On Monday, there was no desire to move the GBP/USD currency pair. Since there was not a single significant event or publication in the UK or the USA on this day, as we have already stated, this market behavior should not be surprising. Additionally, the holidays of Christmas and the New Year are drawing near, so a flat might become available on the market soon. The pound did not exhibit the expected movements last week, when there were numerous events and reports. In general, only one day stands out as being particularly volatile: Thursday, when the pair lost 250 points. Every other day was "passed by the register." We now have a clear signal for the potential start of the fall, which we have been waiting for three weeks, but it is important to note that the price is still fixed below the moving average line. The approaching New Year's holiday may also cause a delay in putting this scenario into action.

In theory, there are no concerns or questions raised by the current upward trend as a whole. Check it out for yourself: every subsequent price peak and minimum is higher than the preceding one. The previous local low was not changed despite Thursday's 250-point drop. As a result, the pair can quickly resume the development of an upward trend, which has now generated a lot of inquiries. We have stated numerous times that in just 2.5 months, the pound has increased by 2,000 points. Whatever the fundamentals, which were not always in the pound's favor, it is still a lot for such a short time. We can only conclude that the long-term downward trend has most likely ended in light of this growth. You may recall that we stated that strong trends end with a swift and forceful movement in the opposite direction. The pair should not, however, continue to move exclusively in one direction for the foreseeable future, even in the absence of corrections.

What are the chances that the pound will have next year?

Let's be clear: starting in 2023, neither the pound nor the dollar is expected to grow significantly. In the first half of the year, the rate situation should "settle down," and the market will no longer be affected by the thing that made it trade actively in 2022. A lot will also depend on the geopolitical situation in Ukraine, Nicola Sturgeon's ability to hold the promised independence referendum, new economic shocks to the British economy, and the Bank of England's ability to fight off inflation. As sad as it may be, geopolitics ultimately determines the fate of the pound; however, other factors should not be discounted. The pound has already increased by 50% since it fell over the previous two years. Consequently, we don't think it will be able to maintain strong growth over the following 12 months. However, there are currently no fresh, potent factors that could support the US dollar.

There is no need to wait for strong dollar growth because the Fed and Jerome Powell have already said that the rate will only be raised 2-3 more times. In general, we think the pound's situation can now be characterized as a "pendulum." First, there should be a long and powerful fall, then a half-rise, and finally a half-fall, or by 800-1000 points, to the vicinity of the 1.1400 level. The pair can then start to consolidate, which involves moving 500–600 points in each direction while frequently switching the direction of movement. As a result, there should be a downward pullback first, after which it will be possible to wait for a new wave of growth. Since only genuinely minor events are scheduled in the UK and elsewhere this week, there is nothing to look forward to. Next week, however, will be genuinely festive.

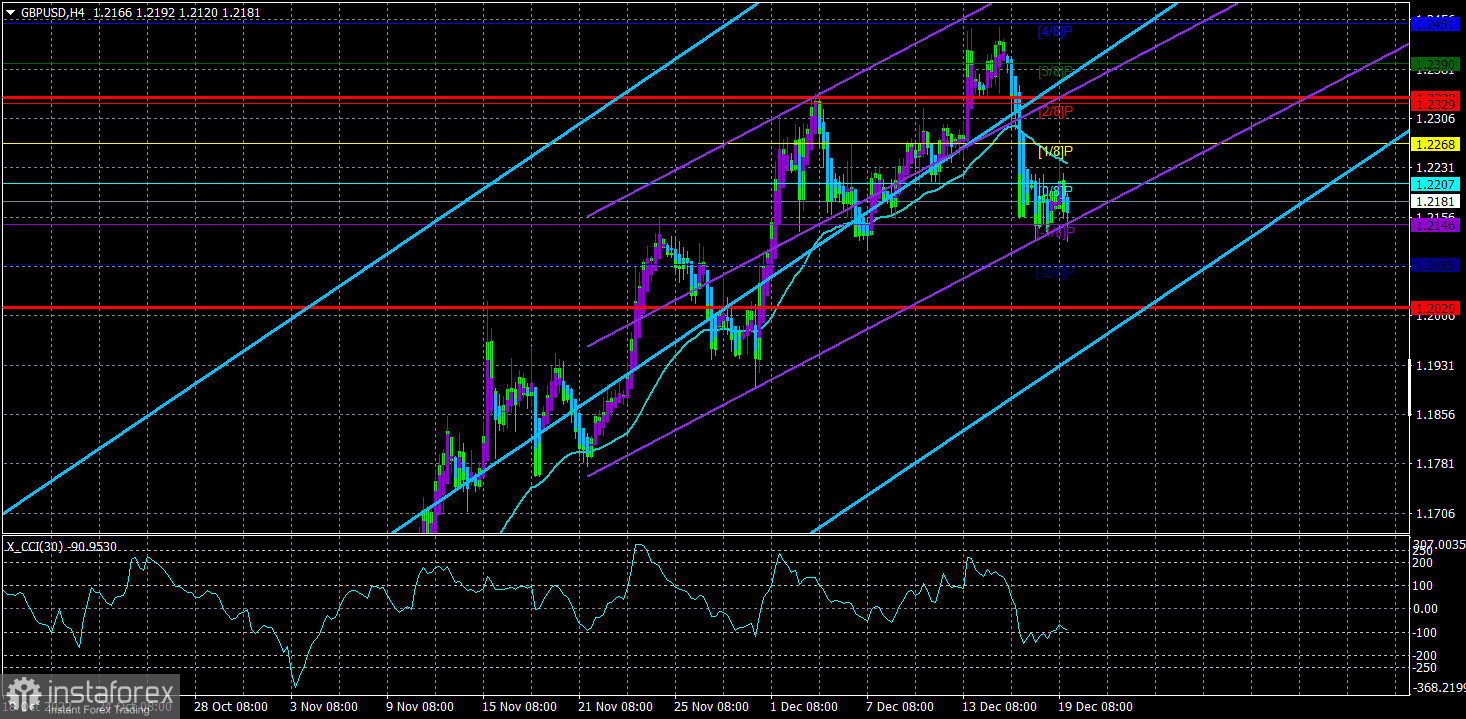

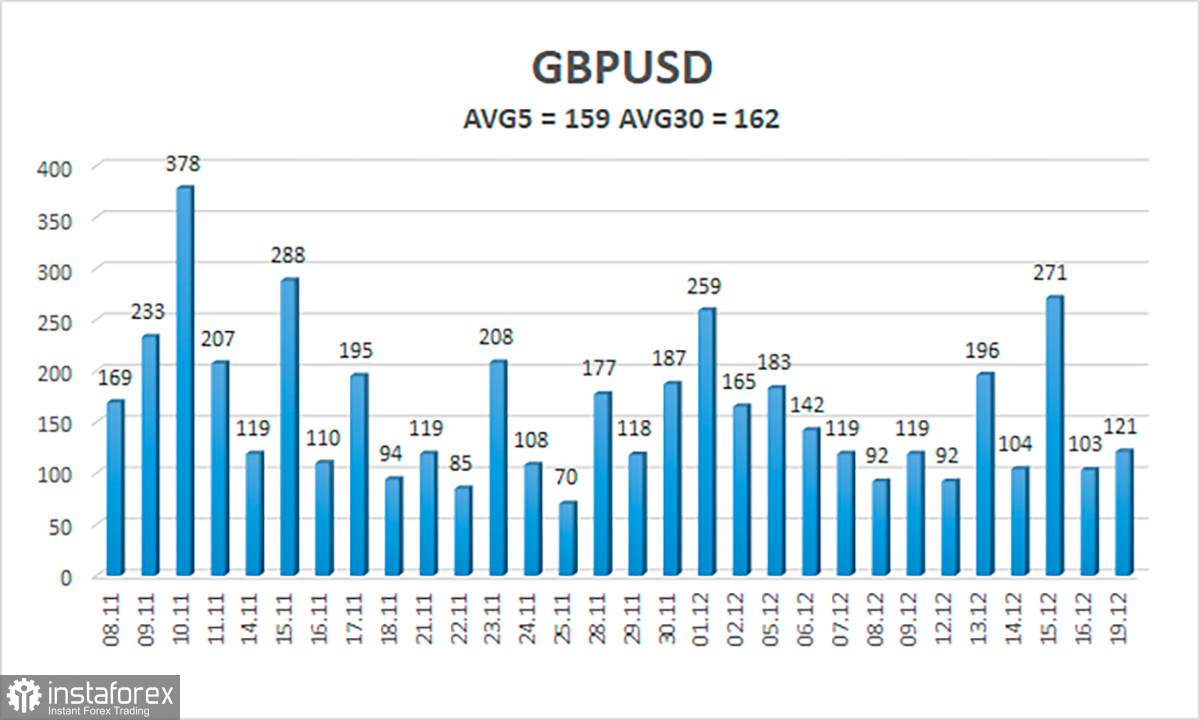

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 159 points. This value is "high" for the dollar/pound exchange rate. Thus, we anticipate movement inside the channel on Tuesday, December 20, with movement being constrained by levels of 1.2020 and 1.2338. A round of upward correction is indicated by the Heiken Ashi indicator's upward reversal.

Nearest levels of support

S1 – 1.2146

S2 – 1.2085

Nearest levels of resistance

R1 – 1.2207

R2 – 1.2268

R3 – 1.2329

Trading Suggestions:

In the 4-hour timeframe, the GBP/USD pair began moving downward. Therefore, until the Heiken Ashi indicator appears, you should maintain sell orders with targets of 1.2085 and 1.2020. When the moving average is fixed above, buy orders should be placed with targets of 1.2329 and 1.2338.

Explanations for the illustrations:

Determine the present trend with the aid of linear regression channels. The trend is currently strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the likely price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română