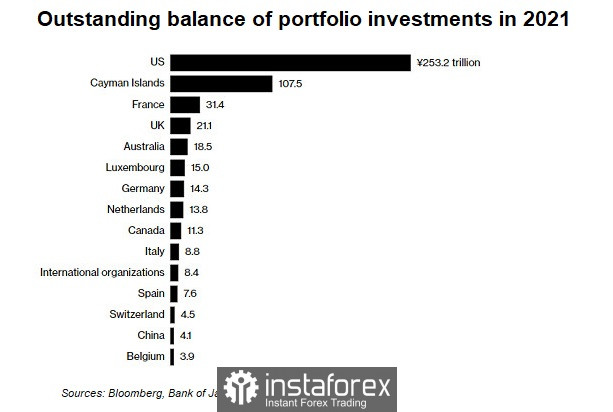

Japan is the biggest creditor in the world and a tightening of domestic financial conditions could lead to a wave of capital coming home. This threatens to depress asset prices and raise global borrowing costs, while the economic outlook worsens. UBS Group said investors are likely to exit US, while Australian and French bonds, as well as developed market equities, could fall.

Japan's benchmark 10-year bond yield jumped 21 basis points to 0.46%, before falling back to 0.4%. Trading of Japanese bond futures briefly halted on the Osaka exchange market after they had reached the cut-off threshold. Yen strengthened by as much as 3.5%, hitting 132.28 per dollar.

Bank of Japan Governor Haruhiko Kuroda said no further widening of the yield corridor is needed and a change in control of the yield curve would probably be positive for the economy.

The policy adjustment came after core inflation in Japan rose to its highest level in four decades. Speculation of a shift rattled markets on Monday after Kyodo news reported that Prime Minister Fumio Kishida plans to renegotiate a decade-old agreement with the Bank of Japan on a 2% inflation target.

"The Bank of Japan's action is unequivocally negative for global bonds," TD Securities said. "If today's move was the first step towards the end of the YCC, yen could rise substantially as Japanese investors could start selling some of their unhedged global bonds in foreign currencies. This will be more bearish for the long side of US and European bond curves," they added.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română