On the eve of tomorrow's Bank of Japan meeting, the yen is strengthening against its main competitors—the euro, the pound and the dollar, after it spent the past week in a range against the dollar, still undecided about the direction of further movement. And last week's controversial macro data from Japan also contributed to this.

The data suggests that Japan's industrial sector remains under pressure due to rising inflation, declining orders and the global economic crisis. Thus, the Tankan sentiment index of Japan's largest enterprises for the manufacturing sector fell from 8.0 points to 7.0 points in the fourth quarter. At the same time, Japan's trade balance deficit in November reached 2.027 trillion yen instead of the expected 1.680 trillion yen due to stronger growth in imports, which, in turn, rose due to increased energy and fuel supplies. The volume of exports from Japan declined, including against the backdrop of lower demand for Japanese goods in China due to serious quarantine restrictions.

The only thing that pleases is the Japanese service sector. The value of the sentiment index of Japan's largest enterprises (in the 4th quarter) for the services sector increased from 14.0 points to 19.0 points, exceeding the projected 17.0 points. The recovery of domestic demand and tourism after lifting coronavirus restrictions also contributed to the growth in the service sector.

Ahead of tomorrow's meeting, the results of a survey conducted by Reuters are of interest, according to which almost half of the surveyed economists believe that the Bank of Japan can curtail its super-loose monetary policy in 2023.

At the same time, Bloomberg reported last week, citing the latest data from the Japanese Bankers Association, that the country's banks could suffer losses on their government bonds in the amount of $1.1 trillion if the Bank of Japan loosens its grip on 10-year bond yields. And, as you know, since 2013, it has been declaring its commitment to achieving the 2% inflation target "as soon as possible" by conducting an ultra-soft monetary policy. Also, according to the Yield Curve Control Policy (YCC), the Bank of Japan provides short-term rates at -0.1% and the yield limit of 10-year bonds around 0%, also acquiring large volumes of government bonds and risky assets to ensure that the inflation target is reached.

In October, Japan's annual core consumer price index (Core CPI) rose 3.6%, the strongest gain in 40 years. Therefore, there is talk in the markets that the Bank of Japan may change its yield curve control policy and allow higher rates when Kuroda's term ends next April.

In the meantime, Bank of Japan Governor Haruhiko Kuroda dismisses the possibility of a rate hike in the short term. Previously, he repeatedly promised to maintain the current level of stimulus until inflation reaches 2% on a stable basis.

Earlier in December, Bank of Japan board member Toyoaki Nakamura also called for maintaining an extremely soft monetary policy to support the economy during the recovery period after the recession caused by the coronavirus pandemic, and BoJ deputy governor Masayoshi Amamiya said that the central bank could incur losses of 28.6 trillion Japanese yen if the yield of Japanese government bonds rises by 1%.

Thus, the main scenario for the Bank of Japan tomorrow, in our opinion, is to keep the current monetary policy unchanged. And even if next year the Bank of Japan still decides to raise interest rates and change its YCC policy, interest rates in Japan will remain significantly below the rates of other major world central banks, which will make the yen vulnerable against its competitors in the foreign exchange market.

However, this does not exclude the possibility of periods of its sharp strengthening, especially if market participants remember it as a traditional defensive asset.

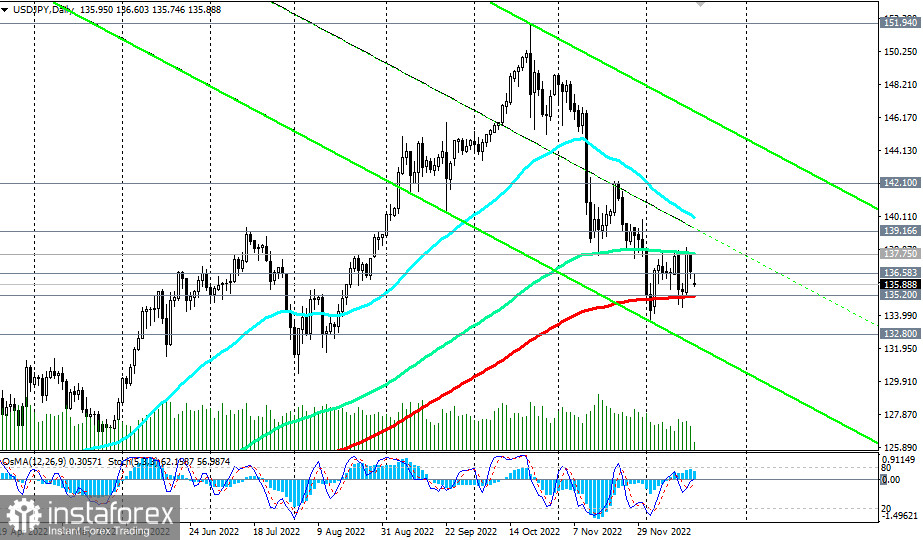

Today, as we noted above, the yen is strengthening, including against the dollar. As of writing, USD/JPY was trading below 136.00, near 135.90, moving towards long-term support at 135.20. Its breakdown, and especially the breakdown of the long-term support level 132.80 significantly increases the risks of breaking the bullish trend of the pair, which so far remains in the long-term bull market zone.

Note that the decision on the rate of the Bank of Japan will be published tomorrow at 03:00 (GMT), and the press conference will begin at 06:00. In its course, Kuroda will comment on the bank's monetary policy and the decision. As Kuroda has repeatedly stated earlier, "it is appropriate for Japan to patiently continue the current loose monetary policy." He will probably say the same thing this time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română