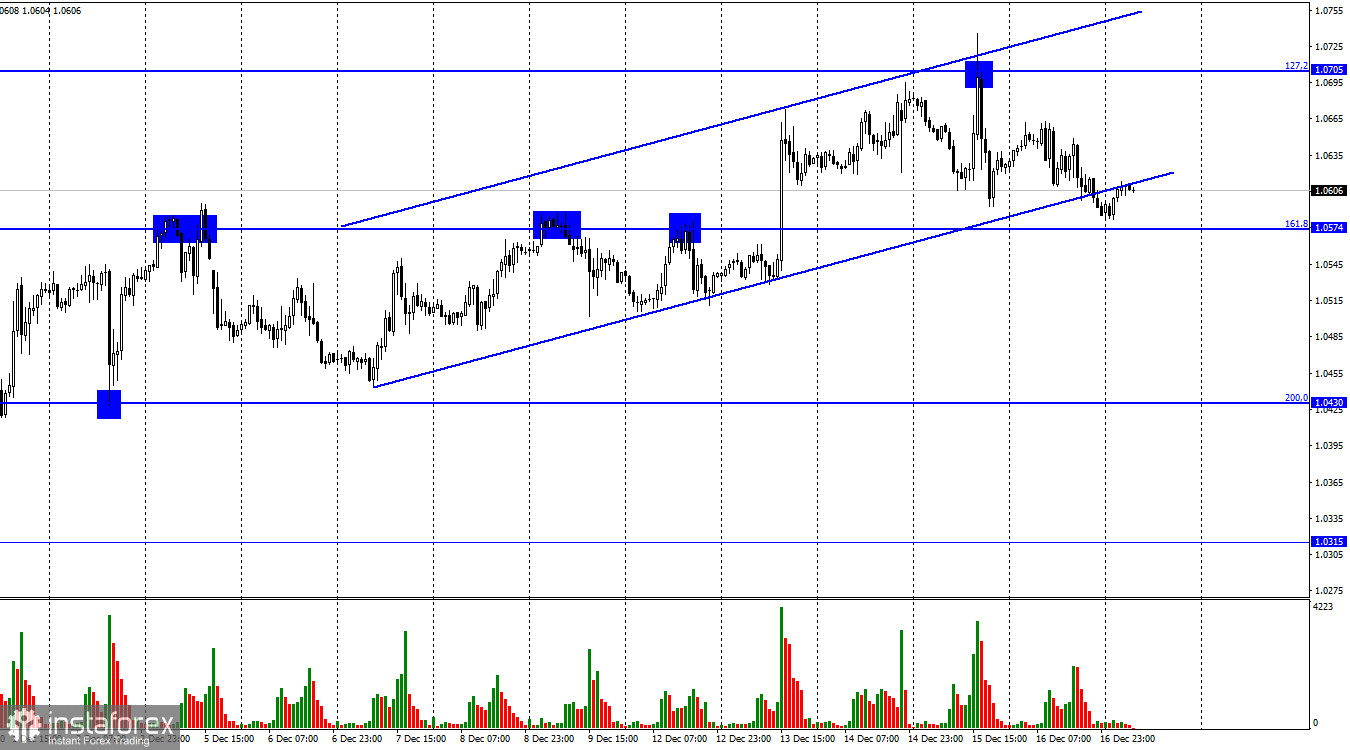

On Friday, EUR/USD developed a new descending cycle toward the Fibonacci retracement level of 161.8% at 1.0574. So, the pair continued to trade within the horizontal channel between 1.0574 and 1.0705. Last week was full of important events, news, and reports but the euro/dollar pair had hardly changed its trajectory. Three central banks' policy meetings took place last week but the clues they gave were not too informative. The main conclusion we can make is that all three regulators will continue to raise rates. However, traders have long been aware of this fact, so they learned nothing new this time.

The pair settled firmly below the ascending trend channel. However, the channel of 1.0574 – 1.0705 is of bigger importance to us. This week, economic calendars of both the US and the EU are almost empty, which means that traders will have few drivers to follow. I doubt that traders will suddenly change their strategies two-three days after the central banks' meetings or inflation reports. None of these events have affected the pair in any certain way. In fact, the incoming data was so mixed and diverse that it could have benefited both the euro and the dollar.

That is why this week, traders will have to rely mainly on technical analysis. I think that consolidation of the price below 1.0574 will act in favor of the US dollar and will initiate a stronger decline. The pair has been rising in recent weeks and months, so a downward pullback was quite logical. Traders may also want to close some of their long positions ahead of the New Year holidays which suggests another cycle of correction.

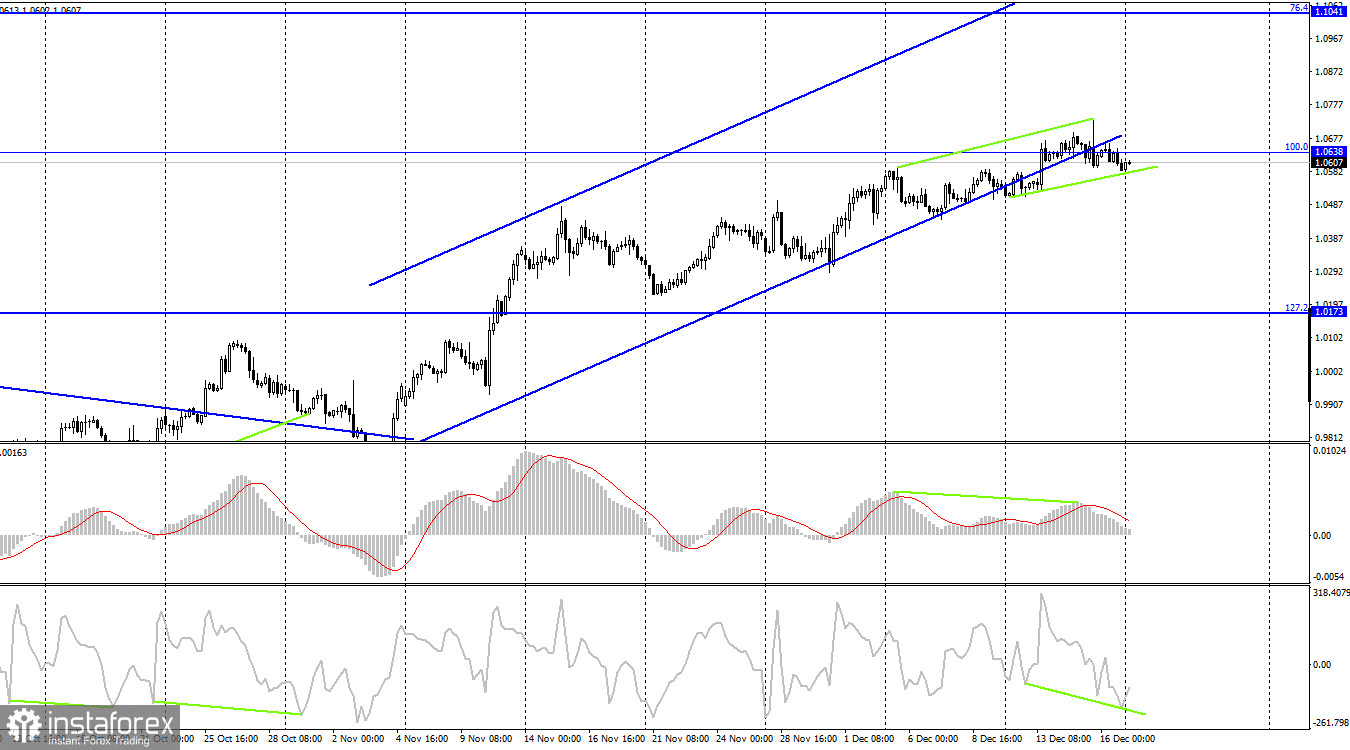

The pair reversed in favor of the US dollar on the 4-hour chart after the MACD indicator formed a bearish divergence. Right after that, the quote settled below the 100.0% Fibo level which suggests the continuation of the downtrend. Besides, the price closed below the ascending channel. However, the CCI indicator is going to form a bullish divergence which may enable the bulls to regain control of the market. If so, the pair may resume its rise toward the retracement level of 76.4% at 1.1041.

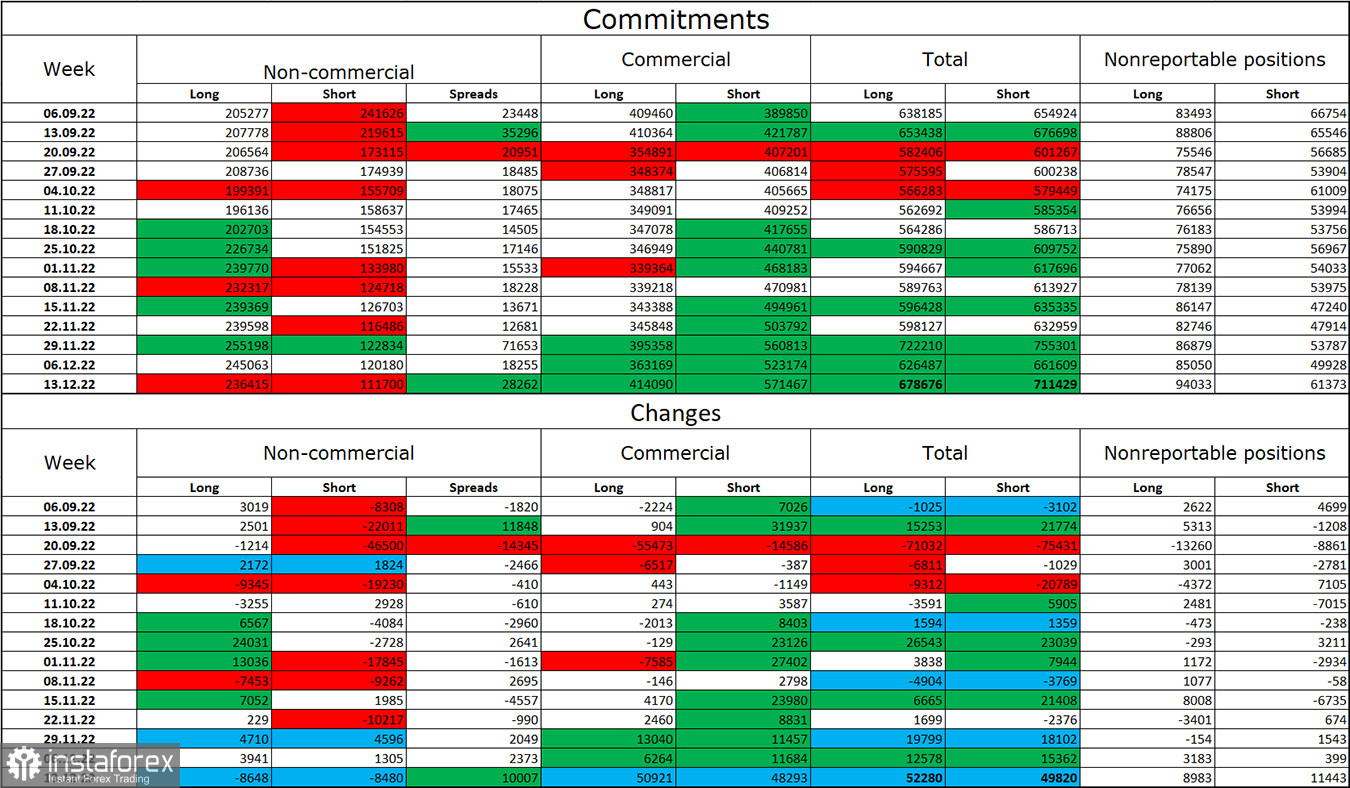

Commitments of Traders (COT):

Last week, traders closed 8,648 long contracts and 8,480 short contracts, an almost equal amount. Large market players remain bullish on the pair, and their sentiment hasn't changed over the previous week. The total number of opened long contracts is 236,000 while the number of short contracts is 111,000. The European currency is rising in line with the COT report. At the same time, the number of long positions is twice as high as the number of short ones. In recent weeks, the chances were getting higher for the euro to develop a proper uptrend. Now there is a risk that EUR has been overbought. After a prolonged decline, the euro has finally seen some improvement, and its prospects remain positive. However, a break below the ascending channel on the 4-hour chart may indicate that the bearish bias may strengthen in the near term.

Economic calendar for US and EU:

On December 19, there are no events in the economic calendars of both countries. Therefore, the influence of the information background on the market will be zero today.

EUR/USD forecast and trading tips:

I recommended selling the pair after a rebound from 1.0705 on the H1 chart with the target at 1.0574. This level has been tested. You can add more short positions when the price settles below 1.00574 on the 1-hour chart with the target at 1.0430. It is advisable to buy the euro when the price rebounds from the level of 1.0574 on H1 with the target at 1.0430.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română