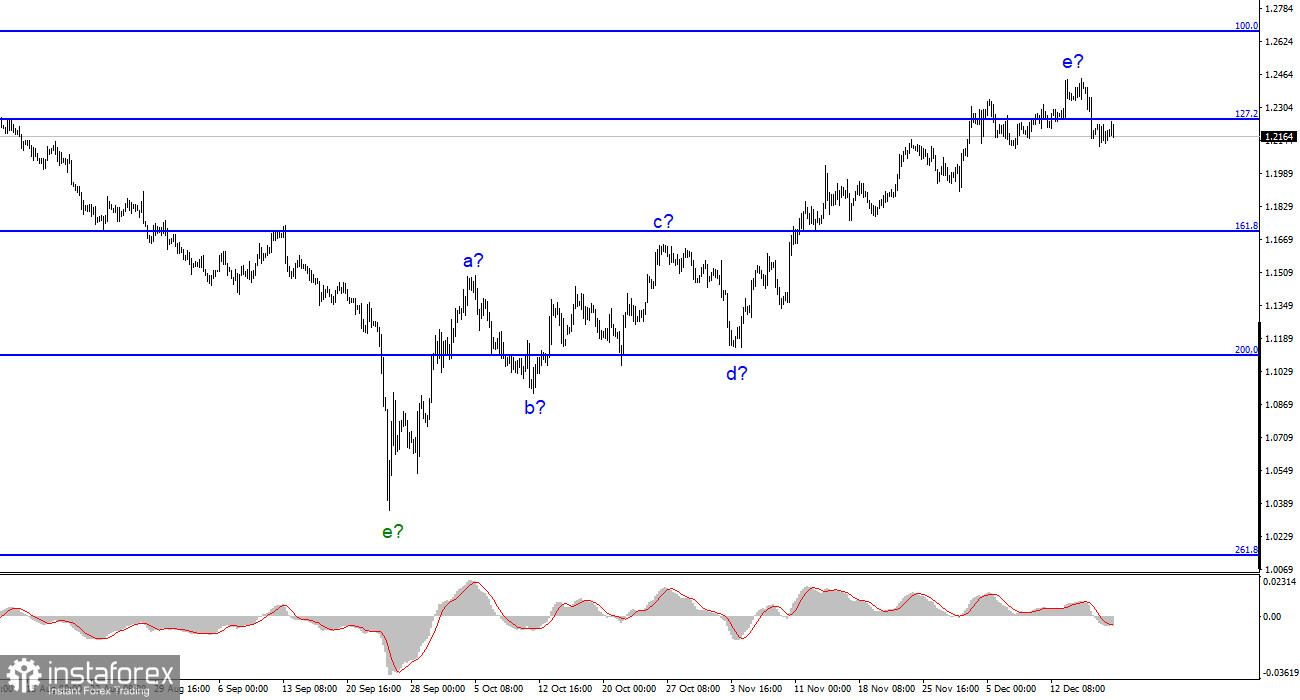

The wave marking for the pound/dollar instrument currently appears quite confusing, but it still needs to call for any clarifications. We have a five-wave upward trend section, which has taken the form a-b-c-d-e and may already be complete. As a result, the instrument's price increase may last for a while. Both instruments are still forming an upward trend segment that will eventually lead to a mutual decline. Recently, the British pound's news background has been so varied that it is challenging to sum it up in one word. The British man had more than enough causes to rise and fall.

As you can see, it primarily chooses the first option and still does so today. The proposed wave e has become more complicated due to the recent rise in quotes. It has already evolved into a sufficiently developed form to be finished. I am currently waiting for the decline of both instruments. Still, these trend sections may take an even longer form because the wave marking on both instruments allows the ascending section to be built up to completion at any time.

No news is available, and the market is idle.

On Monday, the pound/dollar exchange rate increased for the first 100 basis points before declining by the same amount. Trading on the first day of the week was comparatively quiet, but the amplitude still needs to be characterized as strong. There is no background news today, and the UK will only release the third quarter GDP report this week. As with the inflation report or the Bank of England meeting, the market will immediately act because everything now depends on monetary policy and the consumer price index. To lower inflation, which has broken all previous records this year, many nations worldwide have chosen to sacrifice GDP. Many UK government officials have declared that the recession has already started rather than just that the economy may be headed for one. Andrew Bailey discussed the eight quarters during which she will be evaluated. The GDP indicator is no longer significant.

We should now begin with two points. The first is that wave e has reached an end because its form has been sufficiently extended. Naturally, almost any shape could be taken by this wave and by the entire upward portion of the trend. However, I also rely on the possibility that the waves will have a somewhat predictable appearance. In this instance, the wave should have ended long ago. I am therefore anticipating the British's decline. The second is that there won't be any news this week to back up the British pound. Such a background has been present frequently in recent weeks, and even when it wasn't, the increase in the British didn't appear empty because occasionally, the news still supported the pound. This week will be complete without noteworthy events, so the correction wave can continue to develop.

Conclusions in general

The construction of a new downward trend segment is predicated on the wave pattern of the pound/dollar instrument. I cannot advise purchasing the instrument at this time because the wave marking permits the construction of a downward trend section. With targets around the 1,1707 mark, or 161.8% Fibonacci, sales are now more accurate. Wave e is likely finished, though it could take on an even longer form.

The euro/dollar instrument and the picture look similar on the larger wave scale, which is good because both instruments should move similarly. The upward correction portion of the trend is currently almost finished. If this is the case, a new downward trend will soon develop.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română