Forecasts for the UK preliminary PMI figures were absolutely negative as all the indices should have dropped. However, the manufacturing PMI slumped to 44.7 points from 46.5 points instead of falling to 46.3 points. Meanwhile, the services PMI increased to 50.0 points from 48.8 points, whereas economists had expected a drop to 48.3 points. As a result, the composite PMI climbed to 49.0 points from 48.2 points instead of declining to 47.7 points. However, despite a rise in the composite PMI, the pound sterling remained stagnant. At first sight, this could be explained by the slump in the manufacturing PMI, which reflects the terrible condition of the European industry amid high energy prices.

UK Composite PMI

The fact is that the market was stagnant after the publication of the preliminary PMI data in the US. Forecasts were very positive, but, in fact, the data was much worse than in the UK. Thus, the manufacturing PMI tumbled to 46.2 points, whereas analysts had foreseen a drop to 47.7 points from 48.2 points. The services PMI slid to 44.4 points from 46.2 points instead of rising to 47.8 points. There is no wonder that the composite PMI decreased to 44.6 points instead of climbing to 48.0 points from 46.4 points.

US Composite PMI

The pound's failure to rise points to the fact that investors do not see even a mid-term possibility of the US dollar depreciation. It seems that investors have finally realized the results of the recent FOMC and ECB meetings. In other words, the difference between the key rates of both central banks will remain the same. What is more, next year, the gap may increase, thus boosting the greenback not only against the euro but all other currencies, including the pound sterling. That is why such disappointing data from the US forced traders to remain cautious. Since today, the macroeconomic calendar is absolutely empty, the market is likely to stand still. However, it is highly possible that the greenback will show an insignificant rise.

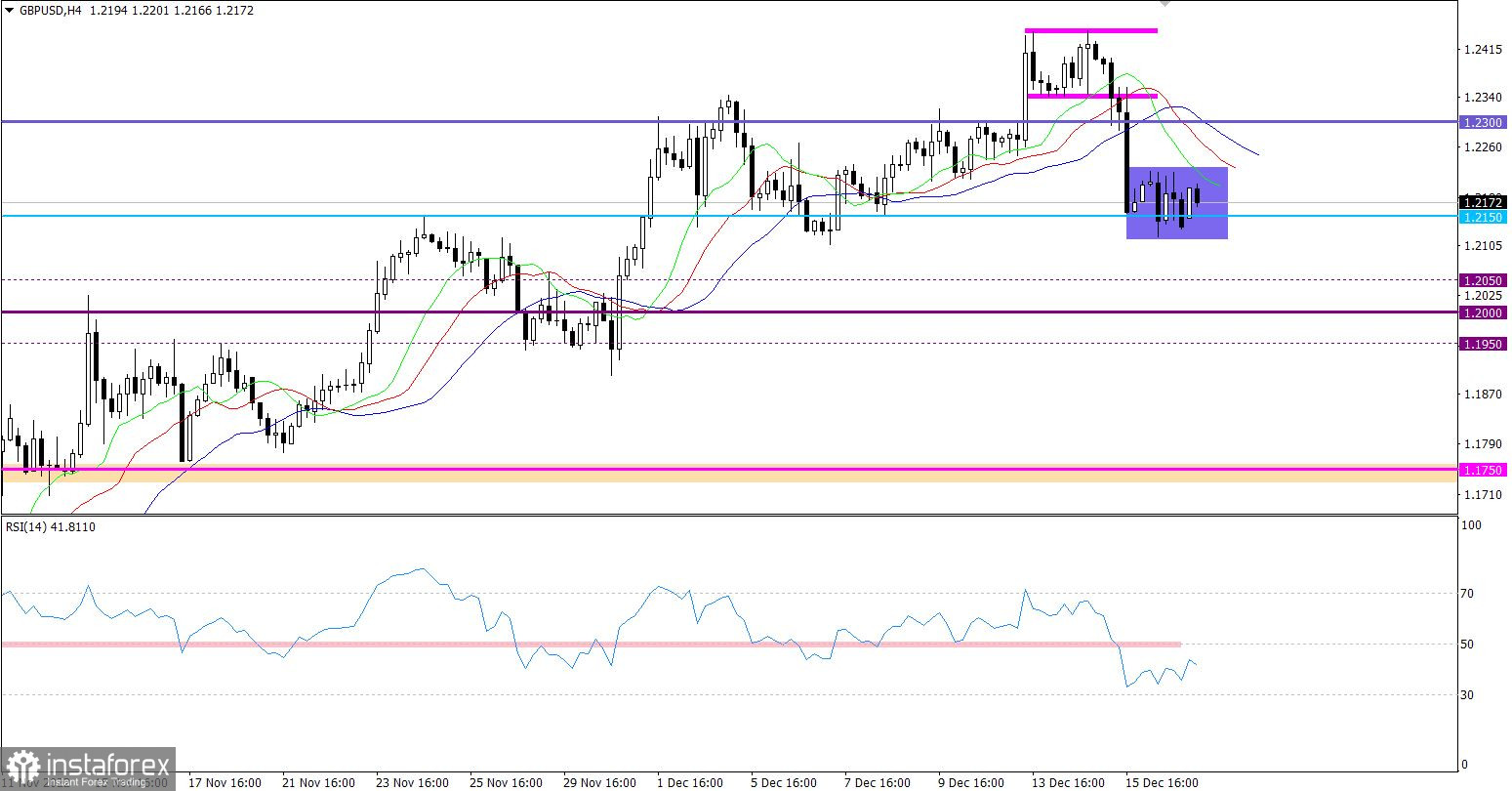

Although the volatility reached 100 pips, the pound/dollar pair was mostly stagnant. The pair entered the sideways channel, whereas the market sentiment was mainly bearish. However, the quote failed to settle below 1.2150.

On the four-hour chart, the RSI technical indicator is moving in the lower area of 30/50, which reflects traders' interest in short positions. On the daily chart, the indicator is ignoring the current bounce from the peak of the uptrend. The quote is hovering in the upper area of the indicator.

On the four-hour chart, the Alligator's MAs are headed downwards, which corresponds to the existing decline. On the daily chart, the MAs are headed upwards, which points to the upward cycle.

Outlook

Under the current conditions, the range formed along 1.2150 points to the accumulation process. Thus, we could see an outgoing impulse, which is expected to indicate a further direction of the pair.

In terms of the complex indicator analysis, we see that in the short-term and intraday periods, technical indicators are signaling mixed opportunities. In the mid-term period, they are ignoring the local price changes, thus providing buy signals.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română