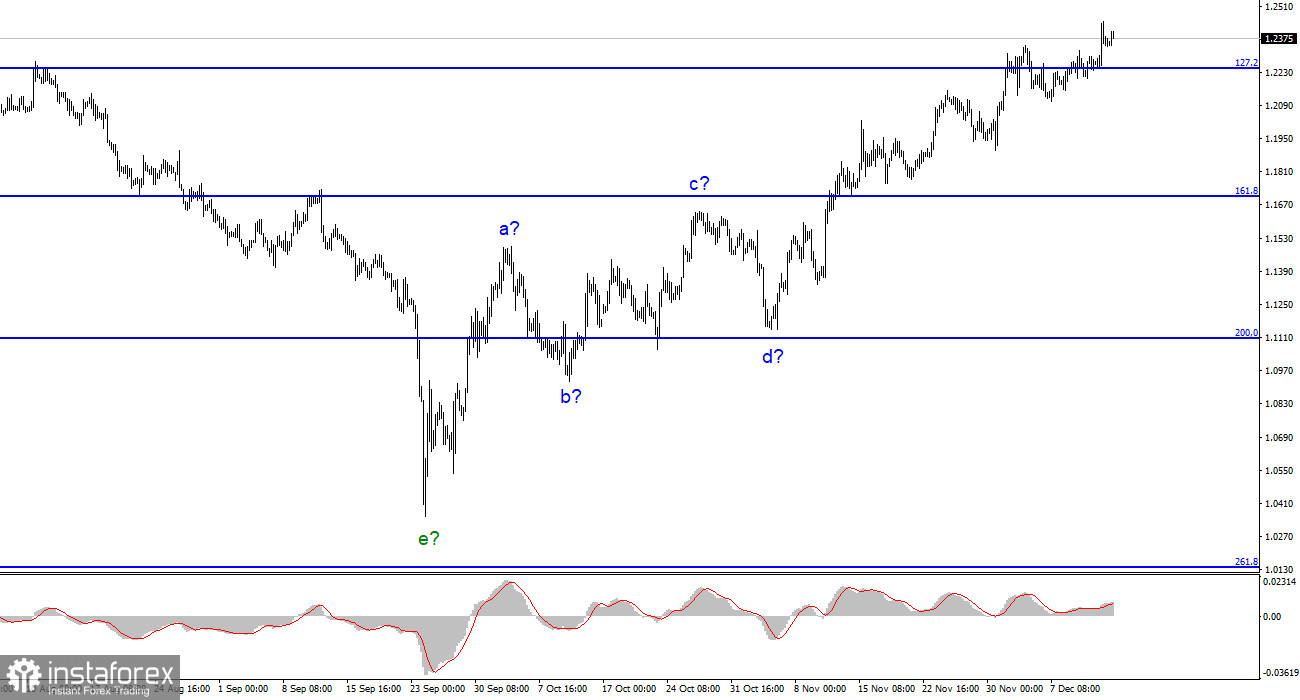

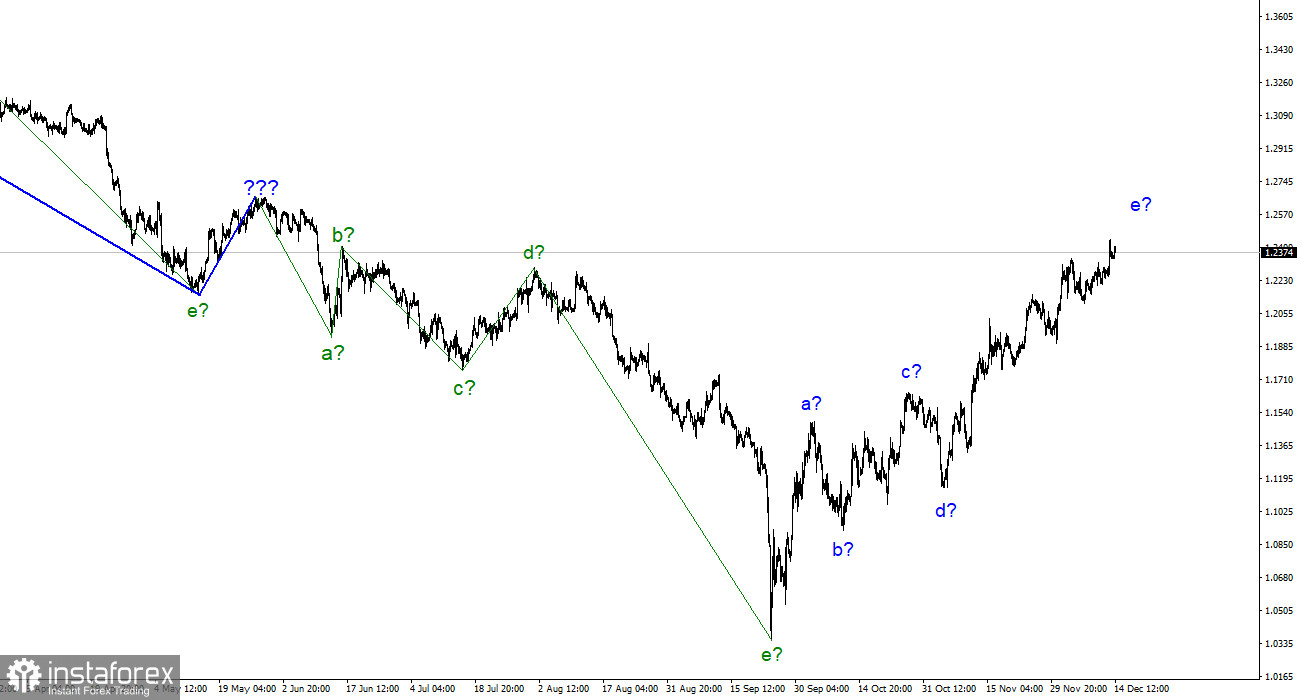

The wave marking for the pound/dollar instrument currently appears quite confusing, but it still needs to be clarified. We have a five-wave upward trend section, which has taken the form a-b-c-d-e and may already be complete. As a result, the instrument's price increase may last for a while. Both instruments are still forming an upward trend segment that will eventually lead to a mutual decline. Recently, the British pound's news background has been so varied that it is challenging to sum it up in one word. The British pound had more than enough reasons to rise and fall. As we can see, it primarily chose and continues to choose the first option. The proposed wave e has become more complicated due to the recent rise in quotes. It has already evolved into a long enough form to be finished soon. I am currently waiting for the decline of both instruments. Still, these trend sections may take an even longer form because the wave marking on both instruments allows the ascending section to be built up to completion at any time.

The UK's inflation has begun to decline.

On Tuesday, the pound/dollar exchange rate increased by 100 basis points; today, it increased by 0. The demand for British currency remains extremely high. However, it had stayed the same relative to the day's opening mark when writing the review, and the development of an upward trend had been delayed. As I've stated numerous times before, I'm still waiting for the creation of a new downward trend segment. The pound is currently increasing without consideration for recent news. The US's inflation rate slowed yesterday, which logically reduced demand for the dollar. However, the UK's inflation rate has already started to decline today, and demand for the British pound has remained relatively high. The FOMC meeting results were announced in the evening, so the market may be currently overexcited and unable to display the movements I anticipate. Even though I don't anticipate the Fed making any jarring announcements or unexpected decisions, the situation should improve in the evening.

Wave e has already assumed an excessively extended appearance from all angles. It has a 1300 base point length. The first two upward waves also have a 1300-point length. I need to see how the need for a pound could increase. Ironically, though, I do not see why it should decline tonight. Because the Fed will slow the interest rate increase in December, the market has been selling US dollars in recent weeks. It then transpires that the market has already taken this factor into account. Therefore, tonight's instrument performance may still be negative, barring any unexpectedly "dovish" remarks from Fed President Jerome Powell. It can function without it, but I am not the Fed's president.

Conclusions in general

The construction of a new downward trend segment is predicated on the wave pattern of the Pound/Dollar instrument. I cannot advise purchasing the instrument at this time because the wave marking permits the construction of a downward trend section. With targets around the 1.1707 mark, or 161.8% Fibonacci, sales are now more accurate. The wave e, however, can evolve into an even longer form.

The euro/dollar instrument and the picture look very similar at the larger wave scale, which is good because both instruments should move similarly. The upward correction portion of the trend is currently almost finished. If this is the case, a new downward trend will soon develop.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română