A crucial week has come to an end. I anticipated that it would move around the two instruments I frequently review. Today, it is certain that no rearrangement has taken place:

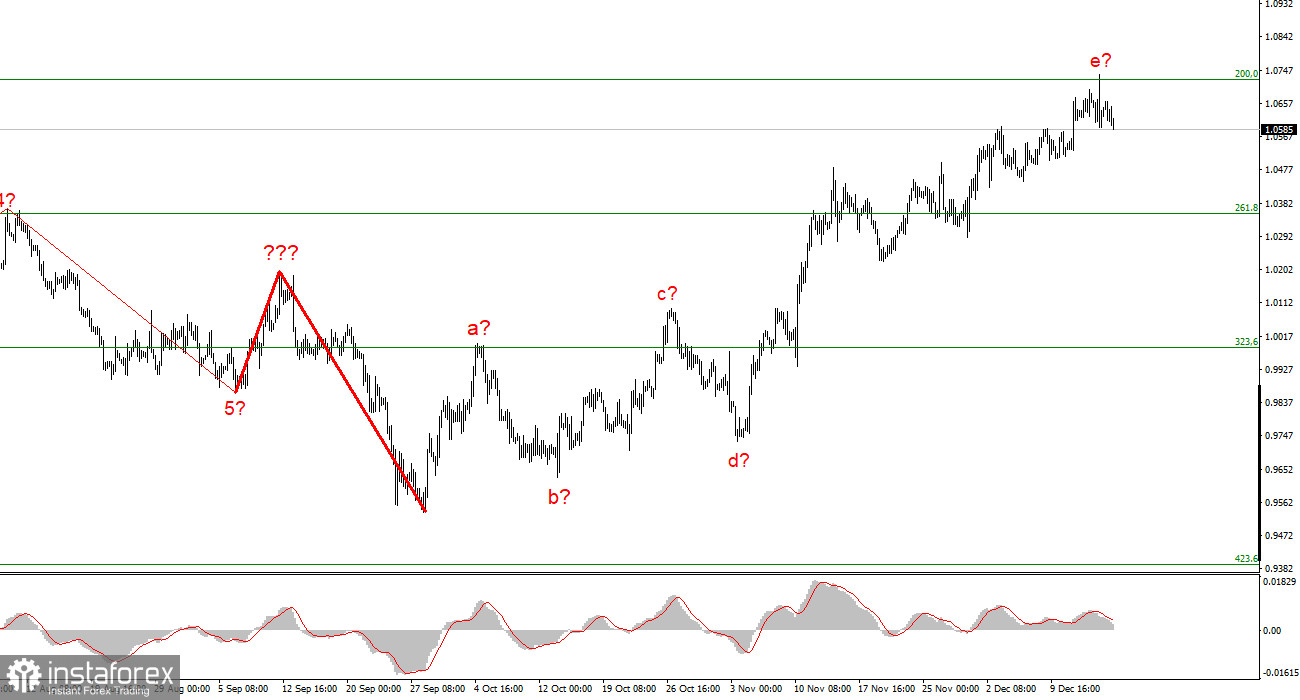

- Over the past week, the expected peak of wave e has been updated on the EUR/USD instrument. Therefore, it was once more about strengthening the euro rather than the end of the upward trend section.

- The proposed wave e has already taken on a very elaborate and extended form. The market's indirect readiness to begin constructing a descending set of waves is only indirectly indicated by an unsuccessful attempt at the level of 200.0%.

- There were no surprises as central banks increased their rates by 50 basis points.

- It is impossible to predict the future of the rates of the three banks because of the current course of action, which prevents an accurate forecast for the beginning of 2023.

So let's take a closer look at it.

ECB. The rate rose by 50 points to reach 2.5%. According to Christine Lagarde, at least a few more increases of 50 points will be required. The market still needs to be clearer about one thing: will the ECB increase the rate as much as necessary to get inflation back to 2%, or will it only do so up to a certain point, which might not be sufficient to achieve the inflationary goal? The European regulator also announced the introduction of a program of quantitative tightening in 2023. I think the market was expecting more "hawkish" results, so I believe these statements offered little support for the euro.

The Bank of England. They did not say anything and increased the rate by 50 basis points. There needs to be more information about inflation or the PEPP's upcoming tightening. Regarding the British regulator, the market is still asking the same question. The UK's inflation rate dropped by 0.4%, but this is only the indicator's first decline. The Bank of England rate is currently 3.5%, and it is currently 10.7%. The British economy is experiencing serious issues, which Jeremy Hunt, Andrew Bailey, and Rishi Sunak openly discuss. If the regulator raises the rate like the Fed, that is, as much as it needs to, then everything is fine. However, the Bank of England may raise the rate differently, given these issues.

The Fed. They are prepared to increase the rate, and from this point forward, meetings will decide whether an increase is necessary. Although the rate is expected to rise to 5.1% according to the consensus forecast, some FOMC members have already stated that it may now rise higher than anticipated. As a result, only the American regulator publicly states that it will tighten monetary policy as much as is required. This should increase demand for American currency. Additionally, a set of corrective waves has long been a presumption in wave analysis. I'm still waiting for both instruments to stop working.

The upward trend section's construction has grown more intricate and is almost finished. As a result, I suggest making sales with targets close to the estimated 0.9994 level, or 323.6% Fibonacci. It would be best if you waited for a strong sales signal because the upward section of trend could become even more extended and complicated. The likelihood of this happening is still high.

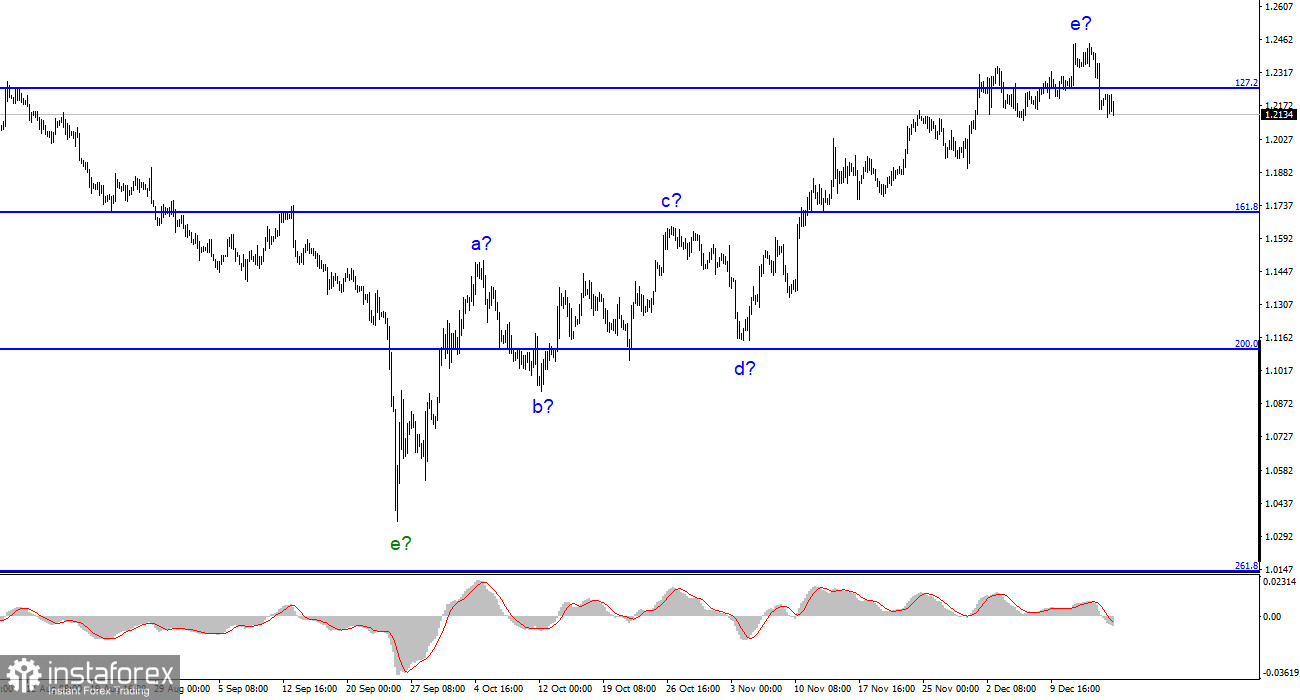

The construction of a new downward trend segment is predicated on the wave pattern of the pound/dollar instrument. Since the wave marking permits the construction of a downward trend section, I cannot advise purchasing the instrument. With targets around the 1.1707 mark, or 161.8% Fibonacci, sales are now more accurate. The wave e, however, can evolve into an even longer form.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română