Volatility has been extremely high for financial markets last week due to the Fed, Bank of England and ECB meetings and the release of economic data. All of them caused sell-offs in risky assets, primarily because nothing new has happened and nothing substantial has been said. The ECB and the Fed raised interest rates as expected, while the latest statistics were in line with expectations. Most central banks also noted that tight monetary policy will continue in 2023.

Basically, last week's events have brought back the expectations that a widespread recession could start as early as next year. This led to another stock market crash and a rise of dollar to recent highs. However, the decline is likely just a correction, not a full-scale downward trend as demand could return if market sentiment improves. That could also lead to a weaker dollar and more stable treasury yields during the last two weeks of the year.

Forecasts for today:

AUD/USD

0.6680 is a key support level in AUD/USD. If market sentiment improves today, the pair could bounce up to 0.6800, then go to 0.6915.

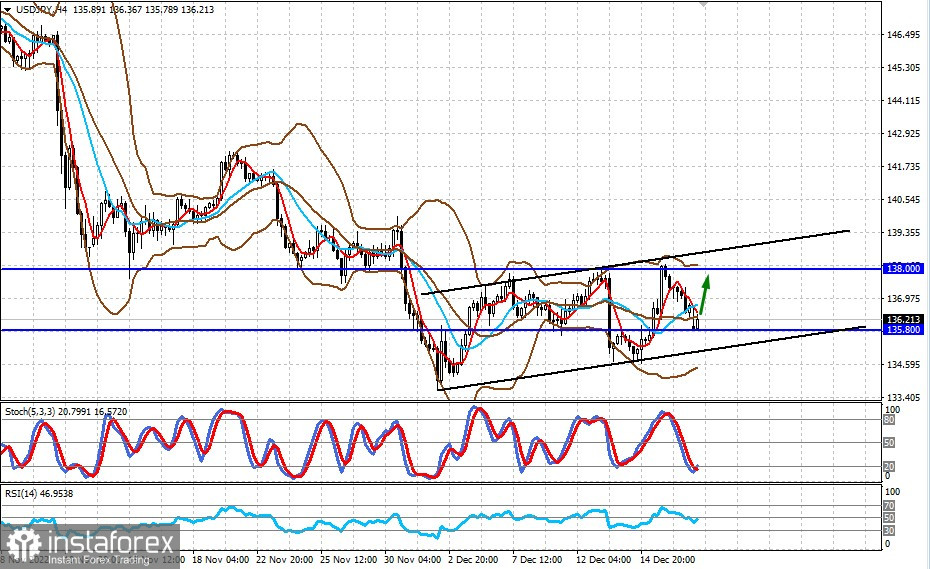

USD/JPY

Even if USD/JPY is bullish, a rise in risk appetite could prompt the pair to rebound to 138.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română