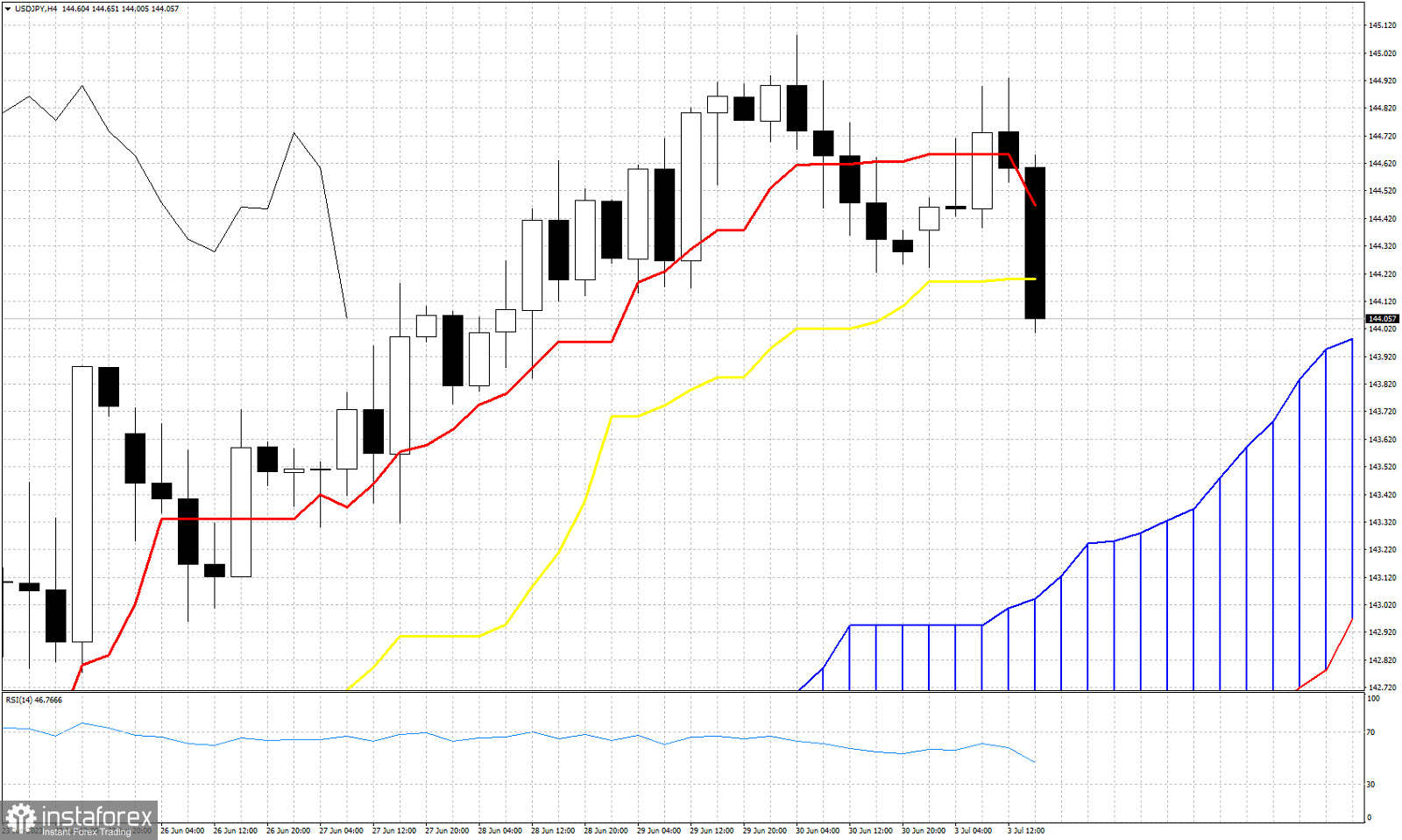

USDJPY is trading around 144.07 after making a high around 145.08. In the 4 hour chart using the Ichimoku cloud indicator we get the first reversal warning signs. USDJPY has been in an up trend making higher highs and higher lows since the beginning of June and 139 price level. Short-term trend remains bullish since June 14th and the close above the Kumo at 140. Price is now starting to making lower lows and lower highs as it breaks below the tenkan-sen (Red line indicator) and the kijun-sen (yellow line indicator). The Chikou span (black line indicator) remains above the canldestick pattern (bullish). However the break below the kijun-sen is a sign of vulnerability and increases the chances of a pull back to test the upper cloud boundary at 143.25. So traders need to be cautious because a pull back towards the 143 level is highly probable.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română