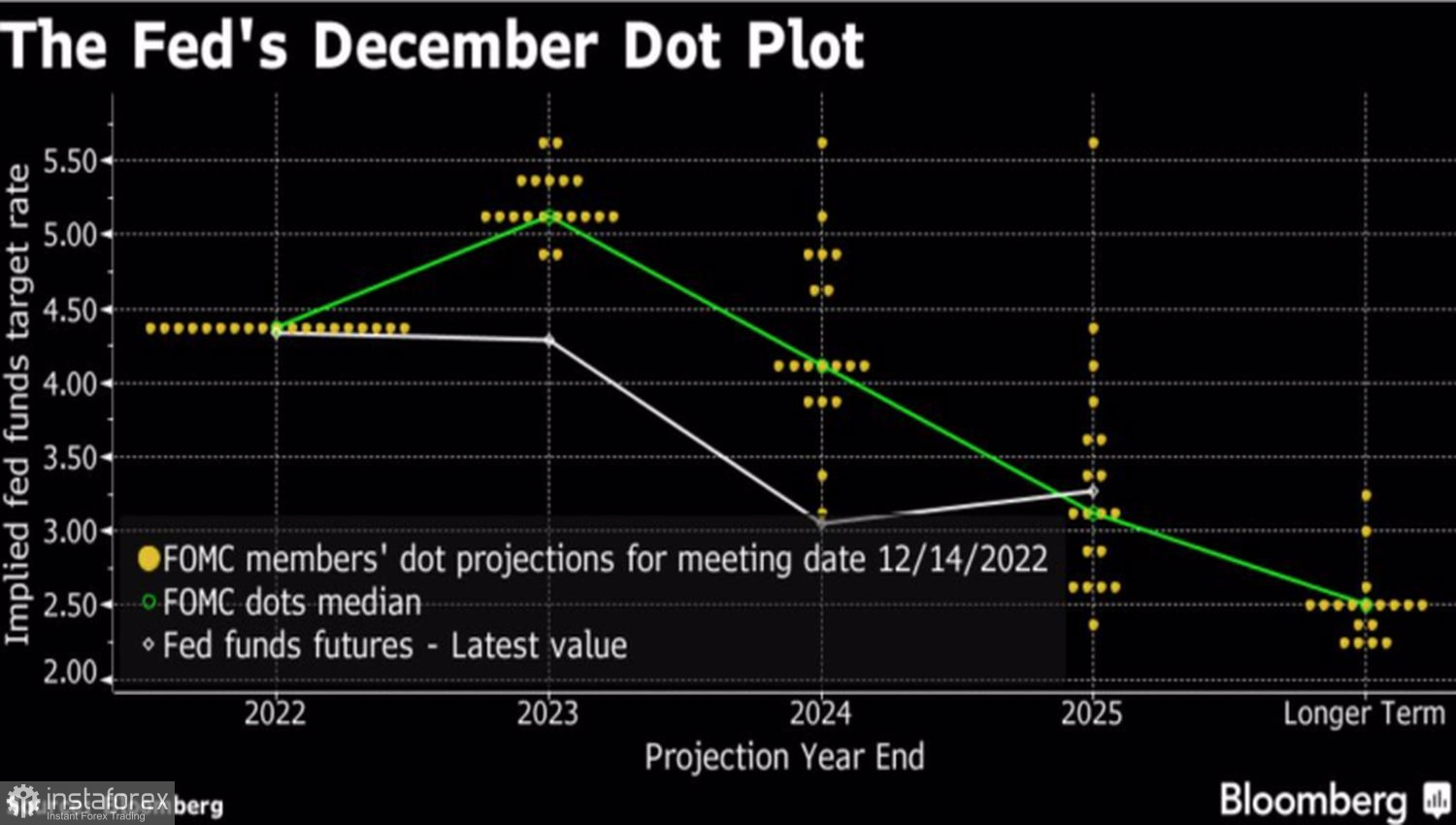

You can disbelieve the Fed as much as you like, but going against it is like death. Gold perfectly understands this, reacting sensitively to monetary policy. And if the lion's share of FOMC officials predicts that the federal funds rate will rise by 75 bps in 2023, to 5.25%, and not by 50 bps, as the futures market expected before, then it would be nice for the bulls on XAUUSD to fix part of the profit on longs. Inflation is still very high by historical standards, the Fed's work is not yet done, and all this means that a stable upward trend in precious metals should not be expected. There will be serious pullbacks.

Fed forecasts for the federal funds rate

In fact, FOMC members are human beings first and foremost, and human beings make mistakes. At the end of 2021, the Committee predicted an increase in the cost of borrowing by 75 bps, to 1%, but in fact the rate rose to 4.5%. Twelve months ago, there was hope that inflation would slow down on its own without much intervention from the central bank. Now the dominant idea is that prices can be reduced to 3%–4%, but further movement towards the target looks very problematic. If not impossible.

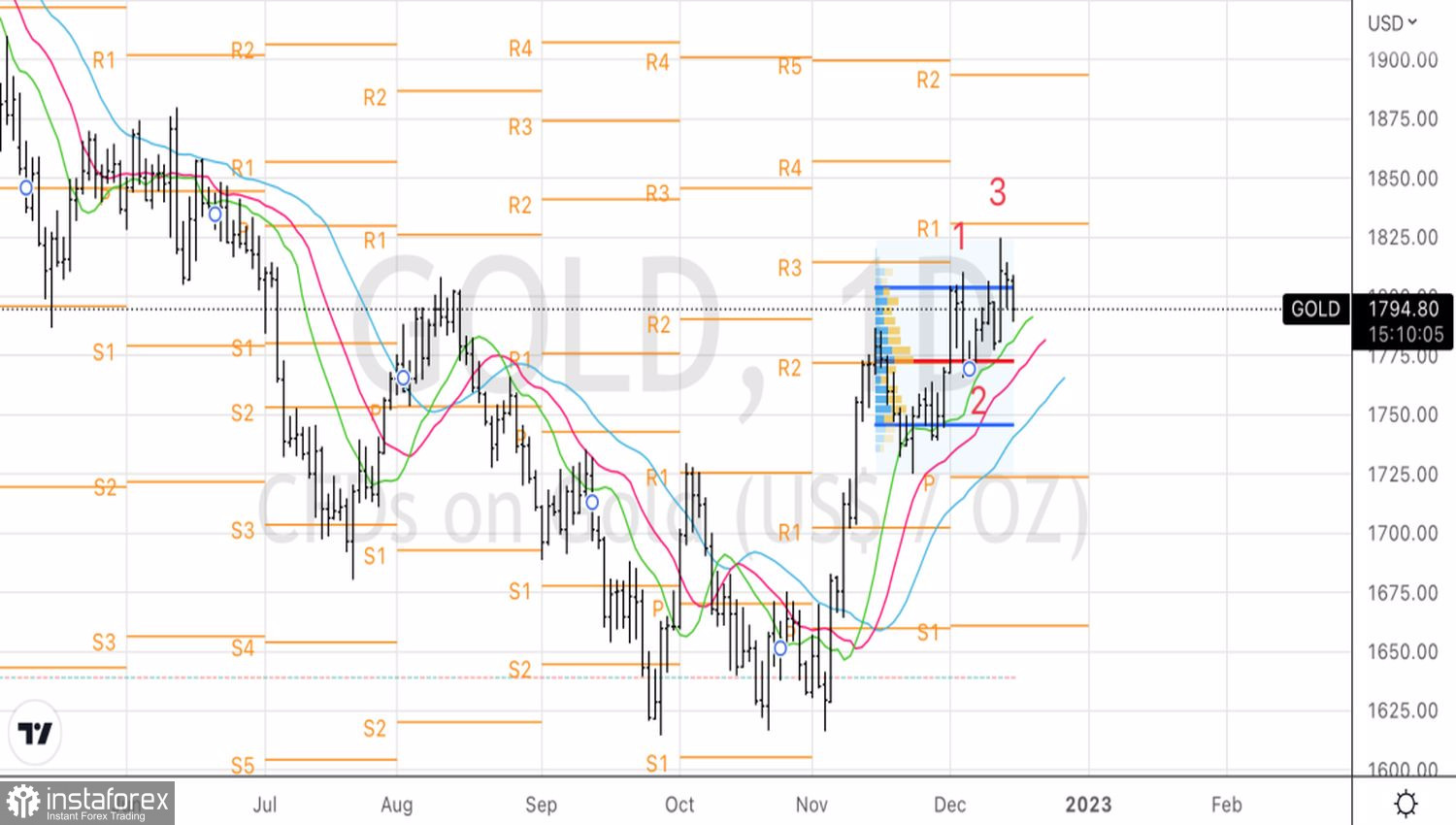

In any case, the current 7% CPI is still very high, and it is inappropriate to say that the Fed's job is done. The further trajectory of the federal funds rate will depend on new data. Its 50 bps hike in February is not out of the question, which brings back investor interest in the disgraced U.S. dollar. Gold is anti-dollar and usually goes down when the American currency goes up, so the decline of the XAUUSD quotes looks quite logical in response to the hawkish rhetoric of the Fed.

Dynamics of the U.S. dollar and gold

What's next? In my opinion, the fall of the USD index has gone too far, and it would be nice for the precious metal to go for a correction amid profit-taking on longs by speculators. If the nearest U.S. macro statistics convince of the strength of the economy, the chances for the federal funds rate to rise to 5% in early February will increase, and the U.S. dollar will strengthen. On the contrary, worsening data will benefit Treasury bonds. Rising prices for these papers leads to a decrease in yields and turns on the green light before EURUSD and gold.

A lot depends on the main currency pair. The share of the euro in the structure of the USD index is 57%. At the moment, EURUSD remains stable due to the expectations of the ECB's "hawkish" rhetoric at the December 15 meeting. If the market is disappointed, the pair will collapse, dragging XAUUSD with it.

Technically, on gold's daily chart, the "bears" are trying to implement the Anti-Turtles reversal pattern and the inside bar. If their opponents fail to catch the lower boundary of the latter at $1,796 per ounce, it will be an evidence of their weakness and a reason to form short positions. They can be increased later on a breakout of supports at $1,789, $1,783 and $1,777. At the same time, I wouldn't be too keen on selling. As the precious metal quotes move down, we're looking for an opportunity to fix profits and reverse.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română