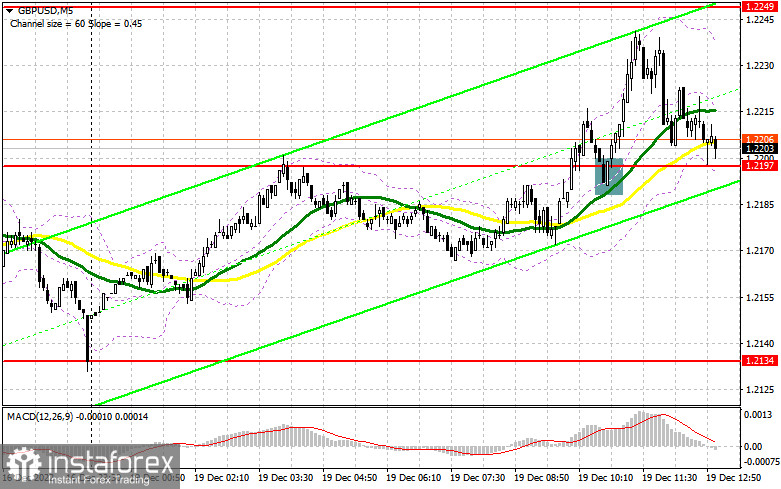

In the morning article, I turned your attention to 1.2197 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and figure out what actually happened. A breakout and a downward retest of 1.2197 created to an excellent entry point into long positions. The GBP/USD pair rose by more than 40 pips. However, it failed to reach 1.2249. For this reason, it was impossible to find a good entry point for opening short positions.

When to open long positions on GBP/USD:

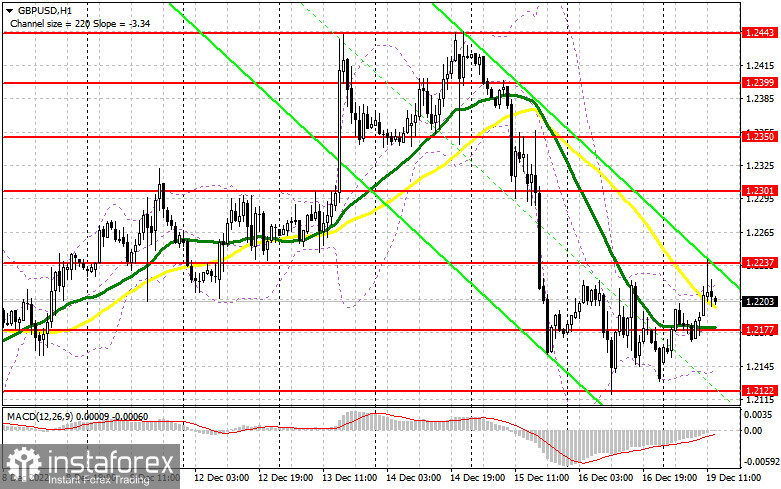

In the afternoon, the economic calendar is completely empty. This is why the pair is likely to remain in the sideways channel. Bulls failed to push the pair out of it in the morning. Only the support and resistance levels have slightly changed. A buy signal may appear if a false breakout of 1.2177 takes place. It will help the pair advance to a new resistance level of 1.2237. A breakout and a downward retest of this level will generate a buy signal with the prospect of a rise to 1.2301. A breakout of this level will also strengthen the bullish sentiment, giving an additional buy signal. The pair may grow to a new high of 1.2350 where I recommend locking in profits. If the bulls fail to push the pair to 1.2177 in the afternoon, it will hardly undermine a bull market. The pressure on the pair could increase at the end of the week. In this case, I would advise you to open long positions only at 1.2122, which is the lower border of the sideways channel, after a false breakout takes place. You could buy GBP/USD immediately at a bounce from 1.2070 or lower at 1.19999, keeping in mind an intraday upward correction of 30-35 pips.

When to open short positions on GBP/USD:

Sellers managed to protect 1.2237, the upper border of the sideways channel. A false breakout there will give a signal with the prospect of a decline to 1.2177. Only a breakout of this level as well as an upward retest will generate an additional sell signal, significantly weakening the bullish momentum. The pair may decrease to 1.2122. It will be difficult for sellers to push the pair below this level. A breakout and an upward retest of this level will open the way to the levels of 1.2070 and 1.19999 where I recommend locking in profits. If the price does not fall to 1.2237, the bulls will try to regain control. If so, the price could rise sharply to 1.2304. A false breakout of this level may create an entry point into short positions, pushing the pair down. If bears show no activity there, you could sell GBP/USD immediately at a bounce from 1.2350, keeping in mind an intraday downward movement of 30-35 pips.

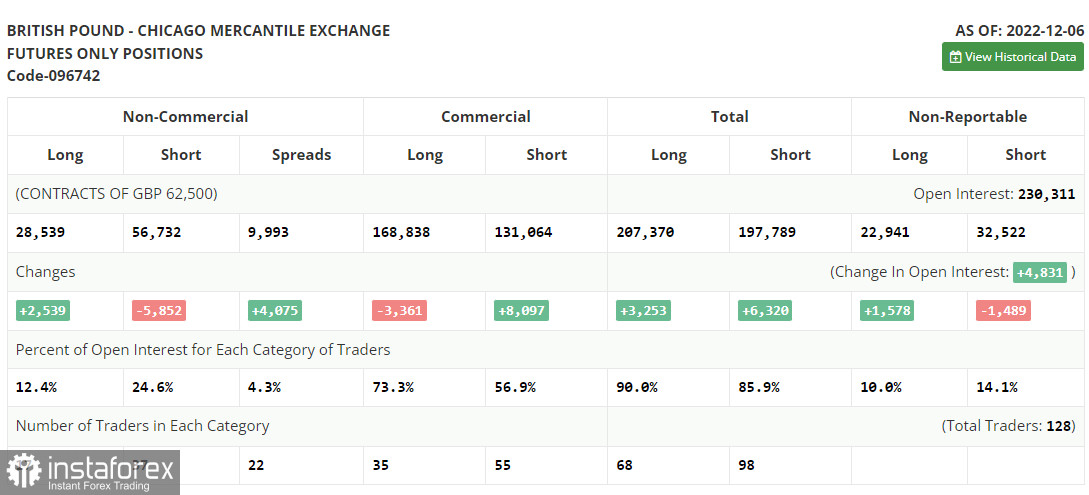

COT report

The COT report (Commitment of Traders) for December 6 logged an increase in long positions and a drop in short ones. Apparently, GBP bulls are confident that the uptrend will persist as the Fed is widely expected to shift to a less hawkish stance. It means that the rate gap between the BoE and the Fed could narrow in the near future. However, the UK Business activity data released last week turned out to be rather disappointing. It clearly indicated a looming recession in the economy. The UK GDP report was slightly better than expected. However, the third straight month of a contraction in economic activity confirms growing recession concerns. Given that the Bank of England is strongly committed to taming inflation and raising the interest rate, the economic prospects are rather grim. It explains why traders are cautious when buying the instrument despite the short-term uptrend. According to the latest COT report, short non-commercial positions dropped by 5,852 to 56,732 and long non-commercial positions grew by 2,539 to 2,8539. Consequently, the non-commercial net position came in at -28,193 versus -36,584 a week ago. The weekly closing price of GBP/USD grew to 1.2149 against 1.1958.

Indicators' signals:

Trading is carried out near the 30 and 50 daily moving averages. It indicates that the pair is moving in the sideways range.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If GBP/USD grows, the indicator's upper border at 1.2205 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română